Oscar Health Inc. (NYSE:OSCR) shares are trending on Tuesday.

Check out the current price of OSCR stock here.

Shares on Dip

The healthcare technology company’s shares dropped 3.63% in after-hours trading, falling to $18.05 from $18.73 at the close of Monday’s regular session. Oscar Health also revealed plans to offer $350 million in convertible senior subordinated notes.

Convertible Notes Details Drive Market Reaction

The New York-based company intends to issue convertible notes due in 2030 through a private placement to eligible investors. Initial buyers will have the option to purchase an additional $52.5 million in notes within 13 days of issuance.

These unsecured notes will be junior to Oscar’s senior debt and will accrue interest, paid semi-annually. The notes are set to mature on September 1, 2030, unless they are converted, redeemed, or repurchased earlier.

See Also: Nukkleus Spikes 16% After-Hours: Here’s Why The Stock Is Trending

Strategic Growth Initiative Funding

Oscar plans to use the funds from the offering for general corporate needs, such as strategic AI initiatives, cost-cutting measures, and improving consumer healthcare services. The company will also use the proceeds to support potential premium tax credit extensions and fund capped call transactions.

The proceeds will result in an equivalent increase in parent cash after accounting for capped call transaction costs.

Market Impact and Hedging Activities

The offering includes capped call transactions with initial purchasers or affiliates to reduce potential dilution upon note conversion. According to the press release, option counterparties expect to establish hedges through derivative transactions and Class A common stock purchases.

This hedging activity could increase or decrease Oscar’s stock price and affect noteholders’ conversion abilities. The company serves approximately 2.0 million members as of June 30.

Stock Performance Shows Mixed Signals

Over the past year, the OSCR has fallen by 14.55%, but it has rebounded with a 39.36% gain this year. On June 30, the price peaked at $21.44, marking the highest point for 2025 so far. It has also seen a 39.26% increase over the last six months and a 12.49% gain in the past month, though it experienced a 7.73% drop over the last five days.

The tech-driven healthcare has traded between $11.20 and $23.79 over the past year. Its market capitalization stands at $4.84 billion, with an average trading volume of 18.01 million shares.

Price Action: According to Benzinga Pro data, OSCR experienced a 3.10% dip on Monday.

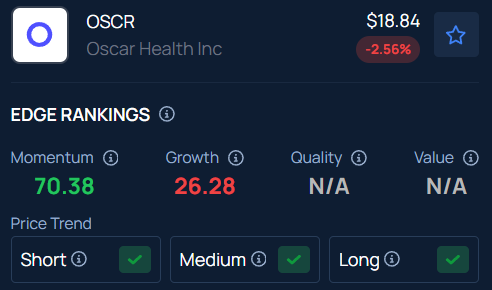

Benzinga’s Edge Stock Rankings indicate that OSCR has a negative price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Photo Courtesy: Tada Images on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.