Owens & Minor, Inc. (NYSE:OMI) reported worse-than-expected second-quarter earnings on Monday.

Owens & Minor posted adjusted earnings of 26 cents per share, missing market estimates of 27 cents per share.

Owens & Minor said it sees FY2025 adjusted EPS of $1.02-$1.07 and sales of $2.760 billion-$2.820 billion.

“We are in the final stages of our robust process for the divestiture of the Products & Healthcare Services segment, and, as a result, have classified this segment as discontinued operations. We are looking forward to concluding the sale of the business and working with a buyer who has the vision and greater flexibility to better support our customers and long-term growth,” said Ed Pesicka, Owens & Minor’s Chief Executive Officer.

Owens & Minor shares jumped 18% to close at $5.47 on Tuesday.

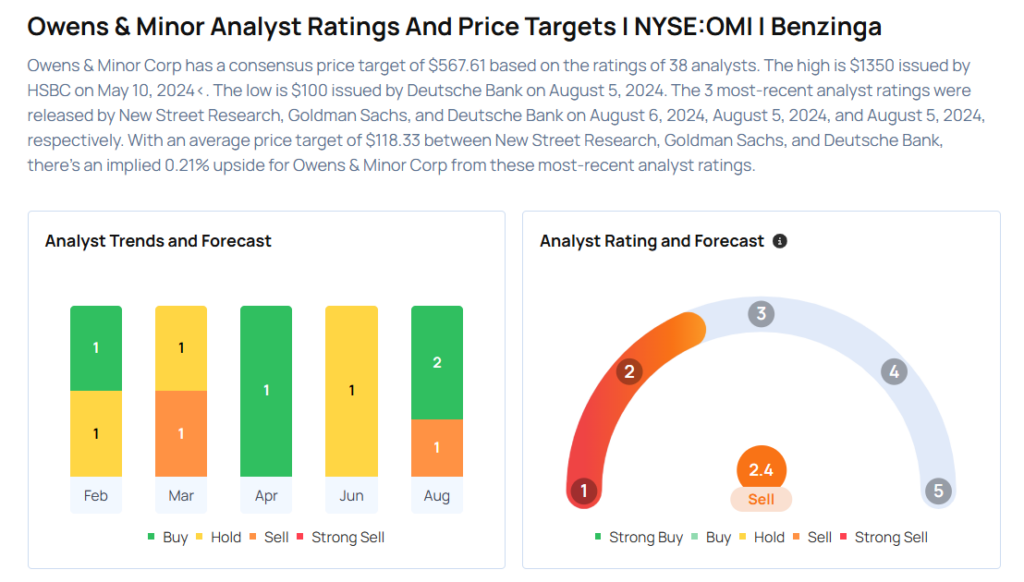

These analysts made changes to their price targets on Owens & Minor following earnings announcement.

- B of A Securities analyst Allen Lutz maintained Owens & Minor with an Underperform rating and lowered the price target from $7.5 to $4.75.

- Citigroup analyst Daniel Grosslight maintained Owens & Minor with a Buy and lowered the price target from $11 to $7.

- Baird analyst Eric Coldwell maintained Owens & Minor with an Outperform rating and lowered the price target from $10 to $7.

Considering buying OMI stock? Here’s what analysts think:

Photo via Shutterstock