Palantir Technologies Inc. (NASDAQ:PLTR) co-founder Joe Lonsdale said he is "uncomfortable" with the federal government taking an equity stake in Intel Corp. (NASDAQ:INTC), calling the move unusual and a form of favoritism.

Intel Stake Draws ‘Cronyism' Charge From Palantir Co-Founder

"It's very weird, of course, for the government to be taking a stake in something," Lonsdale said on CNBC's Squawk Box. "It's also a little bit weird for the government to be giving $9 billion to a company, too." He added, "It's cronyism in some form."

Intel Corp. has said the "government's equity stake will be funded by the remaining $5.7 billion in grants previously awarded, but not yet paid, to Intel under the U.S. CHIPS and Science Act and $3.2 billion awarded to the company as part of the Secure Enclave program," describing the plan alongside a new factory-investment push.

White House Signals Potential Expansion To Other Industries

The White House has signaled the Intel deal may not be the last. According to a report by Reuters in late August, National Economic Council Director Kevin Hassett likened the approach to a sovereign wealth strategy. "There'll be more transactions, if not in this industry, in other industries," he said.

Lonsdale, during his CNBC interview, said he could support public investment if it clearly advances national security, but he questioned the precedent of direct ownership in a private company outside an emergency context.

The federal government last took large corporate stakes at scale during the 2008 crisis, when Treasury capitalized banks under the Troubled Asset Relief Program, or TARP, which is an extraordinary measure to stabilize markets.

Critics Warn Of Precedent And Market Distortions

Criticism from Capitol Hill and markets has mounted over the Intel plan, which envisions the U.S. ultimately holding about 10% of the chipmaker. Sen. Rand Paul (R-Ky.) blasted the proposal last week, saying that it takes away “forces away that breed excellence," and labelled it a “big mistake”.

Economist Peter Schiff argued the move is "not only unconstitutional, but a bad idea," while ‘Shark Tank’ investor Kevin O'Leary said he hates the idea of the government buying into Intel.

Not all reactions have been negative. Sen. Bernie Sanders (I-Vt.) backed the framework, saying, "I am pleased the [Donald] Trump administration agrees with the amendment I proposed three years ago," and adding that taxpayers should not hand out billions of dollars in corporate welfare without getting something in return.

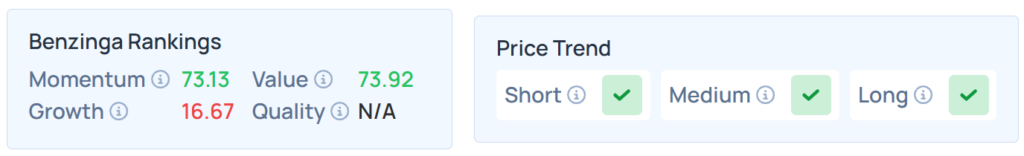

Shares of Intel were down 0.49% on Friday, closing at $24.49, and are down 0.69% after hours. The stock scores fairly well in Benzinga's Edge Stock Rankings, with high Momentum and Value scores, with a favorable price trend in the short, medium and long term. Click here for more insights into the stock and its peers.

Photo Courtesy: Tada Images via Shutterstock.com

Read Next: