/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies Inc. (PLTR), with a market cap of $426 billion and specializes in developing advanced software platforms for government and commercial clients. The company, headquartered in Denver, Colorado, plays a key role in supporting counterterrorism efforts and intelligence operations across the United States, the United Kingdom, and other global markets.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and PLTR perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the software infrastructure industry.

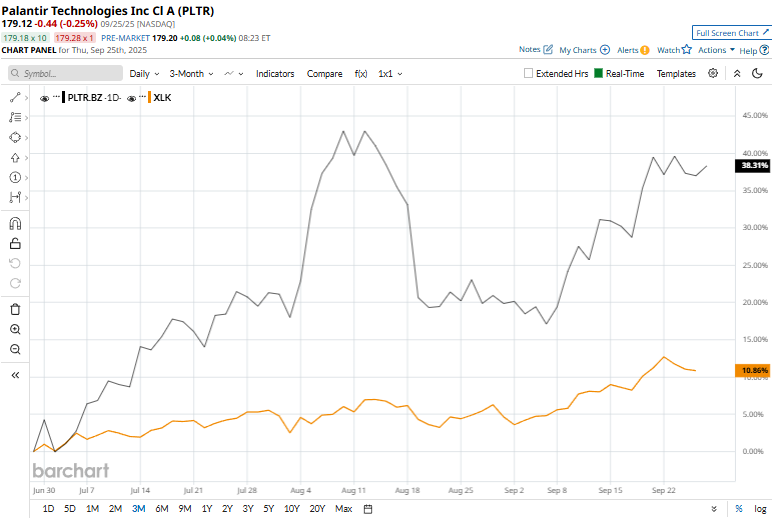

PLTR recorded its 52-week high of $190 on Aug. 12, and is currently trading 5.7% below the peak. The stock surged 25.4% over the past three months, outpacing the Technology Select Sector SPDR Fund’s (XLK) 11.5% returns over the same time frame.

Shares of PLTR have been on a remarkable run, skyrocketing 382.5% over the past year, far eclipsing XLK’s 24% gain in the same period. The momentum has only accelerated in 2025, with the stock climbing 136.8% year-to-date, compared with XLK’s more modest 19.6% rise.

Technically, the rally shows no signs of losing steam. PLTR has maintained a position above its 200-day moving average for the entire past year and has traded mostly above its 50-day moving average since late April, underscoring a strong and sustained uptrend.

On Sept. 23, shares of Palantir Technologies climbed over 1% after the U.S. Treasury Department awarded the company a new contract centered on strengthening data integrity and enhancing technical infrastructure. The deal underscores Palantir’s growing role as a trusted government technology partner, reinforcing its reputation for delivering advanced data analytics and infrastructure solutions.

Its rival, Microsoft Corporation (MSFT), has lagged behind, with its shares rising 20.3% on a YTD basis and 17.3% over the past 52 weeks.

Despite the robust momentum, analysts are skeptical. Among the 21 analysts covering the PLTR stock, the consensus rating is a “Hold.” On the bright side, it currently trades above its mean price target of $157.72.