/Oracle%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

Valued at a market cap of $807.7 billion, Oracle Corporation (ORCL) is a leading provider of enterprise software, cloud services, and database technologies. The Austin, Texas-based company helps businesses manage and analyze data, automate processes, and run critical operations through integrated cloud-based and on-premise solutions. It is scheduled to announce its fiscal Q2 2026 earnings in mid-December.

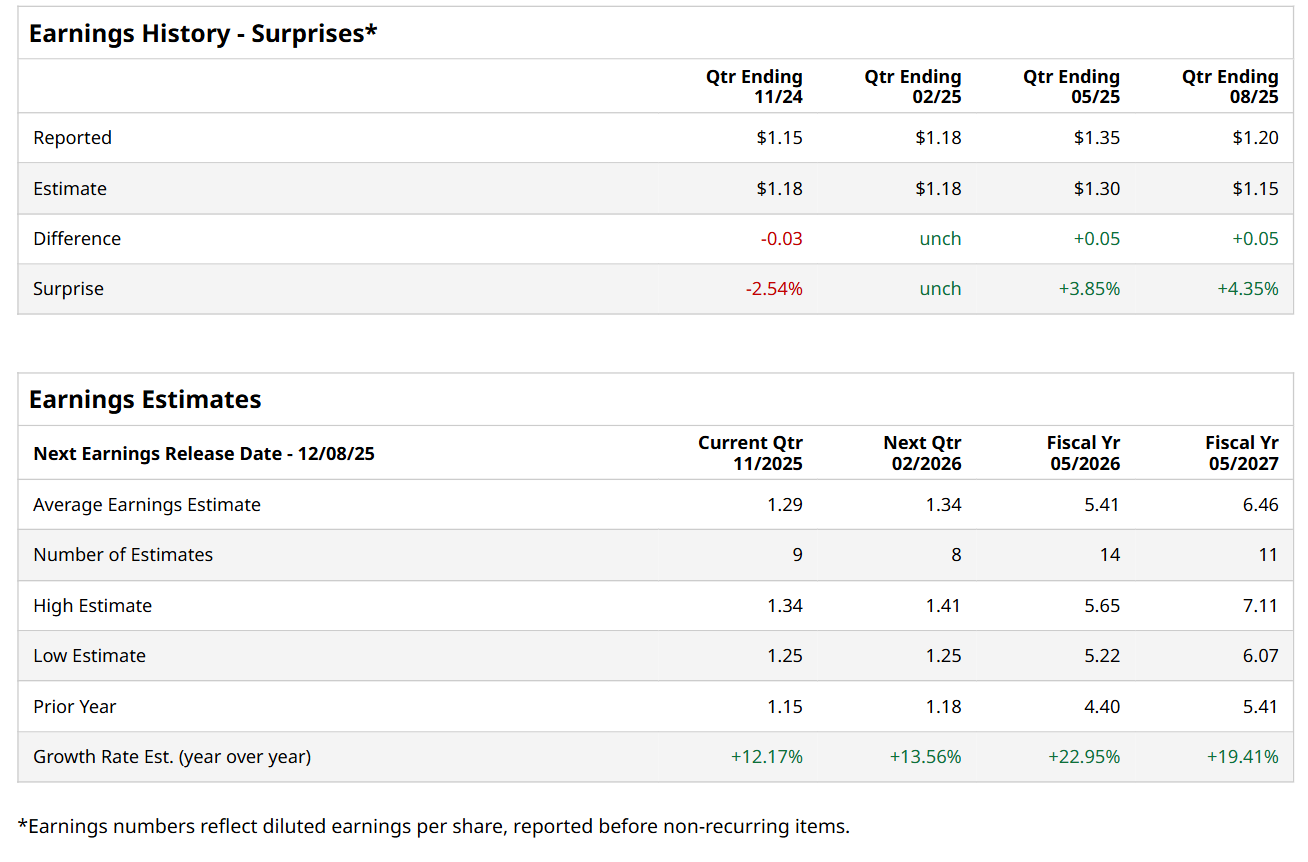

Ahead of this event, analysts expect this software giant to report a profit of $1.29 per share, up 12.2% from $1.15 per share in the year-ago quarter. The company has met or surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. In Q1, Oracle’s EPS of $1.20 outpaced the forecasted figure by 4.4%

For fiscal 2026, analysts expect Oracle to report a profit of $5.41 per share, up 23% from $4.40 per share in fiscal 2025. Its EPS is expected to further grow 19.4% year-over-year to $6.46 in fiscal 2027.

Oracle has soared 63.3% over the past 52 weeks, significantly outpacing both the S&P 500 Index's ($SPX) 18.4% return and the Technology Select Sector SPDR Fund’s (XLK) 30% uptick over the same time frame.

On Oct. 13, shares of Oracle surged 5.1% following the announcement of a strategic partnership with Zoom Communications Inc. (ZM) aimed at strengthening its cloud capabilities. The agreement involves running Zoom's customer experience platform on Oracle Cloud Infrastructure, expanding its reach and enabling more organizations to leverage its advanced customer engagement capabilities.

Wall Street analysts are moderately optimistic about Oracle’s stock, with an overall "Moderate Buy" rating. Among 40 analysts covering the stock, 28 recommend "Strong Buy," one indicates a "Moderate Buy," 10 suggest "Hold,” and one advises a "Strong Sell” rating. The mean price target for ORCL is $355.80, indicating a 26.4% potential upside from the current levels.