Senior Palantir Technologies Inc. (NASDAQ:PLTR) is seeing one of the heaviest stretches of insider selling in years, amid growing scrutiny on the company’s valuations in recent weeks.

$250 Million Being Offloaded

According to filings made with the SEC on Thursday, the company’s insiders, comprising senior executives and board members, are preparing to offload shares worth over $250 million.

This was led by the company’s CEO, Alex Karp, who is by far the biggest seller, filing to sell of 585,000 shares valued at $95.93 million. Karp previously sold $62.7 million worth of shares in August, while still owning a significant stake in the company, valued at over $2 billion.

See Also: Palantir Technologies’s Options: A Look at What the Big Money is Thinking

President and co-founder Stephen Cohen is planning to sell 405,000 shares worth $66.4 million, alongside prior August transactions totaling more than $24.9 million.

Followed by the company’s CFO and Chief Revenue Officers, David Glazer and Ryan Taylor, with both planning stake sales worth $3.8 million, after similar filings made in September.

The company’s CTO, Shyam Sankar, has filed to sell 225,000 shares in the company, valued at $36.89 million, with multiple prior transactions, including a $12.1 million stake sale in August, and a few smaller transactions since.

| Executive | Shares To Be Sold | Estimated Value |

|---|---|---|

| Alex Karp (CEO) | 585,000 | $95.93M |

| Stephen Cohen (President, Co-founder) | 405,000 | $66.4M |

| Shyam Sankar (CTO) | 225,000 | $36.89M |

| David Glazer (CFO) | 23,290 | $3.82M |

| Ryan Taylor (CRO) | 23,290 | $3.82M |

Palantir did not immediately respond to Benzinga’s request for a comment on this matter. This story will be updated as soon as we receive a response.

Palantir Shares Under Pressure

Despite its strong third-quarter performance early this month, Palantir shares have been under pressure, with several leading analysts and investors questioning its valuation of 381 times earnings and 107 times sales.

After hitting a new all-time high of $207.18 per share this month, the stock has witnessed a significant pullback, and is currently down 24.82% since then. This began after renowned investor Michael Burry revealed his bearish position against the stock, with a market value of $912 million.

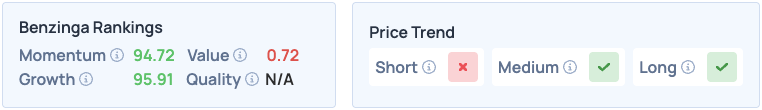

Palantir shares were down 5.85% on Thursday, closing at $155.74, and are down 0.07% overnight. Despite its recent pullback, the stock scores high on Momentum and Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the Medium and Long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo: Sundry Photography / Shutterstock

Read More: