While all publicly traded enterprises aim for business success, achieving it can also ironically lead to valuation pressures. That's the tough lesson that pharmaceutical giant Gilead Sciences, Inc. (NASDAQ:GILD) learned the hard way recently. Although the company delivered the goods for its latest financial disclosure, post-earnings digestion appears to have negatively impacted GILD stock. Nevertheless, the red ink presents a potential opportunity for bullish speculators.

On paper, the print was impressive. For the second quarter, Gilead Sciences posted earnings per share of $2.01, beating Wall Street analysts' consensus target of $1.94. The latest figure matched the year-ago quarter's result. On the top line, the pharmaceutical firm generated $7.08 billion, up 1.77% from analysts' consensus view of $6.94 billion. Further, the latest tally was an improvement over the prior year's print of $6.95 billion.

The results were released on Aug. 7, when GILD stock closed at $110.28. A day later, GILD closed at $119.41, with investors clearly jubilant at the news. Shortly afterwards, though, the security entered a gradual downtrend. Interestingly, when Gilead subsidiary Kite Pharma announced that it would acquire Interius BioTherapeutics on Aug. 21 for $350 million in cash, GILD conspicuously declined further.

So, what gives? As mentioned earlier, it appears that Gilead is suffering from a classic case of post-earnings digestion. Investors initially got the warm and fuzzies from the company's strong print. But as GILD stock shot higher, investors began to question whether the enhanced premium justified continued risk exposure. Many have obviously decided to take some profits off the table.

Still, it's important to realize that Gilead is a dividend-paying company with an overall strong, relevant business. Yes, there are challenges to consider, such as the sales impact from decreasing COVID-19 hospitalizations. On balance, though, as the latest earnings print demonstrated, GILD stock appears to be a solid investment.

Ironing Out A Game Plan For GILD Stock Options

While Gilead Sciences arguably has the appearance of a sound investment, using narratives alone presents a vague picture. For those seeking leveraged trades using options, vagueness is obviously not a utility. Traders require a far more specific game plan that incorporates both directional magnitude and time (since all options eventually expire).

With that said, traders have two mechanisms to establish their game plan. First, the most common approach is volatility-dependent analysis. Long story short, every optionable security features a baseline volatility. Then, by using calculations derived from the Black-Scholes-Merton formula, volatility accelerants are added to (or taken away) from the baseline, based on exogenous factors such as upcoming earnings reports. What comes out is an up/down price range for each upcoming options chain, commonly known as the expected move calculator.

The advantage of volatility dependency is that it's useful for understanding what the market might be thinking, especially for fresh securities for which historical datapoints are limited. On the other hand, the main disadvantage is that the process tells you the total range of outcomes, not which specific subset of outcomes is likely. For that info, you must rely on other mechanisms like technical analysis, which is vulnerable to post-hoc rationalizations.

On the other end of the spectrum, traders can use pathway dependency. This approach takes what has occurred conditionally in the past and projects out what could happen under the same conditions in the future. Pathway dependency respects the actual pricing geometry of the market. However, the disadvantage is that it’s not useful at all (outside of deploying advanced Bayesian inferences) for securities that have very little data.

Now, the trick about pathway dependency is that the dataset must be structured as discrete objects (rather than continuous scalar signals) to work properly. This discretization process enables the categorization of different behavioral states, which ultimately empowers conditional probabilistic analysis.

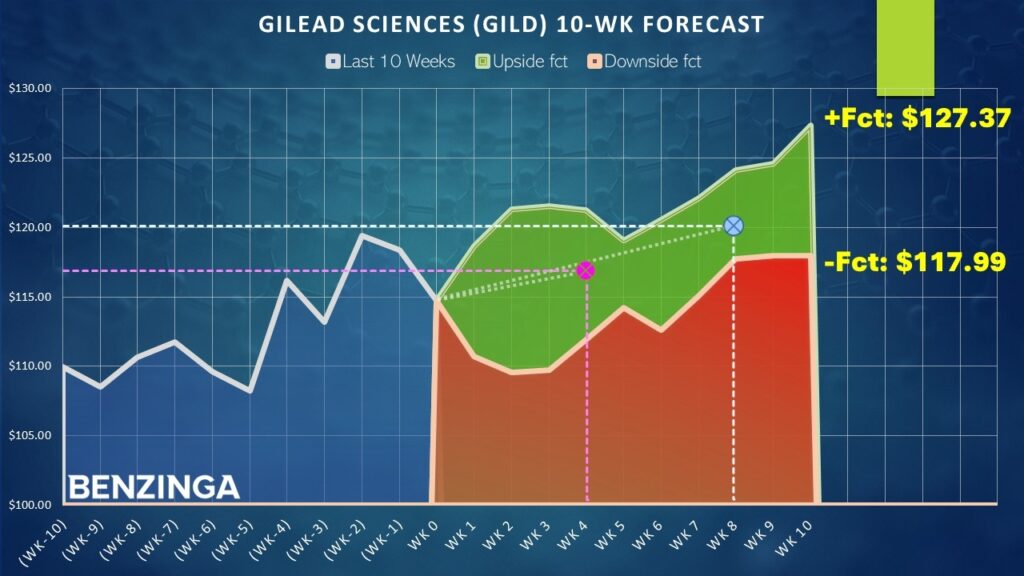

For example, in the past 10 weeks, GILD stock printed a "4-6-U" sequence: four up weeks, six down weeks, with an overall upward trajectory. This is a distinct behavioral state, allowing the trader to look back in the dataset to determine how the market responded to it. From there, a forward projection can be made.

In the near term, the 4-6-U sequence tends to yield positive results. In 69.23% of cases, the following week's price action results in upside, with a median return of 3.41%. Assuming that the bulls take control of the market, GILD stock is aiming for $127.37 over the next 10 weeks. If the negative pathway initially dominates, GILD is looking at a price of just under $118.

Two Bull Spreads Stand Out

Because the projected moves for GILD stock are relatively modest, buying a naked call might not make the most sense. Instead, traders may consider a simple multi-leg options strategy called the bull call spread. This transaction involves buying a call and simultaneously selling a call at a higher strike price. The premium received from the short call partially offsets the debit paid for the long call, resulting in a discounted bullish position.

The drawback? Because the maximum reward is capped, the bull spread isn't appropriate if you anticipate gangbusters performance. Because Gilead is a large-capitalization pharmaceutical rather than a cryptocurrency, the spread seems appropriate. Also, the bull spread's geometry means that the downside risk is also capped, so there are no surprises.

First, traders may consider the 115/117 bull call spread expiring Sept. 19. This transaction requires a net debit of $93, with a maximum profit of $107 if GILD stock rises through the short strike price ($117) at expiration. That's a payout of just over 115%, with the breakeven price landing at $115.93. For this trade to be fully profitable, GILD stock would need to rise 1.94% from where it is to expiration.

Second, speculators may look at the 115/120 bull spread expiring Oct. 17. Here, the net debit is higher at $199, thanks largely to the extra time to expiration. However, the max profit is $301, which translates to a payout of over 151%. Breakeven is at $116.99. GILD would need to rise 4.56% over the next eight weeks for the trade to be fully profitable.

While the payouts are relatively generous, you should note that the projected risk-reward envelope is rather wide. That means that if the trade goes awry, it could do so quite wildly. From a probabilistic standpoint, GILD stock carries more uncertainty; hence, the higher payout. Empirically, though, the odds seem to favor the bulls, which makes the above trades enticing.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read Next:

Photo: Shutterstock