/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

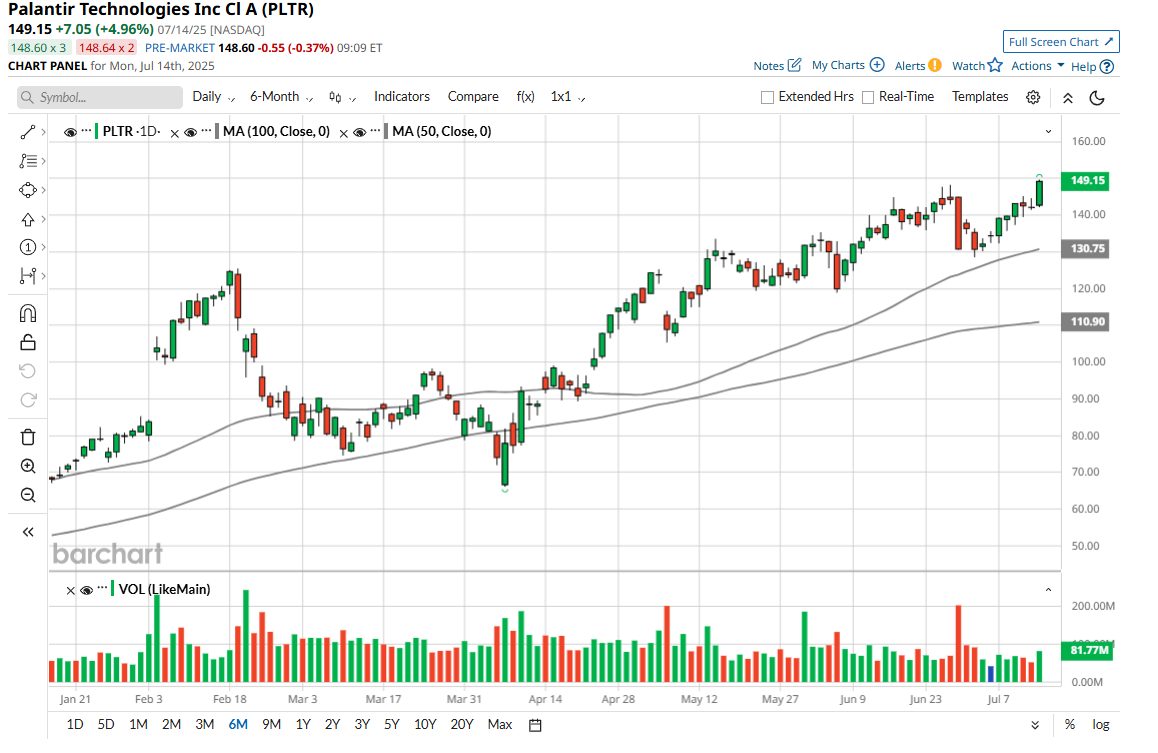

Palantir Technologies (PLTR) has been one of the best-performing S&P 500 Index ($SPX) stocks, delivering a jaw-dropping return of 97.7% so far this year. Moreover, this AI-powered software company’s shares have surged more than 420% over the past 12 months. This rally reflects excitement around its Artificial Intelligence Platform (AIP), which is rapidly gaining traction across industries.

From government agencies to commercial enterprises, more organizations are leaning on Palantir’s software to leverage the power of AI.

The company has long-standing partnerships with U.S. defense and intelligence agencies, which provide a steady revenue base and a strong endorsement of its technology. Now, with AI adoption accelerating globally, Palantir could expand into a much broader market, and its commercial revenue is growing at a rapid pace.

Macroeconomic headwinds haven’t slowed the company down either. In fact, Palantir has demonstrated impressive resilience and has seen its growth rate tick higher, mainly driven by rising demand for its AI-powered solutions. Moreover, operating leverage has led to significant expansion in margins.

Despite its compelling growth prospects, Palantir’s current valuation leaves no margin for error. Trading at a forward earnings multiple of 389x and a price-sales (P/S) multiple of 117.03x, the stock reflects expectations of flawless hypergrowth and sustained market dominance for years to come.

For context, these multiples far surpass those of most established tech giants, which typically trade at P/S ratios in the single to low double digits, and even high-growth software as a service (SaaS) companies. Such a premium implies that investors are not merely betting on strong performance, but on a near-perfect trajectory without any significant headwinds or competitive setbacks.

So, where does that leave Palantir stock today? Is it a buy or too hot to handle? Let’s dive in and find out.

Is Palantir Stock Still Worth Chasing?

