Cryptocurrency exchange Bullish is targeting a valuation of up to $4.32 billion in its upcoming initial public offering in the U.S., the company disclosed on Monday.

Details Of The IPO

Bullish, backed by billionaire investor and entrepreneur Peter Thiel, is seeking to raise up to $629.3 million by offering 20.3 million shares priced between $28 and $31 each. The company applied to list the shares on the New York Stock Exchange under the ticker "BLSH.”

“We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to 3,045,000 additional Ordinary Shares, at the initial public offering price, less underwriting discounts and commissions,” Bullish said. JPMorgan Chase & Co. (NYSE:JPM) and Jefferies Financial Group Inc. (NYSE:JEF) are the lead underwriters.

The company added that the total number of shares outstanding could go up to 139,528,739 after the offering, potentially valuing the IPO at $4.32 billion.

Second Time Lucky

This is the second time Bullish has attempted to go public in the last four years. The company initially planned to go public through a special purpose acquisition company in 2021, but the plan was abandoned in 2022 due to regulatory challenges.

The company intends to convert a significant part of the IPO proceeds into U.S.-dollar-denominated stablecoins with the assistance of one or more issuers of such tokens.

Bullish also operates a crypto news website, CoinDesk, which it acquired from Barry Silbert’s Digital Currency Group in 2023. The firm, led by CEO Tom Farley, has over 275 employees globally and operates in Hong Kong, the U.S. and Europe.

‘Bullish’ Momentum For Crypto In The US

The cryptocurrency industry has gained momentum due to the Trump administration’s friendly policymaking, including the recent passage of the GENIUS Act, which provides an initial regulatory framework for stablecoins.

Notably, Circle Internet Group Inc. (NYSE:CRCL), a prominent stablecoin issuer, recorded a blockbuster public listing in June, surging 138% since its debut.

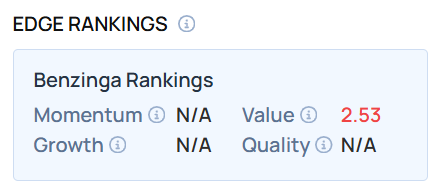

The stock demonstrated a low Value score as of this writing. Are you looking for cryptocurrency-linked stocks for your portfolio? Check out Benzinga Edge Stock Rankings to filter out the best performers on other key measures such as Momentum, Growth, and Quality.

Meanwhile, Palantir Technologies Inc. (NASDAQ:PLTR), co-founded by Thiel, reported financial results for the second quarter after the market closed, with revenue and earnings smashing analysts’ expectations. The firm topped $1 billion in quarterly revenue for the first time.

Photo: Hepha1st0s On Shutterstock.com

Read Next: