Palantir Technologies Inc. (NASDAQ:PLTR) is back in focus after this I/O Fund analyst highlighted its soaring valuation alongside an impressive 93% year-over-year growth in its U.S. commercial business.

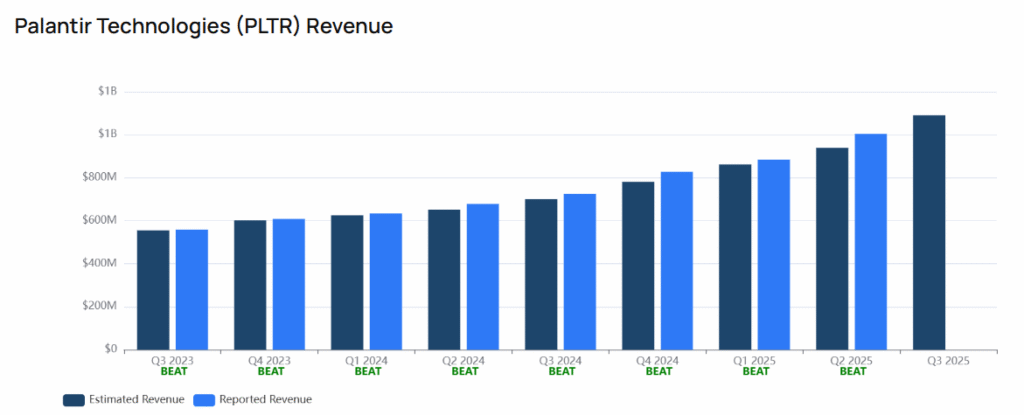

Here’s a fresh perspective on the stock after the software company reported its first-ever quarter surpassing $1 billion in revenue, in August.

PLTR Is Well Beyond Perfect 10, It’s A ‘Perfect 100’

The central challenge is the company’s demanding valuation. Lead Tech Analyst at I/O Fund, Beth Kindig, notes Palantir is “well beyond a Perfect 10 and is rather a ‘Perfect 100’.”

This refers to Palantir’s “astonishing” forward price-to-sales (P/S) ratio of 104. In simpler terms, the analysis suggests that based on its projected 2025 revenue, “it would take over 100 years to pay back its current market cap.”

This stark metric places immense pressure on the company to sustain its extraordinary growth. Meanwhile, according to Benzinga Pro, PLTR has a forward price-to-earnings ratio of 212.766 and a trailing metric of 618.233.

| Stocks | Forward P/E | YTD Performance |

| Palantir Technologies Inc. (NASDAQ:PLTR) | 212.766 | 146.67% |

| Salesforce Inc (NYSE:CRM) | 19.342 | -25.81% |

| SAP SE (ETR: SAP) | 33.784 | 13.44% |

| Adobe Inc (NASDAQ:ADBE) | 14.881 | -21.21% |

| Intuit Inc (NASDAQ:INTU) | 27.933 | 3.55% |

| Average P/E | 61.7412 | (As of Oct. 9 Close) |

See Also: Big Tech Earnings To Validate AI Spending Surge

What’s Contributing To This Rich Valuation?

Fueling this rich valuation is the runaway success of Palantir’s Artificial Intelligence Platform (AIP). Launched in mid-2023, the platform created a “clear and obvious revenue inflection,” according to I/O Fund.

I/O Fund’s analysis emphasizes the rarity of this performance, stating, “you will be hard pressed to find this kind of QoQ growth across AI's biggest players.” AIP’s ability to integrate generative AI with operational data is attracting larger commercial deals.

The numbers back up the hype. Palantir’s second quarter performance marked its eighth consecutive quarter of accelerating revenue growth.

PLTR Remains Confident, Raises Guidance

On the back of strong growth, the company raised its full-year 2025 revenue guidance midpoint to $4.146 billion. Key metrics include a 222% year-over-year increase in U.S. commercial Total Contract Value (TCV) booked, totaling $843 million, and a 64% year-over-year rise in U.S. commercial customers.

While its foundational government business remains strong, accounting for 55% of revenue, all eyes are on the accelerating commercial segment. The primary question for the market is whether Palantir’s spectacular, AI-driven growth can continue to justify its ‘Perfect 100’ valuation, especially as it approaches what analysts believe could be a peak growth quarter.

Price Action

Shares of Palantir were 0.23% lower in premarket on Friday; it ended 1.04% higher at $185.47 per share on Thursday. The stock has risen 146.67% year-to-date and 326.17% over the year.

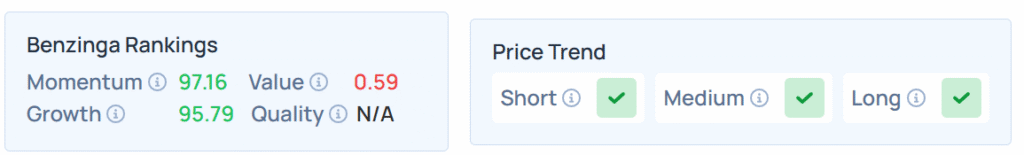

Benzinga's Edge Stock Rankings indicate that PLTR maintains a stronger price trend in the short, medium, and long terms, with a very poor value ranking. Additional performance details are available here.

On Thursday, the S&P 500 index ended 0.28% lower at 6,735.11, whereas the Nasdaq 100 index declined 0.15% to 25,098.18. Dow Jones also tumbled 0.52% to 46,358.42.

The futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher on Friday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock