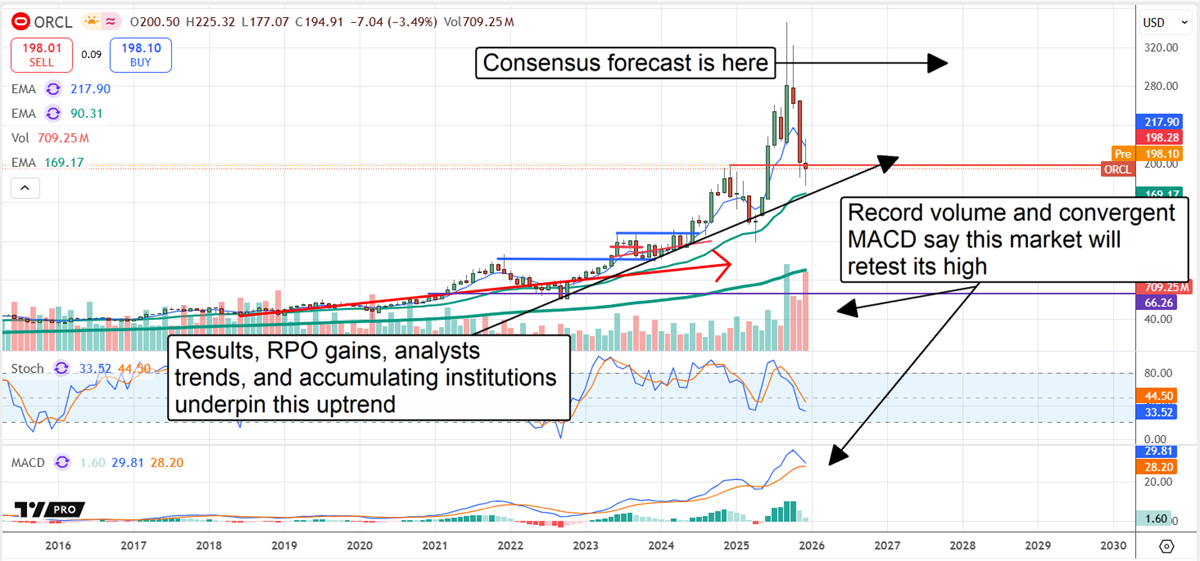

Oracle’s (NYSE: ORCL) 2025 stock price action might suggest it is a hard pass for 2026, but that would be misreading the chart.

The 2025 price correction came after a large inflow of capital, fueled by an expanding positive outlook connected to AI, indicating strong gains are expected.

While uncertainty clouds the near- and mid-term outlooks, the long-term outlook includes Oracle as a well-positioned, critical hub in the global datacenter ecosystem.

Investors who look beyond short-term volatility may find Oracle’s AI infrastructure strategy offers a compelling runway for future growth.

Oracle: Serving and Monetizing AI Needs at Hyperscale

There will be many winners in the AI ecosystem, but the biggest, most enduring wins will be made by the hyperscalers, of which Oracle is one. The hyperscalers control approximately 44% of the global data center industry and are forecast to increase it to over 60% within the coming years. While Oracle holds a small 3% share of the total, it is also gaining share within the industry. It also has a strong presence in non-hyperscale data center activity, including for businesses, enterprises, private AI developers, and sovereign regions.

Oracle operates nearly 150 datacenters globally and has 64 under construction. That’s worth a 43% increase in capacity that internal operating metrics, including the 438% increase in Q2 fiscal year 2026 (FY2026) remaining performance obligations (RPO), suggest is already fully booked. Plans also include “gigawatt-scale” data centers to support advanced HPC computing. Regarding cloud regions, there are more than 100, including 51 public in 26 countries, 23 multicloud (a critical component), and 29 for dedicated clients, including OpenAI.

While data centers and data center growth underpin Oracle’s long-term outlook, its strength lies in multicloud operations. Businesses and enterprises, including large language model builders, rely on multiple clouds for training, inference, and core operations. Oracle is embedded throughout all hyperscale networks, enabling a unified cloud experience across the tech stack. Not only are the model builders able to access, manage, and use data across clouds, but businesses and enterprises can access models and GPUs of their choice via Oracle’s offerings. It has entrenched itself as a centralized, go-to source for AI, AI infrastructure, and AI services, all of which are critical to the global tech industry.

Oracle Revenue Growth to Continue in 2026

Oracle’s market is in a wait-and-see mode, waiting to see when and if its heavy investments in AI will pay off. Among the issues in calendar 2025 is that growth didn’t accelerate as quickly as analysts had hoped, but building the data centers and the GPU racks that go into them takes time. The critical takeaways from the results are that revenue growth accelerated sequentially and year-over-year in Q1 FY2026 and Q2 FY2026, and is forecast to continue accelerating over the next two years.

Oracle is forecast to grow by approximately 17% in 2026, and then double in size by the end of 2028. The only question is the timing of growth, which is tied to data center openings.

Analysts helped trigger the 2025 sell-off by lowering their price targets in the fourth quarter of the calendar year. However, as bearish as the detail may sound, it wasn’t, and the market has overreacted. The 23 revisions and initiations MarketBeat tracked in December include numerous price target revisions, but to levels aligning with the robust consensus forecast, expecting a 60% upside from the critical support level.

MarketBeat data also reveals that coverage increased by 48% to 43 in 2025; coverage is rock-solid with 43 analysts tracked; sentiment is firm at Moderate Buy; and the revision trend is bullish. While Q4 reductions triggered the sell-off, the consensus is up 70% over the preceding 12 months, and the December revisions align with this trend. All this market needs to rebound is a catalyst, and a report good enough to get analysts to lift or affirm targets could be the trigger.

Where Should You Invest $1,000 Right Now?

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

The article "Oracle: A Hard Pass—or a Hard-to-Pass Opportunity?" first appeared on MarketBeat.