As the go-to name in enterprise cloud computing solutions, Salesforce Inc (NYSE:CRM) plays a pivotal role in modern business networks. Thanks to the digitalization of everything, Salesforce has become the core communications platform for how companies interact with their customers. Further, by embedding artificial intelligence into their software, it took an early lead in the push for automated efficiency. Still, this hasn't always led to strong market performances — which counterintuitively could be a reason to consider CRM stock.

To be sure, Salesforce faces a serious pressure cooker. Ahead of the software giant's fiscal second-quarter earnings disclosure — set to be released tomorrow after the closing bell — the tech sector has conspicuously suffered a mixed-bag performance. Most notably, semiconductor juggernaut Nvidia Corp (NASDAQ:NVDA) stumbled following its earnings report. Despite beating analysts' estimates, data center sales appeared to miss forecasts, leading to the fallout in NVDA stock.

For its part, Salesforce is expected to post earnings per share of $2.52 on revenue of $10.13 billion. In the year-ago quarter, the company posted EPS of $2.56 on sales of $9.32 billion. Generally speaking, Salesforce has consistently delivered the goods. Since December 2020, Salesforce hasn't missed on both the top and bottom lines simultaneously. Further, analysts expect a solid outing, with CRM stock carrying a consensus rating of Outperform.

If Salesforce CEO Marc Benioff's words are anything to go by, the company has a chance to distinguish itself from the recently struggling tech sector. In a podcast, Benioff stated that he reduced headcount in the company's customer support division from 9,000 heads to approximately 5,000, all thanks to AI agents.

In other words, while there's legitimate fear that the AI boom is waning, Salesforce appears to be walking the talk — and the upcoming earnings disclosure will be the chance to codify the sentiment.

Using A Cross-Validated Quant Signal To Trade CRM Stock

As exciting as the narrative may be for Salesforce, what really matters is investor demand. In other words, people can say great things about each presidential candidate. But at the end of the day, the vote has to go to a clear winner. From this perspective, CRM stock stands on unusual ground.

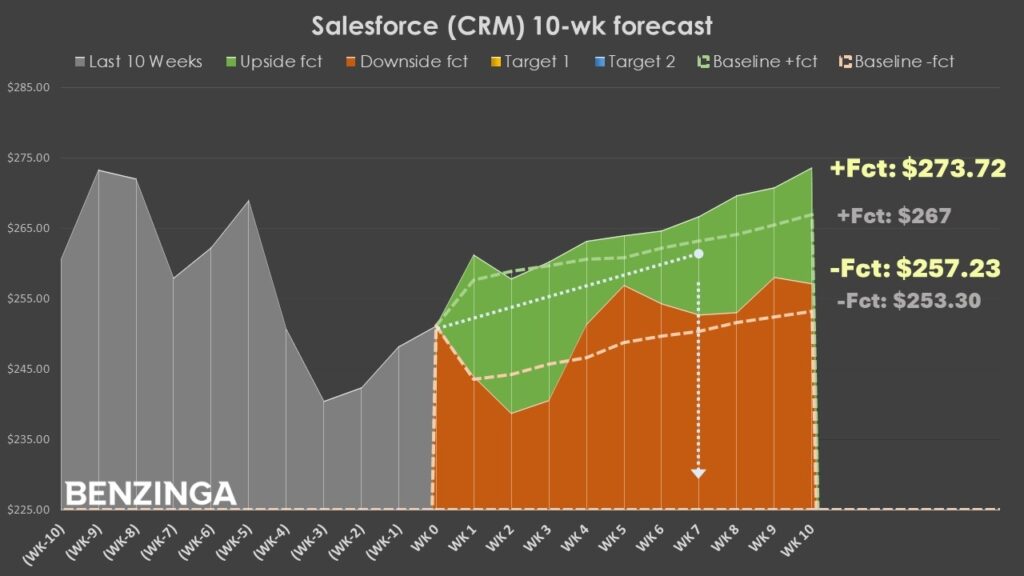

In the past 10 weeks, CRM has printed six up weeks, four down weeks, with an overall upward trajectory across the period. For classification purposes, this sequence or quantitative signal can be labeled 6-4-D. It's an unusual pattern as the balance of accumulative sessions outweighs distributive, yet the overall trajectory is negative.

