/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Even after a meteoric rally, Palantir Technologies (PLTR) isn’t running out of steam just yet. Piper Sandler’s latest research pushes back against the idea that the stock has peaked, lifting its price target from $182 to $201 while reaffirming an “Overweight” rating.

That bullish call is underpinned by Palantir’s unusually strong contract visibility, with over $7 billion in defined deals plus $4 billion in IDIQ (Indefinite Delivery, Indefinite Quantity) pipeline and surging commercial bookings showing triple-digit growth so far this year.

Despite lofty valuation concerns, Piper contends there’s no sign yet that Palantir’s growth engine is losing steam. Instead, the firm argues that the stock has more room to run, making PLTR a buy.

About Palantir Stock

Palantir Technologies is a software and data analytics company that develops platforms designed to integrate, manage, and secure complex datasets across government and commercial clients. Headquartered in Denver, Colorado, Palantir has grown from its roots in government intelligence into a broader enterprise-tech play. It specializes in big‑data analytics and artificial intelligence (AI) platforms including Gotham, Foundry, Apollo, and its newer Artificial Intelligence Platform (or AIP) for both government and enterprise clients.

Its market cap is around $426.4 billion, placing it among the largest software and analytics companies globally.

Palantir stock has been nothing short of explosive in 2025, delivering a year-to-date (YTD) return of nearly 140%. Over the trailing 52 weeks, the story is even more dramatic as PLTR has climbed 323%, powered by accelerating AI momentum, government contract wins, and renewed investor appetite.

The stock also set a lofty all-time high of $190 on Aug. 11, putting the current price just a modest distance below that peak, even as volatility remains a constant companion. The magnitude of PLTR’s run this year signals strong conviction, but its proximity to record highs also means any missteps or sentiment shifts could reverberate quickly.

The stock is currently trading at a substantial premium over peers and its own historical average at 395 times forward earnings.

Steady Top-Tine Growth

Palantir released its Q2 2025 results on Aug. 4, marking a major milestone as quarterly revenue surpassed $1 billion for the first time, reaching $1.004 billion, up 48% year-over-year (YoY) and 14% sequentially. Growth in the U.S. market was particularly strong, with revenue climbing 68% YoY and 17% quarter-over-quarter (QoQ), fueled by continued momentum in both commercial and government segments. Notably, U.S. commercial revenue surged 93% YoY and 20% sequentially, underscoring Palantir’s accelerating enterprise adoption.

Adjusted operating income rose to $464 million, reflecting a 46% adjusted operating margin. Adjusted EPS grew to $0.16, surpassing expectations.

As a measure of combined growth and profitability, Palantir’s Rule of 40 score reached 94% in Q2, a strong signal of balance between expansion and operating leverage. On deal metrics, the company closed 157 deals of $1 million or greater during the quarter, including 66 deals at least of $5 million and 42 at least $10 million thresholds. Palantir also reported strong contract momentum with a substantial remaining deal value base.

For FY 2025, Palantir raised its total revenue outlook to $4.142 billion to $4.150 billion. It also boosted its U.S. commercial revenue forecast, now projecting more than $1.302 billion, implying at least 85% growth in that segment.

Analysts expect the company’s EPS to climb 462.5% YoY to $0.45 in fiscal 2025 and rise another 33.3% to $0.60 in fiscal 2026.

What Do Analysts Expect for Palantir Stock?

Piper Sandler raised its price target on Palantir, maintaining an “Overweight” rating. Analyst Clarke Jeffries acknowledged Palantir’s lofty valuation but argued the company still has strong growth momentum.

The firm highlighted Palantir’s triple-digit commercial booking growth and vast potential within the $1 trillion U.S. defense market, noting that even a 0.5% share shift toward Palantir could multiply its government business fivefold. Piper Sandler believes the defense sector’s pivot to software-driven, AI-enabled systems and Palantir’s accelerating AIP-powered commercial adoption signal the company has not yet reached peak growth.

However, last month, Mizuho reiterated its “Neutral” rating and $165 price target on Palantir. The firm praised Palantir’s “stunning” execution, and strong momentum across both commercial and government segments. However, despite the impressive fundamentals and a solid YTD stock gain, Mizuho maintained its neutral stance, citing Palantir’s “extreme” valuation multiples that leave the shares vulnerable to potential multiple compression.

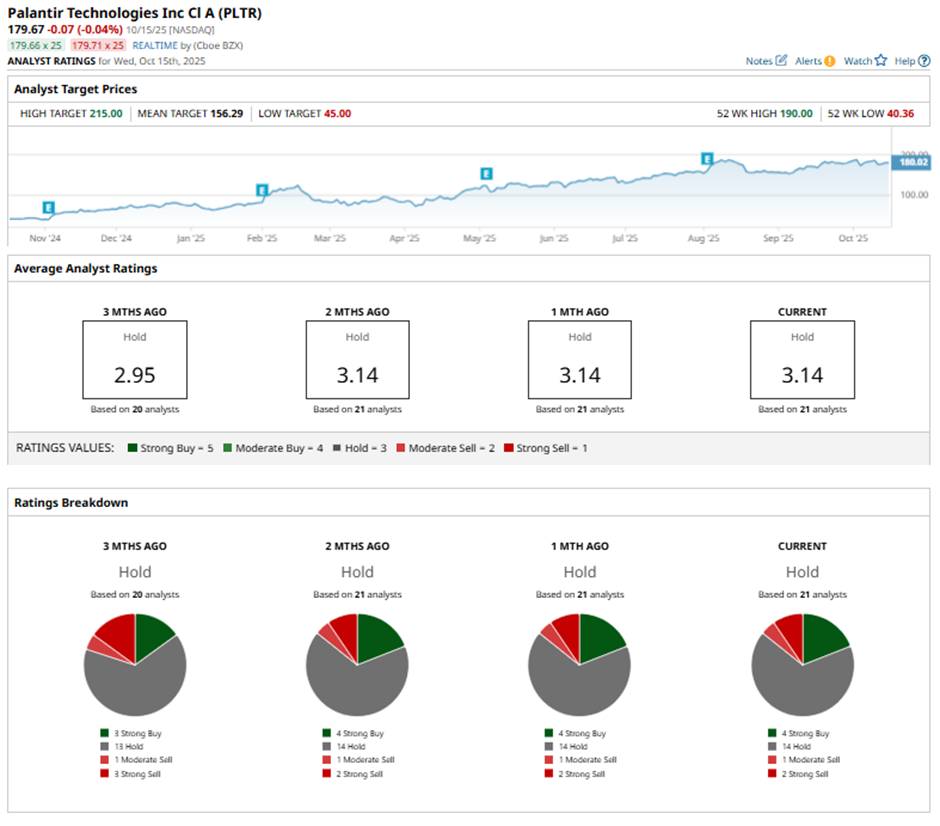

PLTR has a consensus rating of a “Hold” overall. Of the 21 analysts covering the stock, four advise a “Strong Buy,” 14 suggest a “Hold,” one analyst gives it a “Moderate Sell” rating, and two rate it as a “Strong Sell.”

While PLTR is trading at a premium to its average analyst price target of $156.29, the Street-high target of $215 signals that PLTR can still rise as much as 19.6% from current levels.