It's an alarming statistic. Essentially, the U.S. government declared that it overstated job growth by 911,000 in the year through March 2025. Subsequently, this disclosure raises anxieties over the labor market's longer-term stability. As such, major financial institutions — including big bank Wells Fargo (NYSE:WFC) — has been encountering choppy price action. Still, the dynamism in WFC stock may present a contrarian opportunity for bullish speculators.

At first glance, betting on Wells Fargo or its banking ilk may seem woefully irrational. Fundamentally, the latest jobs report was poor. Last week, the Bureau of Labor Statistics revealed that the U.S. economy added just 22,000 jobs in August, a significant drop from July's count of 79,000. Further, the latest tally was well off the 75,000 target that economists anticipated.

Yes, WFC stock is one of the winners on Tuesday, gaining about 2% in late-afternoon trading. Much of this sentiment could be tied to speculation that the Federal Reserve may take action, considering the evidence of a fading economy. Still, in the trailing five sessions, WFC stock is down more than 1%. In contrast, the benchmark S&P 500 index is up over 1% during the same period.

Now, the latest info from the BLS translates to the average monthly job creation figure for April 2024 through March 2025 coming down to just 71,000, a sharp decline from the prior estimate of 147,000. Given the severity of the adjustment, it's natural to be pensive — even outright bearish — about WFC stock.

Still, for those with a contrarian mindset, there is a statistical case for upside.

Using Statistical Validation To Guide A Trading Strategy For WFC Stock

Ultimately, to understand where a public security may head next, it's important to analyze the market's price discovery behaviors. Sure, the fundamentals may point toward a particular direction. However, whether the underlying security or asset actually moves there will depend on how credible investors believe the narrative is.

Of course, it's impossible to figure out the motivations of each and every individual or entity. However, the working thesis among (arguably) most traders is that the net market price reflects the overall voting sentiment of investors.

From a quantitative perspective, WFC stock is currently distribution heavy. In the trailing 10 weeks, the security has printed four up weeks and six down weeks, with an overall downward trajectory. For classification, this sequence can be labeled 4-6-D. With a falsifiable signal identified, we can now look back at past analogs to determine how the market typically responds to it.

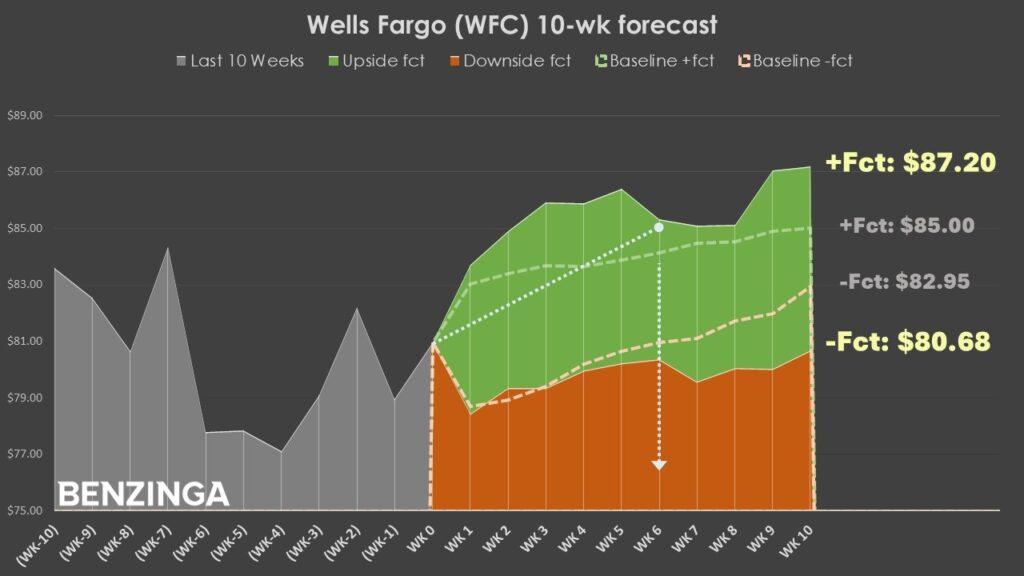

Under normal circumstances, the natural drift witnessed in WFC stock (under an in-sample dataset between January 2019 and July 2025) would be expected to push shares between $82.95 and $85 over the next 10 weeks. However, the conditional drift of the 4-6-D sequence has historically yielded a skew from a median low of $80.68 to a median high of $87.20.

Put another way, the 4-6-D sequence creates more risk but also more reward potential. As well, the sequence tends to create air pockets where reward potential is elevated but without a material increase in risk probability. That's what makes the current setup so intriguing.

However, the assertion that the 4-6-D sequence is enticing for bullish speculators is an in-sample argument; that is, the claim and the evidence come from the same data pool. Left as is, the argument would be self-referential and thus circular.

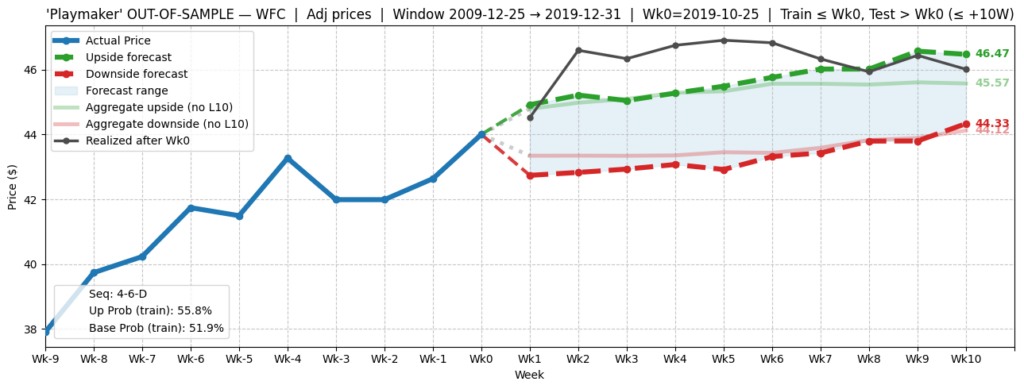

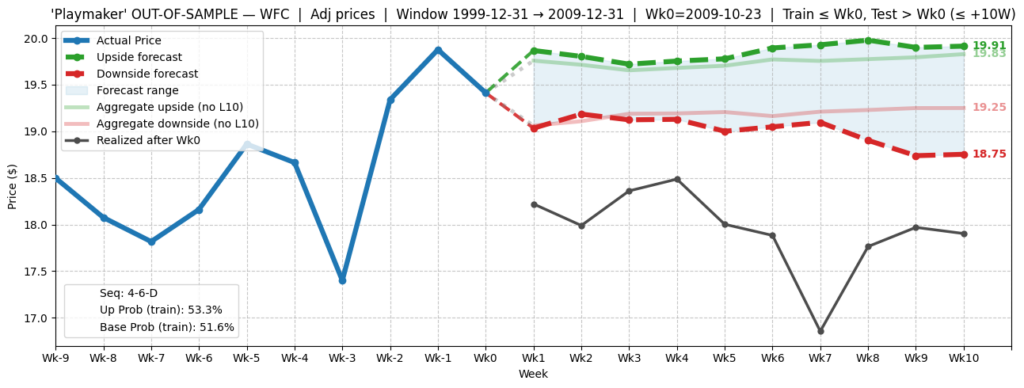

To statistically validate the thesis, I conducted two major out-of-sample tests: one testing the viability of the 4-6-D throughout last decade and another test period for the 2000s decade.

In both test periods, there is a noticeable increase in the reward potential relative to the aggregate or baseline drift. However, as would be expected, the risk profile expanded during the 2000s decade due to the onset of the financial crisis. Even then, the negative expansion was relatively muted.

Barring a severe recessionary cycle, the aforementioned sequence has been a reliable reversal signal. As such, the contrarian narrative appears compelling.

Betting Big On A Big Bank

Based on the market intelligence above, aggressive traders may consider the 82.50/85.00 bull call spread expiring Oct. 17. This transaction involves buying the $82.50 call and simultaneously selling the $85 call, for a net debit paid of $101 (the most that can be lost in the trade).

Should WFC stock rise through the short strike ($85) at expiration, the maximum profit would be $149, a payout of roughly 148%. Breakeven comes in at $83.51.

What makes this trade enticing is that in the current sentiment regime, the 4-6-D sequence tends to create a positive air bubble in the first five to six weeks. That fits right into the Oct. 17 expiration date. Further, the risk profile isn't particularly elevated relative to expected norms, which statistically benefits the bulls.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock