/Unitedhealth%20Group%20Inc%20%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

UnitedHealth Group (UNH) is quietly strengthening one of its key growth engines—its Optum division. The company reportedly acquired a Massachusetts-based medical practice, further expanding Optum’s nationwide network of clinics and physician groups. The move underscores UnitedHealth’s continued push into direct patient care, a segment that sits at the heart of its integrated healthcare model.

Optum has become much more than a supporting arm to UnitedHealth’s insurance business. It now represents a dynamic ecosystem of data analytics, pharmacy benefit management, and care delivery that helps reduce costs and improve patient outcomes. By bringing more physician groups under its umbrella, UnitedHealth gains greater control over the entire healthcare journey—from insurance coverage to treatment and prescription management—giving it a competitive edge that few rivals can replicate.

Still, investors may be asking the right question: Does Optum’s continued growth necessarily translate into good news for UnitedHealth’s stock? Let’s take a closer look at how the latest deal fits into the broader investment picture and what it could mean for UNH stock moving forward.

About UnitedHealth Group Stock

Founded in 1974, UnitedHealth Group Incorporated is a health and well-being company that provides a diverse range of health insurance and healthcare services. The company is organized into two primary divisions: UnitedHealthcare and Optum. UnitedHealthcare provides health insurance plans, whereas Optum delivers health care services and technology. The company has established a formidable competitive moat by combining these segments, forming a powerful, self-reinforcing ecosystem that is transforming how healthcare is delivered and managed. Its market cap currently stands at $326 billion.

Shares of the health-care conglomerate have slumped 29.4% on a year-to-date (YTD) basis. UNH stock plunged earlier this year after the company first cut and then suspended its full-year earnings guidance. Further weighing on the stock were reports of a Department of Justice investigation into the company’s billing practices and the sudden resignation of its CEO. However, UNH stock has staged a solid rebound since early August, supported by Warren Buffett’s Berkshire Hathaway taking a new stake in the company and stronger-than-expected 2026 Star Ratings.

Despite Recent Setbacks, Optum Remains Central to UnitedHealth’s Growth Story

Optum includes a group of fast-growing businesses—Optum Rx, Optum Insight, and Optum Health—that specialize in pharmacy benefit management, data analytics and technology, and direct patient care, respectively. It’s important to understand that Optum is far more than just a supplement to the UnitedHealthcare segment. It serves as a synergistic partner, utilizing data from the insurance business to reduce healthcare costs and improve patient outcomes.

Optum Health’s network of clinics and physician groups enables the company to directly oversee and coordinate patient care. Optum Insight’s technology delivers analytical tools that identify efficiencies and best practices, while Optum Rx uses technology and integrated pharmacy benefit solutions to reduce costs, improve patient outcomes, and streamline the pharmacy experience. With that, this integrated model creates a powerful competitive advantage that pure-play insurers can scarcely replicate.

In the second quarter, Optum’s revenue rose 7% year-over-year (YoY) to $67.2 billion, beating expectations by $100 million. Optum’s total revenue growth was driven mainly by Optum Rx, partially offset by weaker performance at Optum Health. Meanwhile, Optum’s earnings from operations fell 21% YoY to $3.1 billion, as Optum Health saw a massive 67% YoY earnings drop, which the company attributed to increased care activity, pricing errors, and Medicare funding cuts. In a July call with analysts, UnitedHealth executives stated that Optum Health’s 2025 earnings were $6.6 billion below expectations. Until this year, Optum Health had been UnitedHealth’s fastest-growing profit driver.

Looking ahead, management projects Optum’s full-year revenue to range between $266 billion and $267.5 billion, with Optum Health’s rates expected to fall 4% YoY. “Overall at Optum Health, while we expect continued pressure for the rest of this year, we anticipate meaningful improvement in our operations and with earnings growth in 2026, albeit with a longer path to recovery in our value-based care business,” CEO Dr. Patrick Conway said on the call. With that, despite near-term challenges, the company remains strategically focused on Optum as a strong growth driver.

UnitedHealth to Acquire Medical Group, Signaling Optum Keeps Growing

Management has executed a clear and disciplined strategy aimed at advancing and expanding UnitedHealth’s integrated model. The company consistently invests in technology and strategically acquires assets that strengthen the Optum platform, further expanding its competitive edge. And the latest developments clearly confirm that point.

Last week, Bloomberg reported that UnitedHealth Group plans to acquire a 45-physician medical practice in Massachusetts. The company’s Atrius Health affiliate has agreed to acquire Acton Medical Associates, PC, a primary care group based in the Boston area, according to a notice posted by a Massachusetts regulator. The deal underscores UnitedHealth’s ongoing expansion into primary care and physician groups.

Meanwhile, physician groups fall under UnitedHealth Group’s sprawling Optum Health division. Over the past decade, Optum Health has acquired numerous previously independent medical practices, both large and small. Although that part of the company’s business faced challenges this year, the latest move clearly indicates that management is on track to drive a turnaround and return to earnings growth next year.

Last month, Morgan Stanley analysts met with UnitedHealth Group’s top executives, including CEO Stephen Hemsley. They noted that they came away from those discussions more optimistic about the outlook, as management demonstrated strong confidence in the turnaround. When it comes to Optum, management plans to strengthen the business partly by stabilizing and refocusing its value-based care platform on its “original purpose,” the analyst wrote.

All Eyes on UnitedHealth Group’s Q3 Results

UnitedHealth Group is set to report its Q3 financial results on Oct. 28. Analysts tracking the company predict a 60.04% YoY drop in its third-quarter EPS to $2.86. At the same time, Wall Street expects UNH’s revenue to grow 12.21% YoY to $113.13 billion in Q3.

Several Wall Street analysts have become more bullish on UnitedHealth Group ahead of its Q3 earnings release. Bernstein analyst Lance Wilkes recently raised his price target on UNH stock to $433 from $379 while maintaining an “Outperform” rating. The analyst anticipates that the company’s Q3 results will meet or slightly beat Wall Street expectations. He also said that UNH could raise its 2026 earnings outlook either during the Q3 call or in December.

KeyBanc analyst Matthew Gillmor also lifted his price target on UNH stock to $400 from $350 and reaffirmed an “Overweight” rating, noting that investor sentiment is finally recovering after a sluggish start to the year. The analyst believes that improved execution over the next 12–18 months could drive additional upside.

What Do Analysts Expect for UNH Stock?

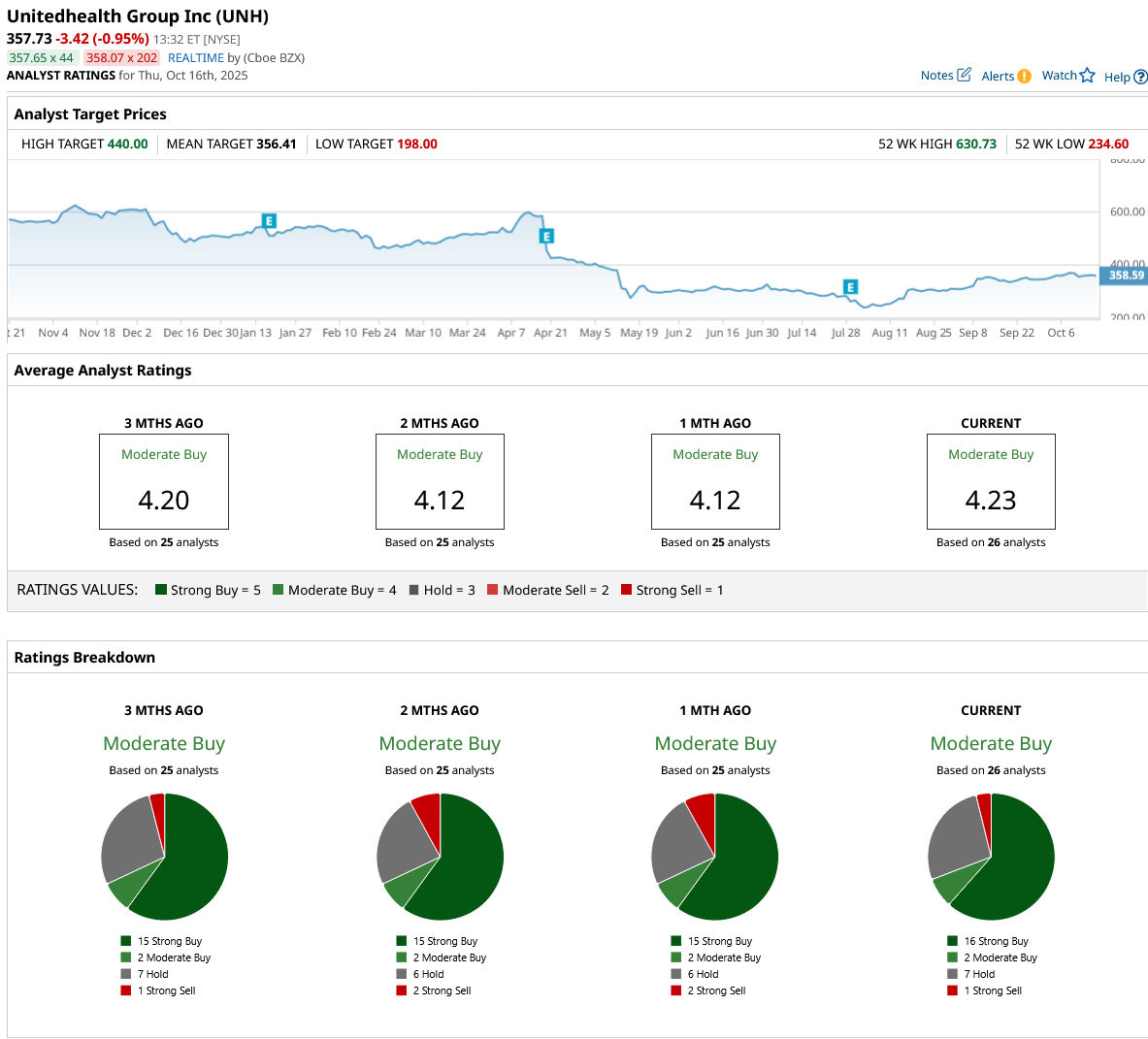

Despite UNH’s underperformance this year, Wall Street analysts remain mostly bullish on the stock, as evidenced by its consensus “Moderate Buy” rating. Among the 26 analysts covering the stock, 16 assign a “Strong Buy” rating, two a “Moderate Buy,” seven recommend holding, and one gives it a “Strong Sell” rating. Notably, UNH stock currently trades just slightly above its average price target but still presents solid upside potential to the Street-high target of $440.

Putting it all together, I believe the recent deal to acquire the medical group is a positive development for UNH, as it clearly shows that management continues to expand UnitedHealth’s integrated model. I will closely follow the company’s Q3 results and earnings call for management’s commentary on Optum, particularly the Optum Health division. I was bullish on UNH before Berkshire Hathaway’s stake announcement and doubled down afterward, expecting the stock to eventually return to its April highs within the next 1–3 years.