Tech bull Dan Ives of Wedbush Securities has raised his price target for Palantir Technologies Inc. (NASDAQ:PLTR), signaling a 12% upside from its current trading price over the next 12 months.

What Happened: In a post on X, Ives expressed growing confidence in Palantir's artificial intelligence strategy and raised his target price on the stock to $160 per share, describing it as the company's "golden path to become an AI stalwart" over the next 12 months.

The bullish outlook comes as Palantir continues to leverage its AI Platform (AIP) to integrate data, decisions, and operations for clients, driving a 45% year-over-year increase in U.S. commercial revenue to $373 million in the first quarter of 2025. –

Ives' enthusiasm underscores his belief in the company's potential to dominate the AI landscape, despite its forward P/E ratio of 256.410, raising valuation concerns among some investors.

Recently, Palantir partnered with BlueForge Alliance to digitize and accelerate U.S. warship production for the Navy. The company is also negotiating to provide technology to the IRS and Social Security Administration, strengthening its government footprint.

Since Donald Trump's inauguration, Palantir has secured over $113 million in contracts, excluding a $795 million DoD deal.

However, controversy looms as states allege the Trump administration illegally shared Medicaid recipients' health data with immigration authorities, violating federal privacy laws.

See Also: Warren Buffett's Quiet Dividend Play: 9 High-Yield Stocks Held By A Berkshire Subsidiary

Why It Matters: Ives has been bullish on the stock, betting that it could triple in the coming years and trade above $400 per share.

"That's why it's the ‘Messi of AI.' I believe we're talking about a trillion-dollar market cap for Palantir in the next few years, and I think when you look at what [Alex] Karp and Palantir are doing, they, along with Nvidia, will be leading the AI revolution," Ives said in May.

Price Action: The stock was 0.25% in premarket on Thursday, but it has risen 90.36% on a year-to-date basis and 403.62% over the last year.

Twenty-five analysts, tracked by Benzinga, have set a consensus price target of $76.72 for Palantir with a consensus ‘sell’ rating. The latest analyst ratings suggest a potential downside of 9.83% for the stock.

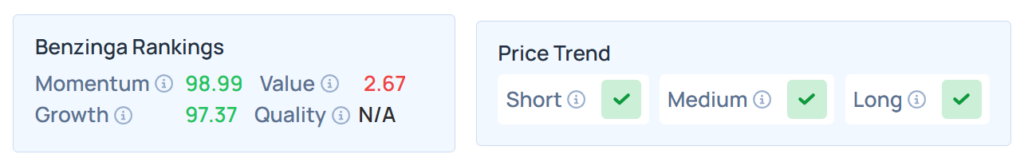

Benzinga Edge Stock Rankings shows that PLTR had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid at the 98.99th percentile, whereas its value ranking was poor at the 2.67th percentile; the details of all the metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were slightly lower in premarket on Thursday. The SPY was down 0.095% at $623.47, while the QQQ declined 0.049% to $555.98, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock