/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Palantir Technologies' (PLTR) stock is up +6% today as the company reported a huge +53.6% Q2 increase in Q/Q free cash flow and a massive 57% FCF margin. This could potentially push PLTR stock over 20% higher to $205 p/sh. This article will show why.

PLTR is currently trading at $171.26 per share, representing a 10% increase from its low of $154.27 on August 1.

Palantir's Strong FCF Results and FCF Guidance

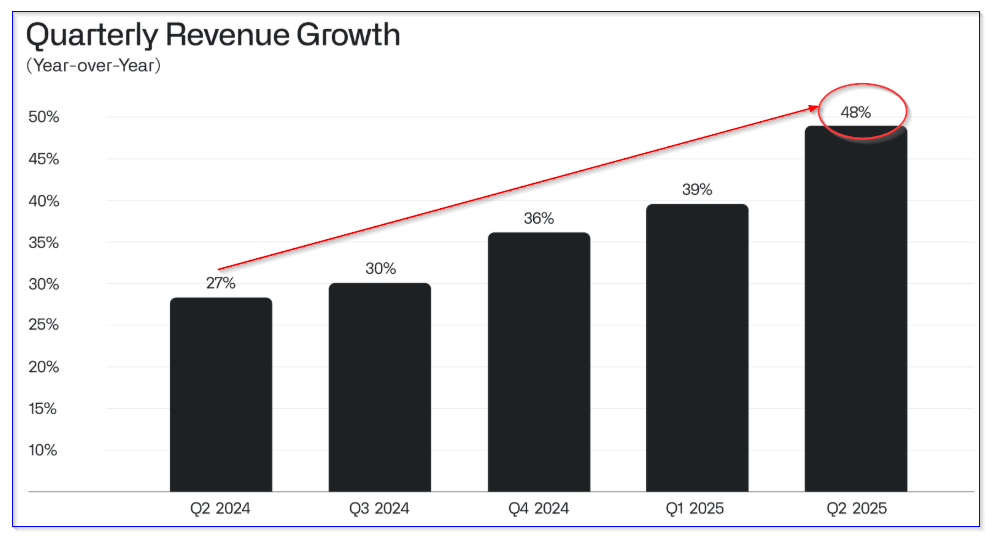

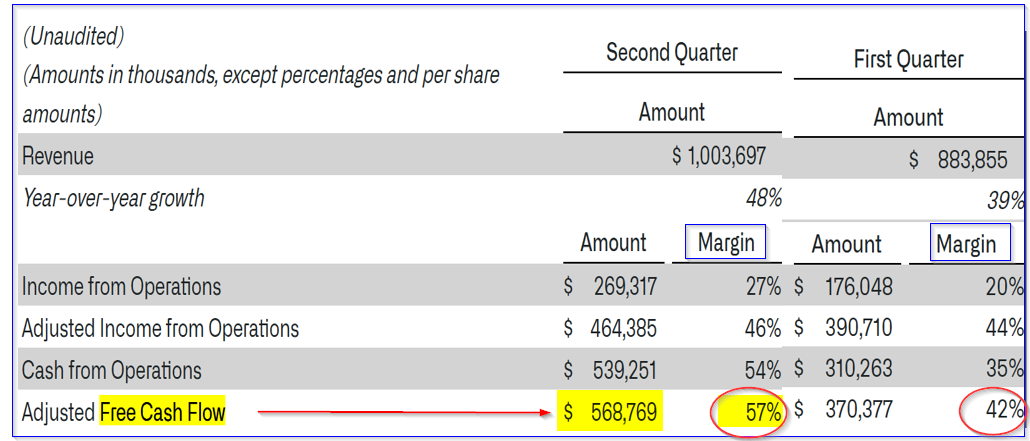

Palantir's $1.004 billion Q2 revenue, up +48% Y/Y and +13.6% Q/Q, was powered by strong AI-driven activities, including strong growth in its software contracts in the U.S.

In addition, Palantir raised its revenue guidance to a range of $4.142 billion to $4.150 billion. That is up from $3.8 billion to $3.902 billion projected in the Q1 release, an increase of +7.68% using the midpoints of the ranges.

Free Cash Flow. More importantly, Palantir's adjusted free cash flow (FCF) and FCF margins exploded. The company generated $568.8 million in Q2 adj. FCF, up +53.6% from $370.4 million in Q2.

Moreover, this Q2 FCF represented 56.7% of the $1.004 billion in revenue, up from a Q1 adj. FCF margin of 41.9%.

In addition, Palantir raised its full-year 2025 adj. FCF guidance to between $1.8 billion and $2.0 billion, up from $1.6 billion to $1.8 billion in its Q1 release. That midpoint represents a +11.8% forecast increase for the full-year.

That also implies its adj. FCF margin in the second half would be 46.3% of revenue.

For example, the $4.146 billion midpoint revenue forecast minus $1.886 billion H1 revenue implies H2 revenue would be $2.26 billion. And H2 FCF could be $1.9 billion in the full-year midpoint forecast for 2025, minus $935.146 million in H1 adj. FCF. That equals an implied H2 adj. FCF of $964.5 million.

In other words, the H2 adj. FCF would be 42.7% of H2 sales (i.e., $964.5 million/$2.26 billion). That is slightly lower than the full-year forecast margin (i.e., $1.9b adj. FCF/$4.146b = 0.458, or 45.8%).

Forecasting FCF for 2026

As a result, we can forecast significantly higher FCF in 2026. For example, analysts surveyed by Yahoo! Finance are projecting $5.33 billion in sales.

However, that is before yesterday's results, and I expect that this will rise by at least 7%, in line with management's increase this quarter for 2025. That brings the 2026 sales forecast to $5.7 billion.

As a result, using the 42.7% H2 2025 FCF margin (which is lower than the 45.8% FCF forecast for all of 2025), FCF could rise to:

$5.7b 2026 revenue x 0.427 = $2.43 billion 2026 FCF

That is +27.9% higher than the midpoint $1.9 billion guidance from Palantir for 2025.

As a result, this could push PLTR stock higher. Here's why.

Price Target for PLTR Stock

Today, the market cap for Palantir stock is $406.287 billion, based on 2.372.34 billion shares outstanding from today's Q2 10-Q filing.

Therefore, using management's midpoint FCF guidance of $1.9 billion, its FCF yield is slightly less than 0.50%:

$1.9b / $406.287b mkt cap = 0.004676 = 0.46%

As a result, we can set a price target using the 2026 FCF forecast:

$2.43b FCF 2026 / 0.005 = $486 billion mkt cap

In other words, PLTR could be worth almost 20% more over the next 12 months:

$486b / 406.287b = 1.1962 -1 = +19.62% upside

That means its price target is 19.6% higher than today's price of $171.26, or $204.83 per share.

Risks With This Valuation

Keep in mind this assumes that the market gives PLTR stock a 0.5% FCF yield, the equivalent of a 200x FCF multiple (i.e., 1/0.005). That is an extremely high multiple.

The slightest dip in FCF or FCF margins could lower that multiple. The risk is that it would push PLTR stock down quite dramatically.

In effect, investors expect FCF to have huge gains over the next several years. This valuation would fully pay up for that expectation.

So, there are large risks involved, both in the FCF growth rate, the FCF margins, and the multiple used to value that FCF. As a result, investors should be very careful here. It might make sense to wait for a pullback in PLTR stock to set a lower buy-in price.