Palantir is off to a blazing start in 2025 thanks to booming demand for its AI solutions. Revenue surged 39% year-over-year to $884 million in Q1, with the U.S. commercial segment emerging as a significant growth engine. That division hit a $1 billion annual run rate, while U.S. commercial revenue soared 71% to $255 million. Notably, bookings in that segment jumped 183% to a record $810 million for the quarter, signaling robust future demand.

Overall, U.S. revenue climbed 55% from the same quarter last year, reflecting strong traction in both government and commercial sectors. Government contracts remain a core strength, with U.S. government revenue rising 45% to $373 million, and international government partnerships, such as with the United Kingdom and NATO, are driving solid growth. The government’s total contract value reached $1.5 billion in the first quarter, a 66% increase from the previous year.

Palantir’s customer base is also expanding rapidly. It is now serving 769 clients, a 39% year-over-year increase. Among its top 20 customers, average revenue grew 26%, reaching $70 million over the past 12 months, a sign of deepening client relationships.

All this growth and solid demand have prompted Palantir to raise its full-year outlook. For 2025, the company now expects revenue to be between $3.89 billion and $3.902 billion, representing a 36% year-over-year increase. U.S. commercial revenue will exceed $1.178 billion, at least 68% higher than last year. Adjusted operating income is projected to reach up to $1.723 billion, and free cash flow is expected to exceed $1.8 billion. For the second quarter alone, Palantir is guiding revenue between $934 million and $938 million, reflecting a 38% annual increase.

As AI becomes increasingly integrated into critical decision-making across industries, Palantir’s strength in commercial enterprise software and government systems could continue to provide long-term tailwinds.

But with Palantir stock trading at an extremely high valuation following a dramatic rally, there’s little margin for error. The expectations now baked into the share price leave almost no room for any missteps.

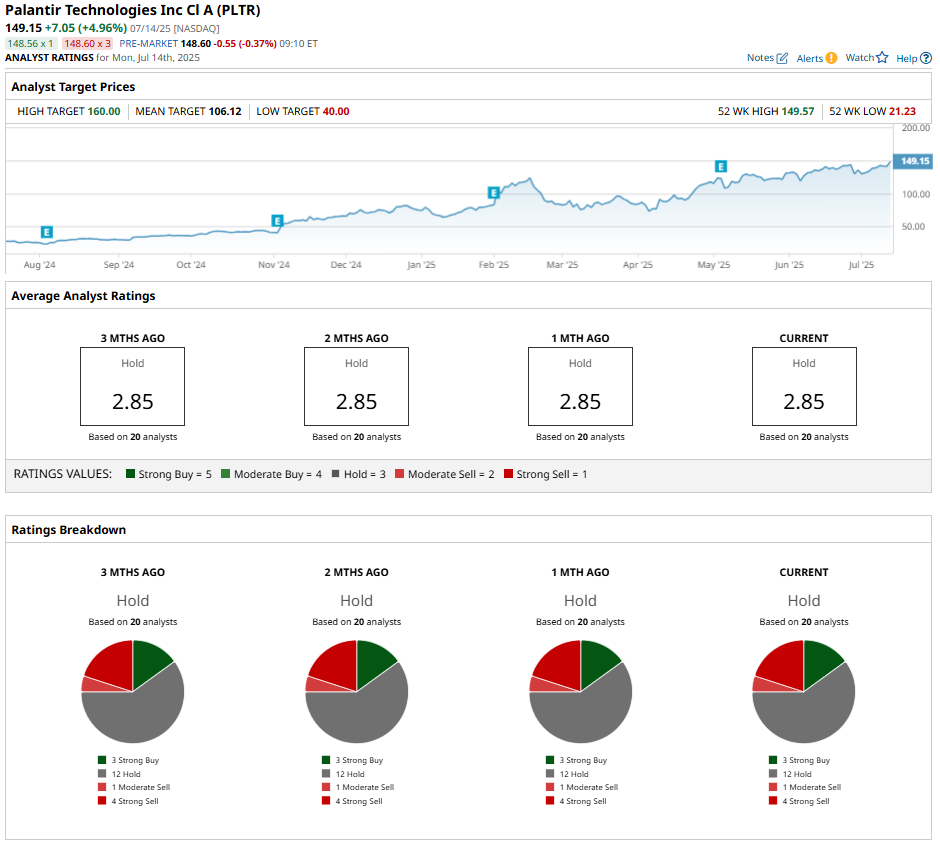

While the company’s trajectory is impressive, Wall Street remains cautious. The consensus rating on Palantir stock remains a “Hold,” indicating that even with its momentum, not all analysts are ready to call it a clear buy. For now, Palantir stock appears to be an overheated bet.