With a market capitalization of $34.6 billion, Pacific Gas & Electric Company (PCG) is one of the largest combined natural gas and electric utilities in the U.S., serving millions of customers across Northern and Central California. Headquartered in California, PG&E delivers electricity, natural gas distribution, and energy services across a vast and diverse service area spanning urban, suburban, and rural regions.

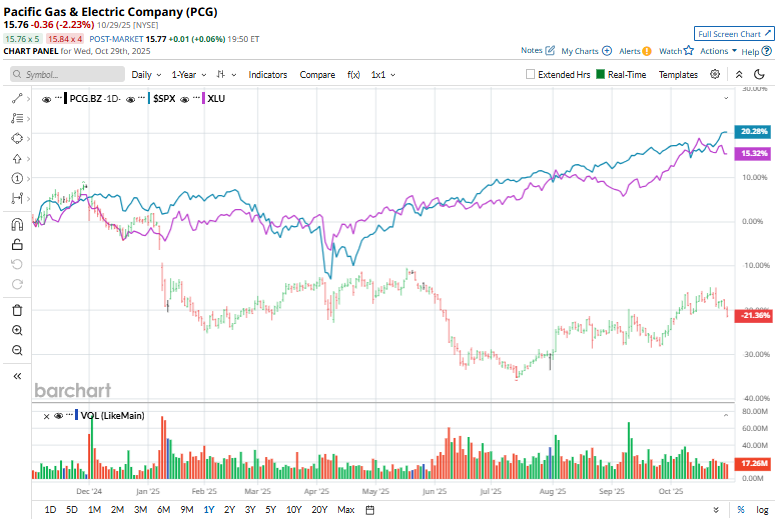

Shares of the utility titan have underperformed the broader market considerably. PCG’s stock has declined by 21.7% over the past 52 weeks, while the broader S&P 500 Index ($SPX) has gained 18.1% over the same period. The weakness has continued into 2025, with the stock sliding 21.9% year-to-date compared to the index’s 17.2% gain.

The lag becomes even more stark when compared to the S&P 500 Utilities Sector SPDR (XLU) ETF, which gained 13.7% over the past 52 weeks and 19% year-to-date.

On Oct. 23, PCG shares declined 1.7% after the company announced FY2025 Q3 earnings. Its adjusted EPS of $0.50 came comfortably above expectations of $0.42, supported by stronger demand and lower operating expenses. However, revenue of $6.25 billion came in slightly below estimates. While PCG unveiled a substantial five-year capital plan totaling $73 billion for 2026-2030, it narrowed its 2025 outlook to $1.49 to $1.51 per share, down from $1.48 to $1.52 per share.

For the current fiscal year, ending in December 2025, analysts expect PCG’s EPS to grow 10.3% annually to $1.50 on a diluted basis. The company’s earnings surprise history is mixed. It beat or met the consensus estimate in two of the last four quarters, while missing the forecast on two other occasions.

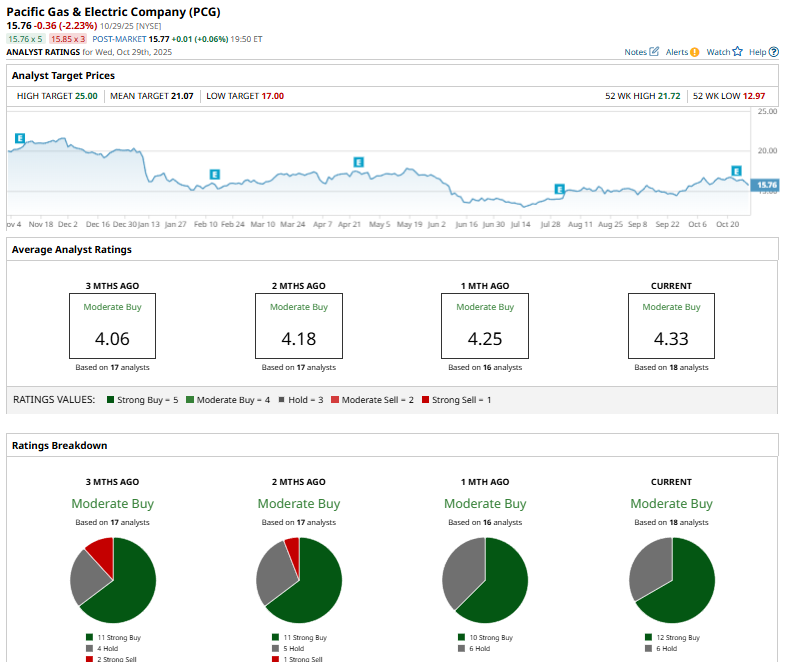

Among the 18 analysts covering PCG’s stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, and six “Holds.”

The configuration is more bullish than a month ago when ten analysts had suggested “Strong Buy” for the stock.

On Oct. 10, Mizuho Securities analyst Anthony Crowdell reiterated a “Buy” rating on PCG and maintained a price target of $21.

PCG’s mean price target of $21.07 indicates premium of 33.7% from the current market prices. The Street-high price target of $25 implies a potential upside of 58.6%.