Although the technology sector suffered some anxious trading following long stretches of upside, certain standout names — including Oracle Corp (NYSE:ORCL) and its blistering forward outlook — helped invigorate confidence in the ecosystem. As it turns out, the quantum computing space has been reading the memo, with the industry delivering robust returns. However, one standout name is D-Wave Quantum Inc (NYSE:QBTS).

Before diving into the characteristic that distinguishes QBTS stock from other popular tech names, it's important to note a key similarity: elevated short interest. On the surface, a stock incurring high short interest isn't necessarily encouraging. At face value, this metric indicates that traders are placing "true" short bets against the targeted security. However, if contrarians bid up the stock, the reverse move — known as a short squeeze — could be intense.

To understand why, you must consider the normal transactional geometry of retail investors. When they initiate a position, they buy to open. However, when short traders begin their speculation, they sell to open. And from where did these shares to sell originate? They were borrowed from a broker, meaning that there is a contractual obligation to make the lender whole.

If a short trade goes smoothly for the bearish speculator, the borrowed shares decline in value. Therefore, the speculator can buy back the shares at a reduced price and return them to the broker, pocketing the difference as profit. However, if the security swings northward instead, the short trader has a difficult decision to make.

Those who are prudent exit early. But at some point, the pain could be so severe that a wholesale exit is forced. Either way, to clear a short position, the speculator must buy to close. That's the underlying catalyst behind a short squeeze — and it has massive implications for QBTS stock.

A Statistical Lag That Could Translate To Upside For QBTS Stock

Another element to consider regarding a short squeeze is that the pressure stems from a credit-based transaction. Essentially, the short trader is underwriting the risk that the targeted security will not rise in value. As long as it doesn't, the rewards can be quite handsome. Unfortunately, uncapped credit transactions carry an obligatory risk that arguably most traders are uncomfortable with.

On the other end, people can be bearish by buying put options but this would be a debit-based transaction. Whatever money was spent on the puts is the most that can be lost. Therefore, heightened put volume by itself doesn't necessarily box directional speculators into a corner. QBTS stock, though, is different because traders have sold shares — and they must be returned to their rightful owners.

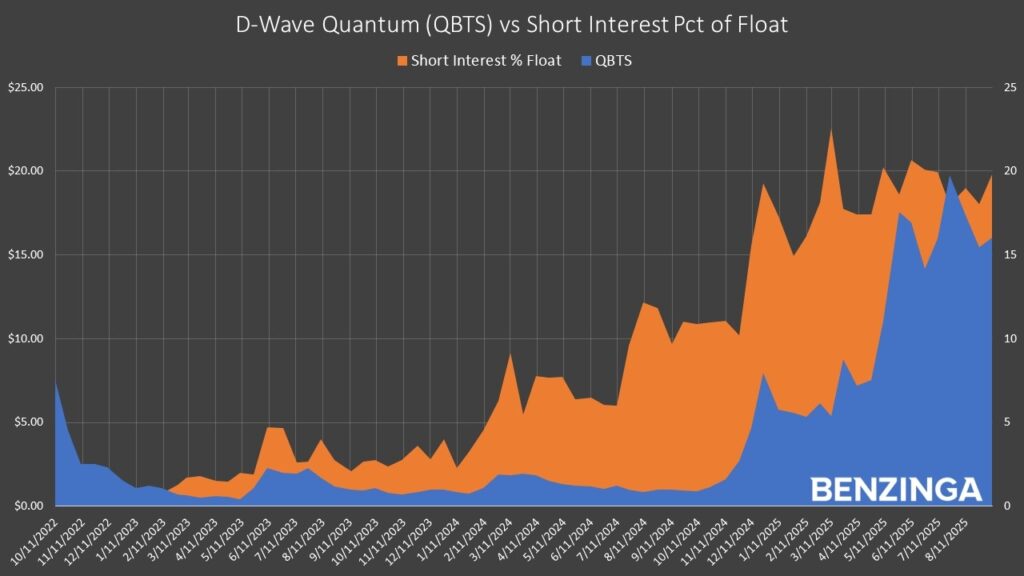

Still, what makes QBTS stock distinct from many other short-squeeze candidates is the relationship between its price action and its short interest. As of the latest information, D-Wave's short interest stands at nearly 20% of its float. That's not unusual relative to other quantum computing stocks, which have also attracted bearish attention.

However, what's interesting about QBTS is the direct correlation between price action and short interest. In fact, the correlation coefficient between the two metrics is 74.94% (though there could be slight variances depending on the source for the short interest data).

Even more intriguing, it appears that price action lags the acceleration witnessed in short interest. It's a presuppositional argument but if this relationship continues to hold, it's possible that QBTS stock could "catch up" to the accelerative short interest. If so, it's possible that the bears could drive QBTS to $20, which would represent a natural psychological target.

Other than this presuppositional argument, there's not much empirical evidence to lean on. For example, QBTS stock in the trailing 10 weeks has printed an unusual 6-4-D sequence: six up weeks, four down weeks, with an overall downward trajectory.

The problem? This sequence has only materialized twice on a rolling basis since D-Wave's initial public offering. As such, there's no way to make an intelligible inference from a dataset of two.

For Speculative Eyes Only

Given the lack of market data, QBTS stock is really an educated guess. If you believe in my earlier presupposition, then the 19/20 bull call spread expiring Oct. 17 may be of interest. This transaction involves buying the $19 call and simultaneously selling the $20 call, for a net debit paid of $31 (the most that can be lost in the trade).

Should QBTS stock rise through the second-leg strike price ($20) at expiration, the maximum profit is $69, translating to a payout of roughly 223%. Breakeven lands at $19.31.

As mentioned earlier, because the argument makes a lot of assumptions about the continuation of an observed trend, there are absolutely no guarantees here. Admittedly, this trade is what I would term "naked" speculation because it's anchored in a volatile mix of modest statistical evidence and a whole lot of hope.

That said, short squeezes are very powerful because of the contractual obligation in making the original broker whole. Therefore, the idea of betting on QBTS stock is inarguably speculation. However, I wouldn't go so far as to call it stupid speculation.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock