/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Oracle (ORCL) continues to build its sovereign cloud strategy through a strategic partnership with SoftBank (SFTBY), delivering secure AI and cloud services across Japan. The collaboration positions Oracle to capitalize on the growing demand for data sovereignty as enterprises prioritize local control over their information.

Under the agreement, SoftBank will launch Cloud PF Type A, a suite of proprietary cloud and AI services powered by Oracle Alloy. This platform enables SoftBank to become a cloud service provider, offering customers access to over 200 Oracle Cloud Infrastructure services deployed across Japanese data centers. The eastern Japan facility is scheduled to launch in April 2026, followed by the western location in October 2026.

Oracle Alloy provides a comprehensive cloud infrastructure platform that enables partners to deliver OCI capabilities while meeting data sovereignty and governance requirements. For Japan, this addresses regulatory and security concerns as organizations accelerate digital transformation initiatives.

SoftBank will integrate generative AI capabilities and high-performance GPUs into the offering, which targets diverse enterprise needs across sectors. The phased rollout of AI services reflects the growing importance of localized cloud infrastructure that combines cutting-edge technology with data residency requirements.

This partnership builds on similar sovereign cloud deals that Oracle has announced globally, positioning it as a leader in addressing enterprise concerns around data control, regulatory compliance, and national security.

As governments and large enterprises demand cloud solutions that keep data within national borders, Oracle's Alloy platform provides a scalable model for expansion.

The Bull Case for Oracle Stock

Oracle ended Q2 2025 with remaining performance obligations of $455 billion, representing a 359% year-over-year (YoY) increase. Moreover, cloud-based RPS rose by 500% YoY.

The company forecasts cloud infrastructure revenue to reach $18 billion in 2025 and increase to $144 billion by 2029. This revenue expansion is staggering, given that its total sales are forecast to touch $44.37 billion in 2025. Much of Oracle’s revenue is already locked in through signed contracts with AI leaders, including OpenAI, xAI, Meta (META), Nvidia (NVDA), and AMD (AMD).

Oracle has become the go-to provider for AI training workloads by building gigawatt-scale data centers that train models faster and more cost-efficiently than competitors. Chairman Larry Ellison emphasized that Oracle's advanced networking enables exceptionally fast data transfer, resulting in lower costs for customers who pay by the hour.

Oracle's new AI database enables customers to ask any business question and receive answers by combining their private data with public information through leading AI models, including ChatGPT, Gemini, Grok, and Llama, all available in Oracle's cloud. This capability addresses what enterprises have wanted since the launch of ChatGPT but couldn't safely implement.

The company expects $35 billion in capital expenditures this year, with a focus on revenue-generating equipment rather than land or buildings. Oracle doesn't own data center facilities and deploys optimized equipment that customers can begin using within days of acceptance, rapidly converting capex into revenue.

Is ORCL Stock Undervalued?

Valued at a market cap of $822 billion, ORCL stock is up over 350% in the last three years. Analysts tracking the AI stock forecast adjusted earnings to increase from $12.66 per share in 2024 to $18.30 in 2029.

Today, ORCL stock trades at 41x forward earnings, which is higher than its five-year average of 20x. At 30x forward earnings, ORCL stock should trade around $550 in early 2029, indicating an upside potential of almost 85% from current levels.

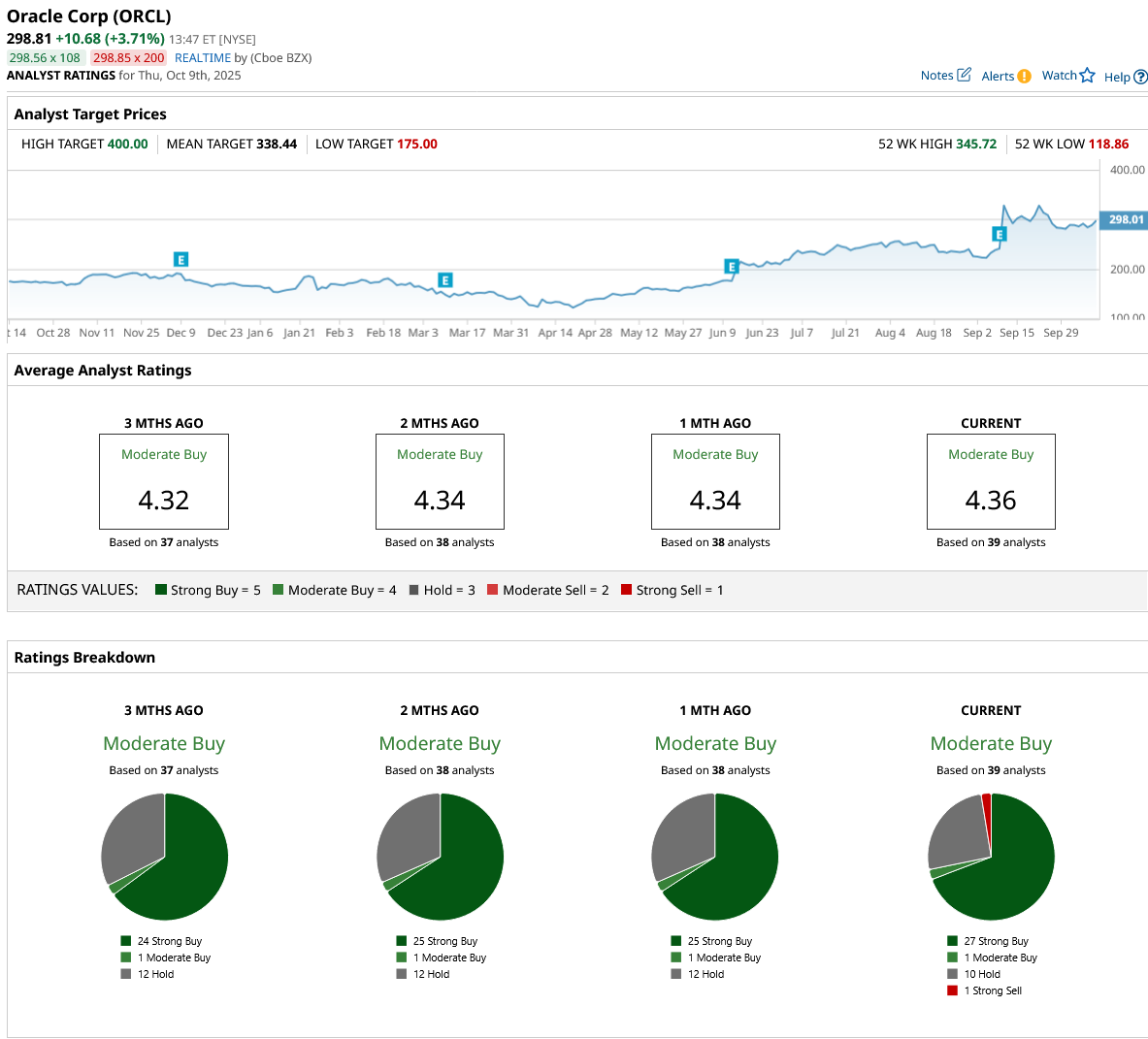

Out of the 39 analysts covering ORCL stock, 27 recommend “Strong Buy,” one recommends “Moderate Buy,” 10 recommend “Hold,” and one recommends “Strong Sell.” The average stock price target for ORCL is $338, which is above the current price of $298.