Oracle Corp. (NYSE:ORCL) is positioned to capitalize on the emerging enterprise software artificial intelligence revolution, according to Wedbush Securities Managing Director Dan Ives, who shared his insights during a CNBC interview on Monday.

What Happened: “The software phase of the AI revolution is now here,” Ives said, highlighting Oracle’s potential alongside industry peers Palantir Technologies Inc. (NYSE:PLTR) and Salesforce Inc. (NYSE:CRM).

Ives emphasized Oracle’s competitive advantage in the enterprise space, particularly noting its cloud infrastructure and software stack. He projected significant benefits for the company over the next 12-18 months as government and enterprise clients accelerate their cloud and AI adoption.

The analyst pointed to 2025 as a pivotal year for enterprise AI applications, with Oracle expected to show substantial growth in its ERP offerings. This aligns with broader industry trends, as enterprise software companies increasingly integrate AI capabilities into their core products.

Why It Matters: Regarding the broader tech landscape, Ives remains bullish on the AI sector’s growth potential. He sees the current transformation as “the biggest tech trend in the last 40 to 50 years,” extending well beyond major tech giants to include various enterprise software providers.

Oracle reported second-quarter revenue of $14.06 billion, up 9% year-over-year. The revenue total missed a Street consensus estimate of $14.11 billion, according to data from Benzinga Pro.

ORCL Price Action: Oracle stock dropped 7.80% to $175.60 in after-hours trading on Monday, within a 52-week range of $99.26 to $198.31. Before the after-hours decline, Oracle shares had gained 82% year-to-date.

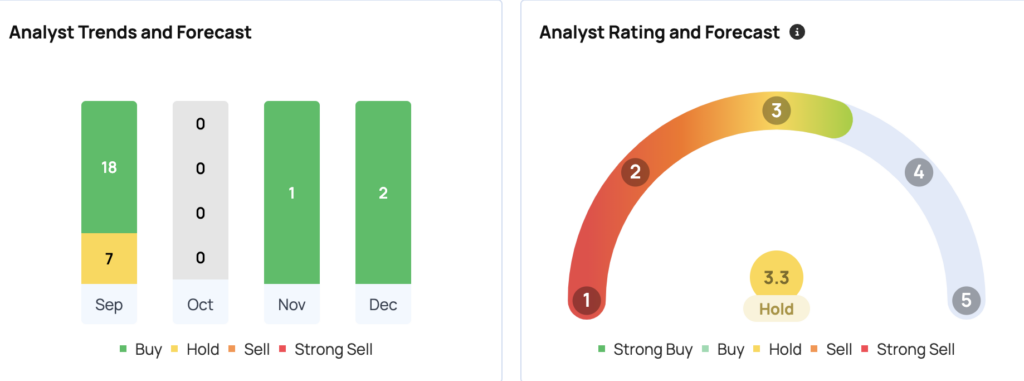

Oracle Corp’s consensus price target is $170.67, based on ratings from 32 analysts. The highest target of $220, while the lowest is $110. Recent ratings by RBC Capital, Guggenheim, and Jefferies average a $201.67 target, implying a 14.87% upside for the stock.

Read Next:

Image via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.