While supporters of President Donald Trump's "Big Beautiful Bill" are reveling in yet another major political win, Amazon.com Inc (NASDAQ:AMZN) founder Jeff Bezos — no stranger to winning himself — isn't exactly smiling. The new law will target tax incentives for buying electric vehicles, thereby impeding Bezos' ambitions of disrupting the market. On the other end, hydrocarbon specialist ConocoPhillips (NYSE:COP) may have just received a cynical lifeline.

Thanks to the passage of the "Beautiful" by Congress and Trump, the law will end the $7,500 EV tax credit in months, thereby eliminating one of the primary incentives for consumers interested in making the switch to electric-powered mobility over the traditional combustion-based mode. This move has significant implications for Slate Auto, which is backed by Bezos.

What makes Slate Auto appealing is the underlying modularity, with the flagship vehicle being a customizable electric pickup truck that can also transform into an SUV. Further, the vehicle is offered with a relatively clean canvas of core features, allowing drivers to customize it according to their preferences.

Most notably, the truck was supposed to be available for around $25,000, with a starting price of under $20,000 — including the federal tax credit. With the new law in place, the truck (based on integration with popular features) will realistically sell closer to $30,000 to $40,000.

At that range, even the cheapest EV manufacturers would look relatively pricey against legacy automakers' offerings. Without the tax credit, it's harder to justify making the switch to EVs, especially because many consumers are still struggling. Subsequently, crude oil players get a helping hand, which makes COP stock fundamentally intriguing.

Making The Statistical Case For COP Stock

While the fundamental narrative for oil industry heavyweights like ConocoPhillips got more exciting, this alone doesn't provide any guidelines for trading COP stock. Options traders especially require a thesis that addresses not only the magnitude component of the target asset but also the time element. To better inform the decision-making process requires statistical analysis.

Trying to explain the topic of statistics in relation to options trading has always been a bear of an assignment. I believe, though, that it can be best explained in a thought experiment.

Imagine flipping a (fair) coin 100 times every day, Monday through Friday. What you flip on Monday will have no impact on what you flip on Tuesday and so on. Obviously, this is because coin flips are random. Therefore, an observation of the ratio between heads or tails across different intervals should be around 50%.

Similarly, if the market were truly random, we would expect the same outcome. Whether the market was bullish or bearish on Monday would have no impact on Tuesday's result. Looking at the long-side success ratio across different intervals should reveal odds of around 50%. Therefore, no advantage would exist in analyzing price behaviors.

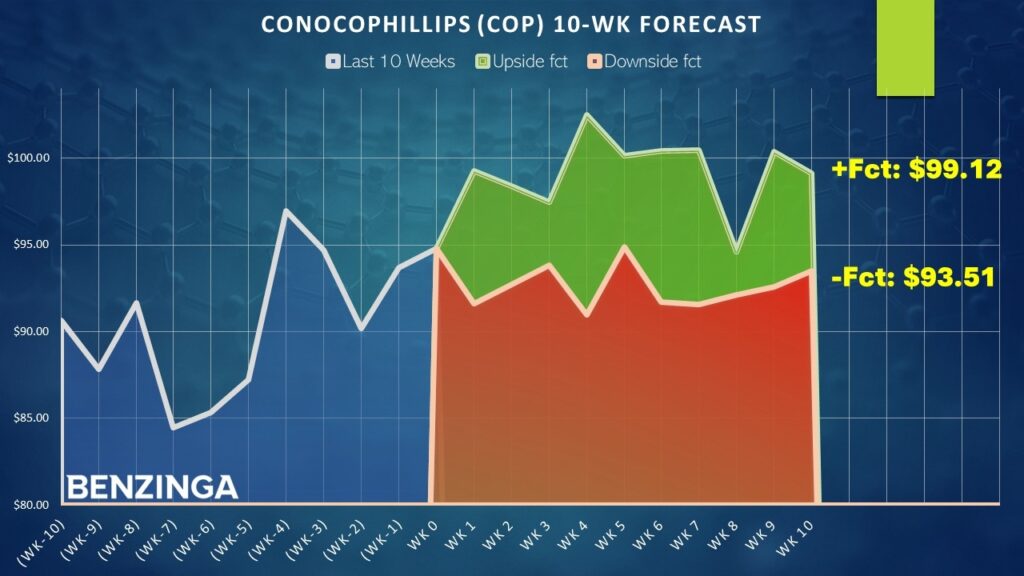

However, that's not what we actually observe in the market. Regarding COP stock, in the trailing two months, the security is printing a "4-6-U" sequence: four up weeks, six down weeks, with a positive trajectory across the 10-week period. Unusually, while the balance of distributive sessions outweighs accumulative, the overall trajectory is positive. It's a rare sequence, having only materialized nine times since January 2019.

Here’s the kicker, though. Again, if the market were truly random, the likelihood that the following week's price action will be positive should be around 50%. Instead, it's 66.67%, with a median return of 4.71%. Granted, we're talking about extremely small, fragile sample sizes here. But different sequences featuring various arrangements of accumulation and distribution frequencies feature vastly different probabilities.

It just so happens that with COP stock, the 4-6-U sequence tends to yield better results for bullish speculators. Thus, intrepid options traders can potentially exploit this edge.

An Aggressive Strategy For The Hard-Nosed Speculator

For those who don't mind taking big risks, the 95/99 bull call spread expiring Aug. 1 could be enticing. This transaction involves buying the $95 call and simultaneously selling the $99 call, for a net debit paid of $167 (the most that can be lost in the trade). Should COP stock rise through the short strike price ($99) at expiration, the maximum reward is $233, a payout of roughly 140%.

Given the median bullish response to the 4-6-U sequence, that would put COP stock over the $99 level, perhaps in a week or two. Therefore, the Aug. 1 expiration date provides an additional time cushion to account for unexpected turbulence.

In addition, the above trade is compelling because, as a baseline, the chance that COP stock will be profitable over any random week is 52.2% (since January 2019). Thus, the flashing of the quantitative signal incentivizes a debit-based strategy.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read Next:

Photo: Shutterstock