/Otis%20Worldwide%20Corp%20company%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Farmington, Connecticut-based Otis Worldwide Corporation (OTIS) develops, manufactures, installs, and services vertical transportation systems, primarily elevators, escalators, and moving walkways. Valued at a market cap of $35.8 billion, the company is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Oct. 29.

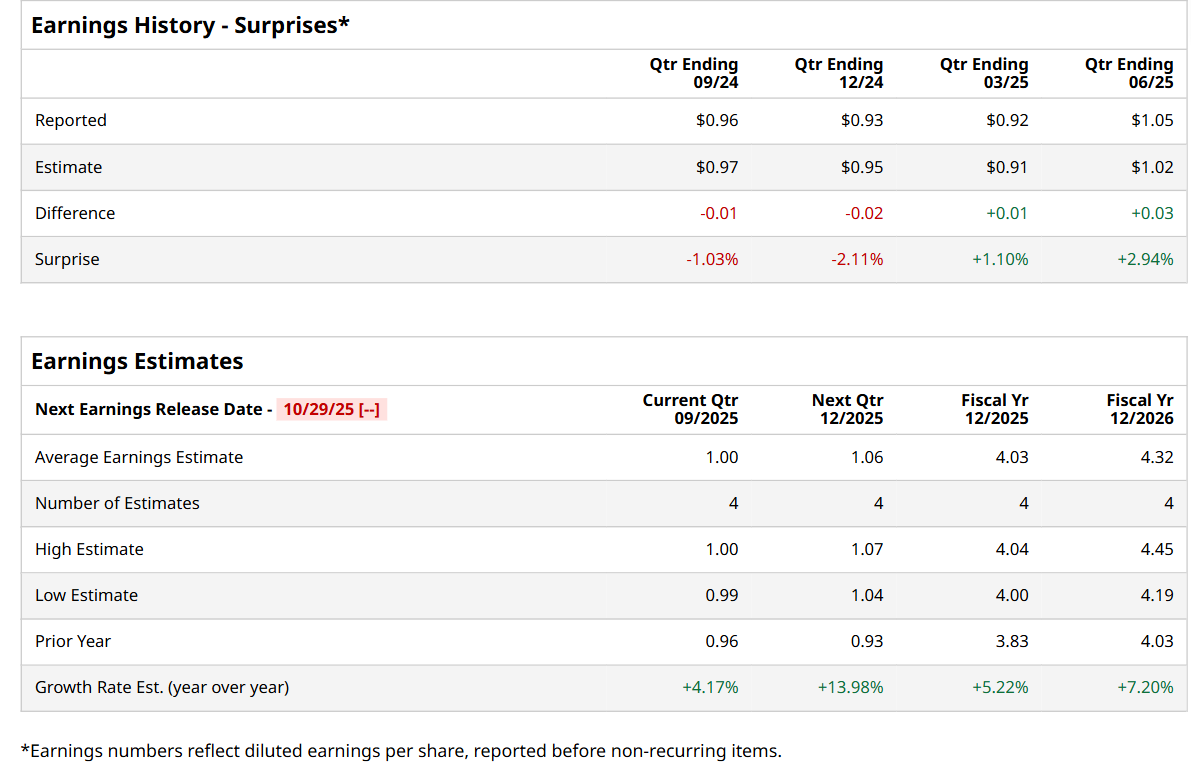

Before this event, analysts expect this elevator manufacturer to report a profit of $1 per share, up 4.2% from $0.96 per share in the year-ago quarter. The company has exceeded Wall Street’s bottom-line estimates in two of the last four quarters, while missing on other two occasions. Its earnings of $1.05 per share in the previous quarter topped the consensus estimates by 2.9%.

For the current fiscal year, ending in December, analysts expect OTIS to report a profit of $4.03 per share, up 5.2% from $3.83 per share in fiscal 2024. Its EPS is expected to further grow 7.2% year-over-year to $4.32 in fiscal 2026.

Shares of OTIS have declined 9.8% over the past 52 weeks, trailing behind both the S&P 500 Index's ($SPX) 17.4% rise and the Industrial Select Sector SPDR Fund’s (XLI) 14.8% uptick over the same time frame.

On Jul. 23, shares of OTIS tumbled 12.4% after reporting mixed Q2 results. Strong growth in its service segment was offset by weaker new equipment sales in China and America. Due to this, the company’s overall revenue declined marginally year-over-year to $3.6 billion, coming in 2.2% below analyst estimates. This top-line miss likely made investors jittery. On the other hand, while its adjusted EPS of $1.05 also declined by a penny from the year-ago quarter, it topped the consensus estimates by 2.9%.

Wall Street analysts are cautious about OTIS’ stock, with a "Hold" rating overall. Among 13 analysts covering the stock, four recommend "Strong Buy," one indicates a "Moderate Buy," six suggest "Hold,” and two advise "Strong Sell.” The mean price target for OTIS is $99.91, indicating a 9.5% potential upside from the current levels.