/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg)

Palantir (PLTR) has been one of the hottest S&P 500 Index ($SPX) stocks over the past year, rising 378%. Moreover, it has more than doubled so far in 2025. However, the stock has recently come under pressure, declining consistently for five trading days and losing about 19% of its value from its 52-week high of $190.

While PLTR stock has cooled off a bit, it still trades at ultra-high valuation levels. At current levels, PLTR trades at a price-sales ratio of 144.1x and a forward price-earnings multiple north of 400x. These multiples far exceed industry averages and signal caution as they leave little margin for error if growth slows or market sentiment shifts.

However, Palantir has proven resilient in the face of lofty expectations. Investors have willingly paid a steep premium for the company’s long-term growth potential in AI, government contracts, and data analytics. That optimism has repeatedly supported the rally in PLTR stock, and the latest pullback could be short-term profit-taking.

Technical indicators also suggest there may be room for the stock to recover. Palantir’s 14-day Relative Strength Index (RSI) sits at around 43 as of this writing, well below the “overbought” threshold of 70. In plain terms, that suggests there is room for the stock to climb again if momentum returns.

Palantir’s Growth Story: Does It Justify the Price?

Palantir has been growing fast, and its latest quarterly result justifies the same. The data analytics and AI company just posted its first billion-dollar quarter, with revenue soaring 48% year-over-year in Q2 2025. That’s a sharp acceleration from the 21% growth it reported in the first quarter of 2024, and much of the momentum reflects very high demand for PLTR’s Artificial Intelligence Platform (AIP).

Palantir’s AI offerings are finding applications in both commercial and government markets. Thanks to this, its customer base is expanding at an impressive clip, standing at 849 at the end of Q2, up 43% from last year. Moreover, its existing clients are spending more, which cushions margins. Notably, revenue from its top 20 customers climbed to an average of $75 million each, a 30% increase. At the same time, margins remain strong, with adjusted operating margin widening to 46% from 37% in Q2 2024, suggesting the company is growing rapidly and profitably.

By regions, the U.S. market remains the key growth catalyst, especially its commercial arm. Domestic commercial revenue nearly doubled in Q2, surging 93% from last year, while sequential growth came in at 20%. The company also logged record-breaking U.S. commercial contract bookings of $843 million in Q2, more than tripling year-over-year. Over the past 12 months, U.S. commercial bookings have totaled $2.8 billion, highlighting a surge in enterprise demand for AI integration. Customer count in this segment rose 64%, reaching 485.

Government contracts continue to provide stability. Palantir’s U.S. government revenue rose 53% year-over-year in Q2, bolstered by a landmark $10 billion deal with the U.S. Army. This agreement consolidates dozens of smaller contracts into a long-term partnership, reaffirming Palantir’s deep-rooted ties with the Army and its capability to deliver mission-critical solutions.

The momentum in the first half of the year was strong enough that Palantir has raised its full-year outlook. The company now expects 2025 revenue of $4.146 billion at the midpoint, implying 45% growth. That’s a significant acceleration and about nine percentage points higher than what the company expected just last quarter. Its U.S. commercial revenue is expected to exceed $1.3 billion, up at least 85% year-over-year, another sharp upward revision.

With accelerating growth, expanding margins, and the stability of long-term government deals, the market, like in the past, will be comfortable betting that growth will justify the sky-high price tag.

Is PLTR Stock a Buy?

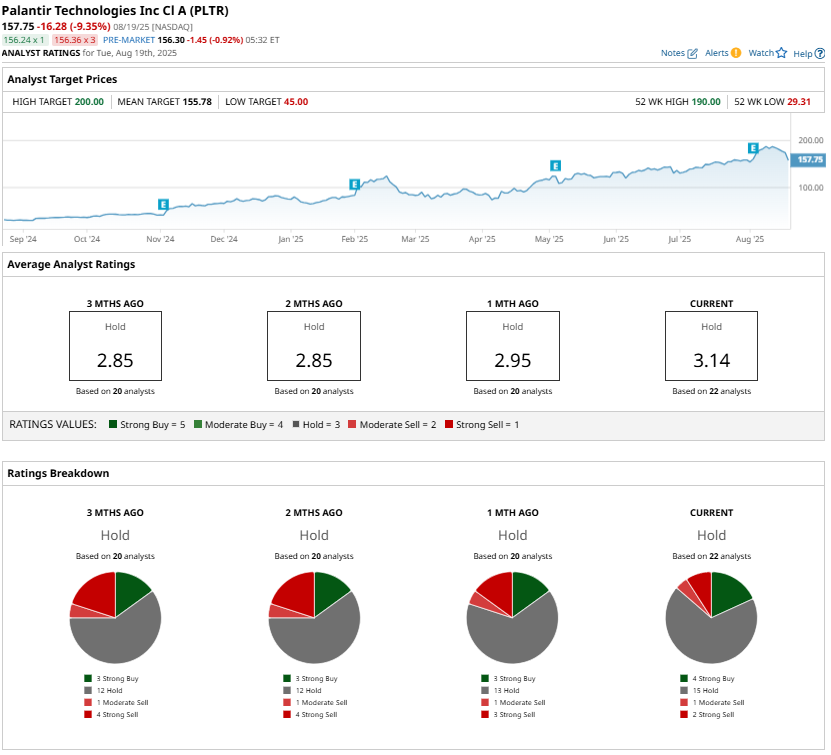

Palantir continues to post exceptional growth, with accelerating revenue, expanding margins, and strong momentum in both government and commercial AI contracts. However, Wall Street remains sidelined given its extremely high valuation multiples. Thus, PLTR remains a high-risk, high-reward play, and investors with a long-term horizon and appetite to tolerate volatility may consider buying on this dip.