TV host Jim Cramer has once again thrown his weight behind Palantir Technologies Inc. (NASDAQ:PLTR), this time with a striking new valuation claim and a nod to the company's latest initiative tied to nuclear infrastructure.

What Happened: On Thursday, during the pre-market segment on CNBC’s Mad Money, Cramer made a bold bet on Palantir, calling it a “$200 stock masquerading as $144,” essentially predicting a 36% upside for the AI giant from its current levels.

Cramer pointed to Palantir's involvement in a so-called Nuclear Operating System (NOS), which he said aims to support on-time, on-budget nuclear construction projects.

While the details around the system remain limited, Cramer suggested that the inclusion of the word “nuclear” alone may be enough to drive investor enthusiasm.

See Also: Palantir Just Teamed Up To Reinvent Nuclear Power: Here’s What’s At Stake

“It's got ‘nuclear’ in the name, that's all that matters today,” he said, pointing to the market's appetite for headline-driven momentum in the burgeoning AI and energy sectors.

The renowned television host also mentioned Microsoft Corp. (NASDAQ:MSFT) CEO Satya Nadella’s recent remarks on Palantir. Nadella reportedly met with the company’s leadership and praised it as being “really important now.”

Cramer also alluded to mounting interest in Washington around AI and defense technology, referencing comments made by Sen. Elizabeth Warren (D-Mass.).

“I was listening to Senator Warr[e]n this morning,” he said, adding that while Warren didn't explicitly mention the company by name, Cramer emphasized the growing sense that firms like Palantir are becoming essential players in government tech procurement.

Why It Matters: Recently, at a Y Combinator event, Nadella praised Palantir’s Forward Deployed Engineer solution as “fantastic,” highlighting its change management model in helping customers and partners truly grasp the value in transformative AI technologies.

The company’s shares hit a new all-time high this week, after rallying 480% over the past 12 months, and 94.6% year-to-date.

According to Wedbush analyst Dan Ives, the stock can triple from here over the next two to three years, reaching a market capitalization of $1 trillion, crediting CEO Alex Karp for its prospects.

“[Alex] Karp, he’s playing chess, others are playing checkers. And I think you are starting to realize more and more in government, enterprise, and that’s why you cannot talk AI revolution without saying Palantir,” Ives said.

Price Action: Shares of Palantir were up 2.39% on Thursday, trading at $146.31, and are down 0.69% after hours.

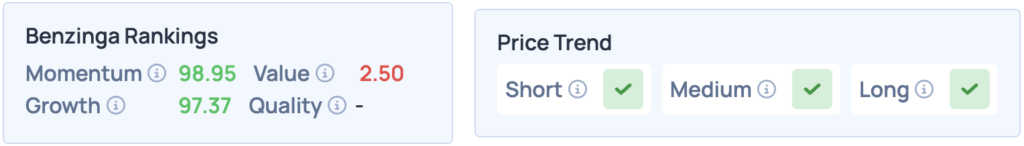

According to Benzinga’s Edge Stock Rankings, Palantir’s performance is truly off-the-charts, ranking 97th and 98th percentile on Growth and Momentum, respectively, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: slyellow / Shutterstock.com