According to Tyler Radke, a senior Citigroup equity analyst, Palantir Technologies Inc.’s (NASDAQ:PLTR) lofty valuations are difficult to justify despite its “outstanding Q2 results.”

Valuation Is Still Too High

The stock has declined 15% over the past week, after Andrew Left’s Citron Research revealed a short position in the company.

Yet, Radke warns that the company’s valuation is still too rich, “this stock, even despite its slide, is still trading at around 70 times forward revenue,” he notes, adding that it was on the high end of the broader market’s valuation range, while speaking on CNBC’s ‘Squawk Box’ on Thursday.

He does, however, acknowledge its strength and performance, pointing to a strong recent Q2 earnings.

See Also: Palantir Just Broke Below 50-Day Average—Is It Time To Buy The Dip?

While Radtke notes that Palantir's mix of growth and profitability is rare, he says the history of buying stocks at such high multiples “hasn’t been great.”

He says Palantir's strength lies in positioning itself as a key enabler for organizations looking to adopt artificial intelligence, but is uncertain about how long the company’s lead and edge could last.

“It’s unclear to me if that edge is sustainable, especially as we get into more AI use cases, moving into production, adopting LLMs,” he said.

Insider Selling, Short Reports Dent Optimism

Early this week, Citron Research initiated a short position in the stock, saying that the company’s fair value based on the 2026 revenue forecast would be $40 per share, which is 74% below its current price, while adding that “at $40, PLTR would still be expensive”.

Citron compares Palantir with OpenAI’s $500 billion valuation, highlighting the latter’s “unprecedented” revenue growth relative to the former’s “steady progress.” The company’s “lumpy, less scalable revenue” from government contracts was compared to OpenAI’s “self-reinforcing growth engine.”

The short thesis also featured significant insider selling at Palantir in recent months, especially by CEO Alex Karp, who has sold $2 billion worth of stock over the past two years.

However, Wedbush Securities analyst Dan Ives continues to remain bullish, describing Palantir as “the poster child of the AI revolution,” while urging investors to see the dip as a buying opportunity.

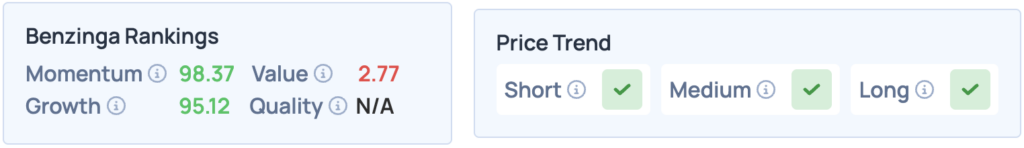

Palantir shares were up 0.11% on Thursday, closing at $156.18, and are down 0.44% after hours. The stock scores high in Benzinga’s Edge Stock Rankings for Momentum and Growth, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Photo Courtesy: Dennis Diatel on Shutterstock.com

Read More: