/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

With a market cap of around $352 billion, Palantir Technologies Inc. (PLTR) is a software company that specializes in data integration and analytics platforms. It serves governments and enterprises globally with products like Palantir Gotham, Foundry, Apollo, and its Artificial Intelligence Platform to support operations ranging from counterterrorism to enterprise decision-making.

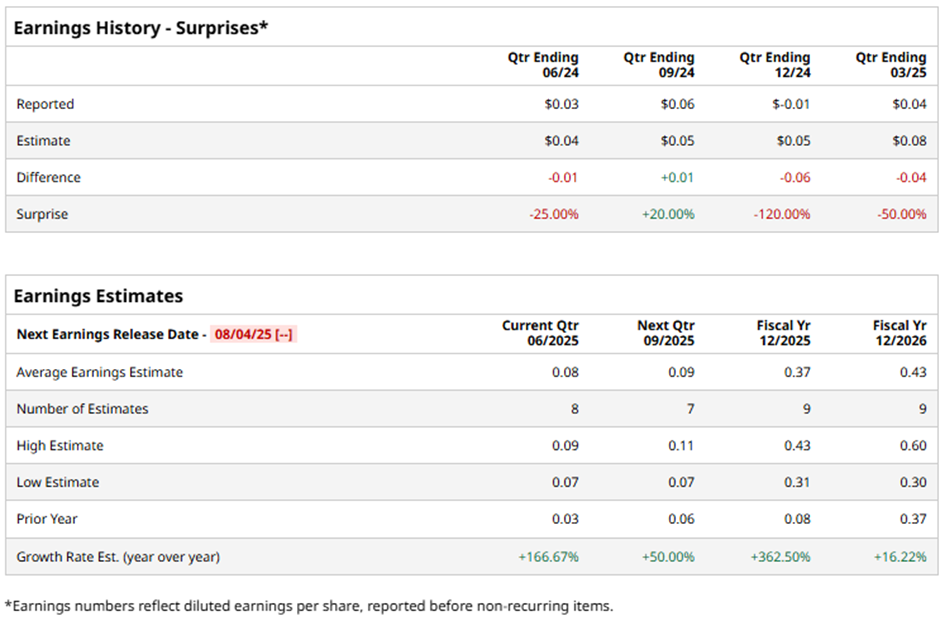

The Denver, Colorado-based company is slated to announce its fiscal Q2 2025 earnings results on Monday, Aug. 4. Ahead of this event, analysts expect PLTR to report an EPS of $0.08, a 166.7% increase from $0.03 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts expect Palantir Technologies to report EPS of $0.37, a significant growth of 362.5% from $0.08 in fiscal 2024.

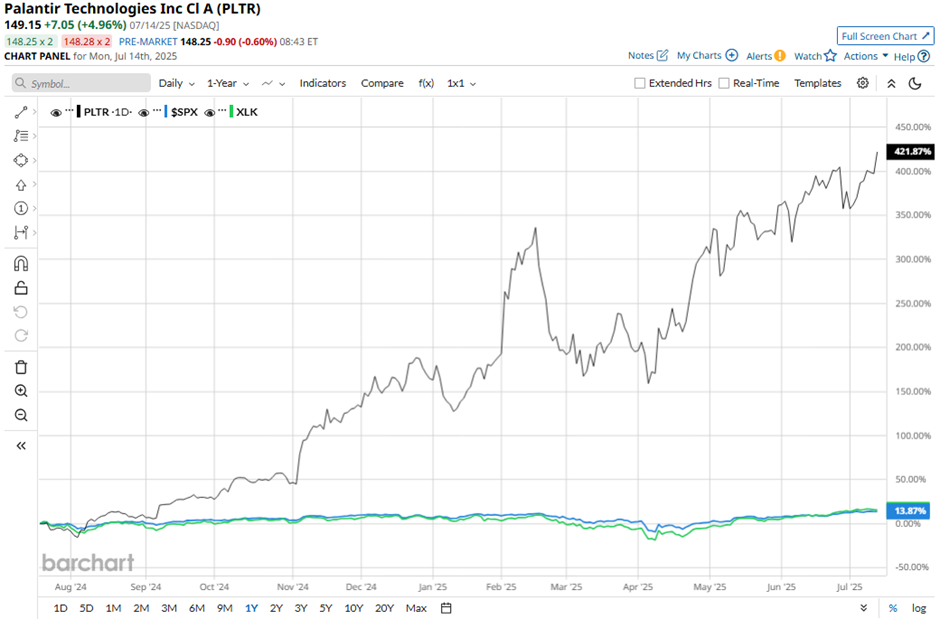

Shares of Palantir Technologies have jumped 418.3% over the past 52 weeks, surpassing the broader S&P 500 Index's ($SPX) 11.6% return and the Technology Select Sector SPDR Fund's (XLK) 10.2% rise over the same period.

Despite beating Q1 2025 revenue expectations with $883.9 million on May 5, Palantir's shares tumbled 12.1% the next day due to a 10% year-over-year decline in global sales, raising concerns about the sustainability of its international growth. While U.S. sales surged 55% and the company raised its full-year forecast, investors were spooked by signs of weakening demand outside the U.S.

However, the stock climbed 4.3% on Jun. 30 after announcing a strategic partnership with Accenture Federal Services to deliver AI-powered solutions to U.S. federal agencies, including training over 1,000 Accenture AI professionals on its Foundry and AIP platforms, significantly expanding its federal market reach.

Analysts' consensus view on Palantir Technologies stock remains cautious, with a "Hold" rating overall. Out of 20 analysts covering the stock, three recommend a "Strong Buy," 12 "Holds," one "Moderate Sell," and four have a "Strong Sell" rating.

As of writing, the stock is trading above the average analyst price target of $106.12.