It doesn't look like it at first view but Archer Aviation Inc (NYSE:ACHR) has been under significant pressure from the bears during the trailing two months. Indeed, lumpiness has been a key characteristic of ACHR stock. In the past 52 weeks, ACHR stock has gained nearly 219%. However, on a year-to-date basis, the equity is up less than 5%. Still, there are emerging signs that Archer could see a decisive lift in market value.

Fundamentally, excitement is brewing for the underlying air mobility industry. Specifically, Archer represents one of the top competitors in electric vertical takeoff and landing (eVTOL) aircraft. First, several of Archer's peers, including the more speculative outfits like EHang Holdings Ltd (NASDAQ:EH) and Blade Urban Air Mobility (NASDAQ:SRTAW), popped higher today. Second, the sector appears to have attracted institutional traders.

Late last month, Benzinga published a whale alert for ACHR stock. On Sept. 23, an entity or entities bought 100 contracts of the $9 call with an expiration date of April 17, 2026. As a debit-based transaction, ACHR will need to rise above the strike plus the premium paid for the trade to be profitable. While this circumstance doesn't guarantee upside, it sends the signal that the smart money believes in the eVTOL specialist.

Another factor to keep in mind is short interest. Right now, the percentage of the available pool of ACHR stock that is earmarked for short-side speculation clocks in at 18.6%. That's a very high figure, with 10% serving as a general warning. Further, the underlying ratio comes in at 4.46 days to cover, which means that it would take the bears about one business week to fully unwind their short exposure.

Because of tail risk — the ever-rising threat of an obligatory payment as the underwritten risk gets realized to the extreme — an unexpected upswing can create a phenomenon known as short squeeze. ACHR stock could see such a development, which makes it awfully compelling for bullish speculators.

Cranking Out The Numbers For ACHR Stock

For those who simply want to speculate on ACHR stock without worrying about timing considerations, acquiring shares in the open market represents the most straightforward solution. On the other hand, people who desire leverage turn to the options market as each contract controls 100 shares of the underlying asset. But because options expire, traders must be more deliberate about their approach.

On a simplified level, there are two basic approaches to navigating the options market, which I colloquially refer to as Greek or Russian. In the former methodology, you plug in the "Greeks" into a Black-Scholes-Merton (BSM) framework to gauge what the options should be priced at relative to an assumed lognormal distribution. In the latter, the unique distributive properties of the target asset are analyzed to probabilistically determine how the next move may materialize.

Since you're dealing with an unknown future, there is no right or wrong methodology. However, I prefer the latter — which is based off the work of Russian mathematician Andrey Markov — because it's empirical and is, in my opinion, the least presuppositional.

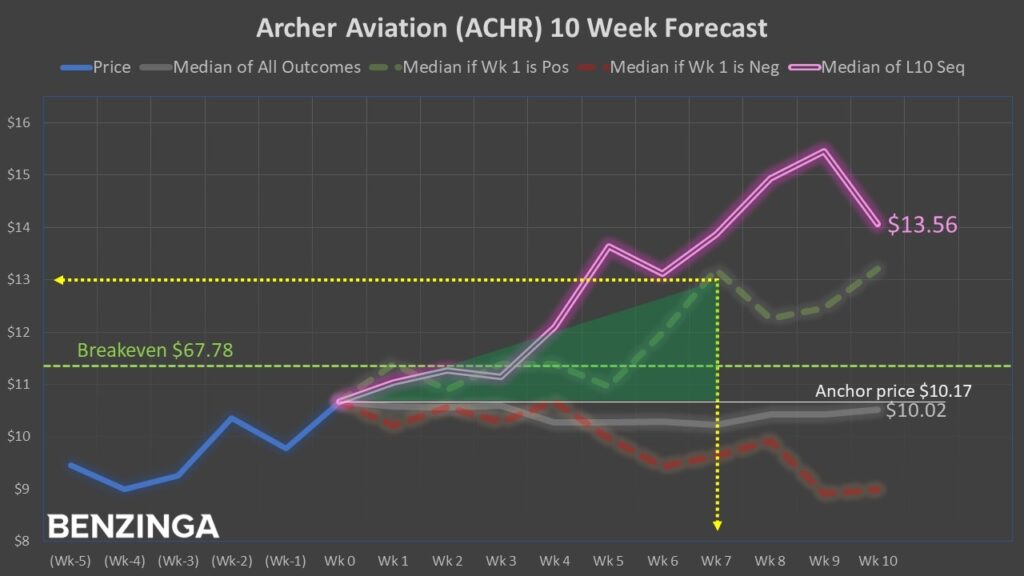

Academically, I utilize a first-order Markov chain defined on higher-order states. In simple language, my hypothesis is that the distinctive attributes of the last 10 weeks can be instructive in probabilistically determining how the next 10 weeks may play out.

For Markovian analyses to be effective, the measurement metrics need to be discrete rather than scalar. When applying this conversion process, we see that in the trailing 10 weeks, ACHR stock has printed a 3-7-D sequence: three up weeks, seven down weeks, with an overall downward trajectory.

Since January 2023, this discrete distribution-heavy state has materialized 11 times on a rolling basis. Why I'm excited about ACHR stock is that, over the next several weeks, the exceedance ratio relative to the starting point (anchor price) is projected to be at or above 63.6% (seven times out of 11). Further, the median price of outcomes tied to the 3-7-D sequence is projected to skyrocket around the fifth week.

Even more intriguing, under baseline conditions (or aggregating all price data going back to January 2023), the projected performance of ACHR stock is a flat consolidation. What that tells me is that when ACHR prints more red bars in a candlestick chart, traders tend to buy the dip.

Anticipating A Huge Lift

Considering the excitement for the eVTOL space and ACHR's high short interest, the most aggressive (but still somewhat rational) trade is the 10/13 bull call spread expiring Nov. 21. This transaction involves buying the $10 call and simultaneously selling the $13 call, for a net debit paid of $85 (the most that can be lost in the trade).

Should ACHR stock rise through the second-leg strike price ($13) at expiration, the maximum profit is $85, a payout of nearly 253%. Breakeven comes in at $10.85.

Another idea to consider is the 10.50/11.00 bull spread expiring Oct. 31. This trade anticipates that ACHR stock will pop higher earlier but requires a far lower magnitude of lift. If ACHR stock rises through the second-leg strike, the maximum payout would be over 163%.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock