/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

Oracle (ORCL) stock saw focus once again after reports surfaced the company would play the key role for the United States restructuring of TikTok. Oracle would rebuild and retrain a domestic-only iteration of TikTok’s algorithm away from ByteDance, the Chinese parent company, according to a White House official. The deal also places Oracle as the party responsible for TikTok’s United States user data through a cloud framework.

Though the shares of Oracle slipped by over 5% for the current session, the shares remain up by nearly 5% for the past half a week. The correction provides a buying opportunity as the investors absorb the likely impact of this new deal. The news follows a few weeks after Oracle released strong fiscal Q1 results, including strong growth for the cloud as well as a multiyear order backlog, which may fundamentally re-rate the company's earnings potential.

Against the backdrop of regulatory tailwinds, soaring demand for safe-haven U.S.-based cloud infrastructure, and robust earnings expectations, Oracle could finally begin a new path of gains—thanks, possibly, to the deal for TikTok this week becoming a reality.

About Oracle Stock

Oracle is a global leader in enterprise software and cloud infrastructure services, headquartered in Austin, Texas. With a market capitalization of over $930 billion, the company operates across software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) segments. It serves thousands of customers globally, including many Fortune 500 companies.

In the last 52-week span, the share price of ORCL advanced from a trough of $118.86 to a peak of $345.72. Currently, the share stands at $310.70, up by over 60% this year so far—far outpacing the S&P 500 Index’s ($SPX) less impressive 15% rise. The latest softness could be a sign of profit-taking, but the broader trend is still intact as the sentiment among investors remains strong.

Valuation-wise, the company is trading at a forward price-earnings (P/E) multiple of 57.6x, which is reasonable relative to high-growth peers like Microsoft (MSFT) or Amazon (AMZN). The forward price-sales (P/S) multiple stands at 7.47x, which reflects the strong expectations, but understandably so given the explosive growth of Oracle's multicloud and cloud contracts. ORCL stock appears reasonably valued for long-term owners expecting strong double-digit revenue growth.

Oracle does pay a dividend, offering a yield of around 1.2% with a consistent quarterly payment. Although not a high-yield stock, the dividend payout of Oracle does support shareholder value as well as robust capital appreciation potential.

Oracle Beats on Earnings and Secures Multibillion-Dollar Cloud Deals

In its fiscal Q1 2026 results reported Sept. 9, Oracle beat expectations on most key metrics. Revenue rose 12% year-over-year (YoY) to $14.9 billion, with GAAP EPS at $1.01 (down 2%) and non-GAAP EPS at $1.47, up 6% YoY. Importantly, cloud revenue surged 28% YoY to $7.2 billion, led by a 55% jump in cloud infrastructure sales.

Oracle's Remaining Performance Obligations (RPO) rose by 359% to $455 billion, which means the company's long-term revenue pipeline accelerated faster than expected. CEO Safra Catz detailed four multibillion-dollar contracts signed during the quarter and more expected during the coming months. Oracle projects FY26 revenue for the cloud infrastructure rising by 77% to $18 billion and potentially reaching $144 billion by the fifth year.

Chairman Larry Ellison highlighted the company’s 1,529% growth of multicloud database revenues from partners Amazon, Microsoft, and Alphabet (GOOG) (GOOGL). Oracle also announced a new product, an “AI Database,” which allows enterprises to utilize LLMs like ChatGPT and Gemini natively from Oracle databases—making Oracle an AI enabler, not a simple cloud vendor.

This blending of core infrastructure, AI-ready services, and government-compatible security policies will serve Oracle well for the next generation of enterprise tech.

Oracle hasn't announced the date for Q2 results yet, but assuming the historical pattern repeats, the results would come out during mid-December.

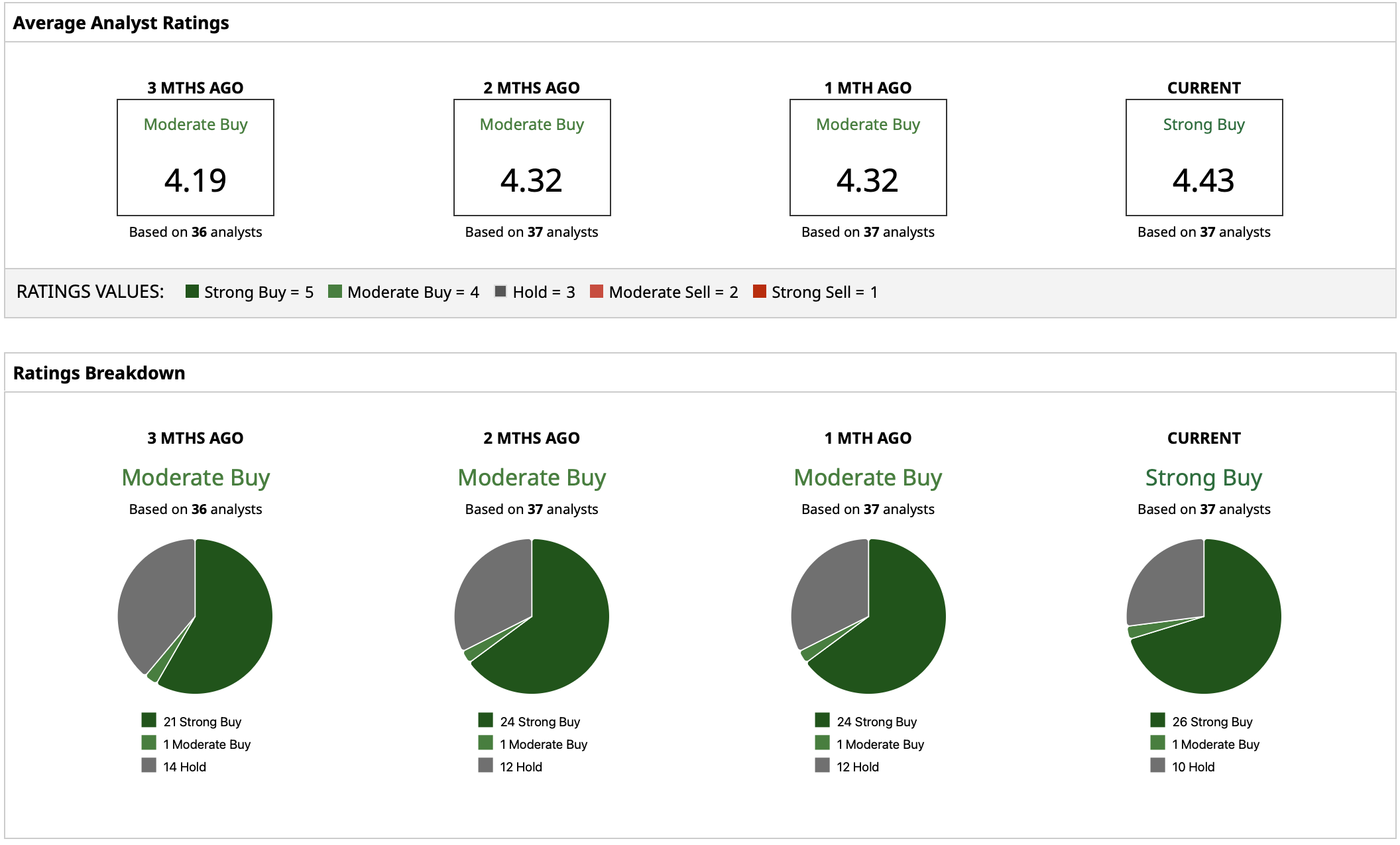

What Do Analysts Expect for ORCL Stock?

Analysts are bullish for Oracle with a “Strong Buy” rating consensus. The average target for Oracle stands at $334.57, which would translate into a potential rise of 7.7% from current levels. The high target stands at $400, which would imply some analysts believe Oracle still has a long way to go if the AI and cloud plans continue to gather pace. The lowest target stands at $195, which would suggest downside risk from macro pressures or execution errors.