Oracle Corp. (NYSE:ORCL) shares surged over 3% to $313 in pre-market trading on Tuesday, building on a 3.41% gain from Monday's regular session. This increase comes as investors prepare for possible updates on a TikTok acquisition and remain optimistic about the company's role in supporting AI infrastructure.

See what is driving the ORCL stock movement here.

TikTok Deal Framework Drives Early Trading

The early trading session jump comes after reports that the U.S. and China have outlined a preliminary framework for a TikTok deal during trade talks in Madrid. Treasury Secretary Scott Bessent confirmed the agreement on Monday, and President Donald Trump, along with Chinese President Xi Jinping, is set to speak on Friday to finalize the details.

“The big Trade Meeting in Europe between The United States of America, and China, has gone VERY WELL!” Trump wrote on Truth Social. “A deal was also reached on a ‘certain’ company that young people in our Country very much wanted to save.”

The cloud infrastructure services provider has become a top contender to acquire TikTok, thanks to its ongoing involvement in Project Texas, which has seen Oracle managing American TikTok user data on its servers since 2022. The social media company is under pressure, facing a Wednesday deadline to divest or risk a ban in the U.S.

Massive Cloud Backlog Fuels Investor Confidence

The pre-market momentum builds on Oracle’s remarkable 26.28% five-day surge following last week’s earnings. Despite missing first-quarter revenue estimates, investors focused on Oracle’s remaining performance obligations surging 359% to $455 billion, driven by major cloud commitments, including a $300 billion OpenAI deal.

AI Infrastructure Positioning Supports Valuation

Berenberg maintained its Hold rating while raising Oracle’s price target from $202 to $306, reflecting confidence in the company’s AI infrastructure pivot. Chairman Larry Ellison‘s emphasis on the “multi-trillion-dollar” AI inference market has resonated with analysts, despite concerns about OpenAI’s ability to fund its massive commitments.

On September 10, Oracle’s stock reached its yearly high at $328.23, with a trading volume of 132 million shares. The stock has gained 81.31% so far in 2025.

Oracle's stock has ranged from $118.86 to $345.72 over the past year. The company currently has a market capitalization of $858.60 billion, with an average daily trading volume of 19.23 million and a price to earnings ratio of 69.93, along with a dividend yield of 0.66%.

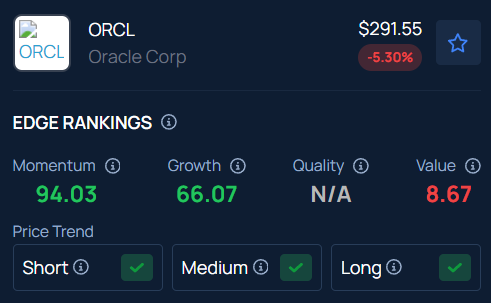

Benzinga's Edge Stock Rankings shows that Oracle has a Momentum score of 94.03 and a growth score of 66.07, with the price trend trending upward across short, medium, and long-term periods. Click here to see how it compares to other industry players.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Jonathan Weiss / Shutterstock