Historically, though, the 6-4-D sequence has generally tended to yield upside performances over the next 10-week period. Following the flashing of the quant signal, the conditional drift has ORCL stock ranging between a median low of $257.23 to a median high of $273.72. In contrast, the aggregate or baseline drift tends to carry the stock between $253.30 and $267.

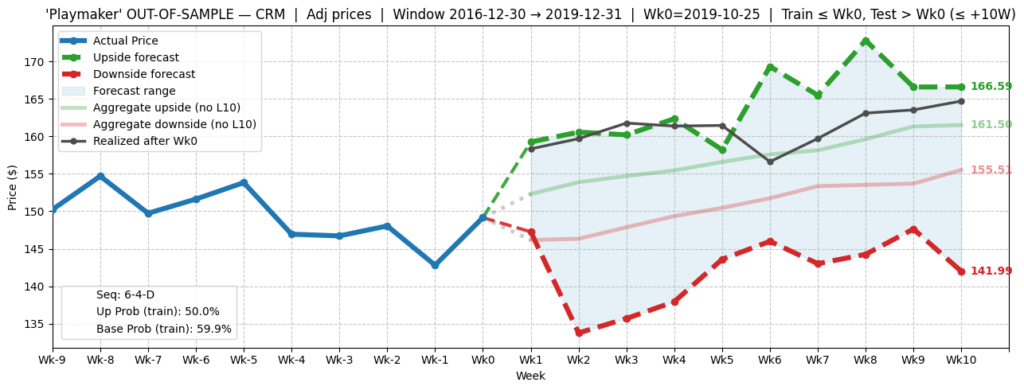

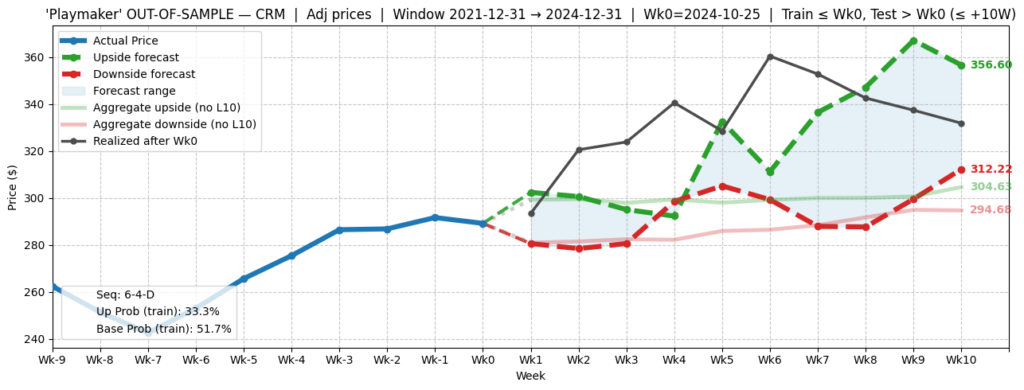

However, the 6-4-D sequence only stems from in-sample data, which ranges from January 2019 to last Friday's close. To better ensure that we're dealing with actual structure and not just random noise, we must conduct cross validation or out-of-sample tests; that is, analyze how the 6-4-D sequence performs in outside datasets.

To get a more holistic picture, I performed two out-of-sample tests of the 6-4-D sequence, with datasets covering the three years before the COVID-19 crisis and three years after the pandemic:

A detailed analysis would extend well beyond the scope of this article. However, the main takeaway is that in both cases (pre-COVID and post-COVID), the conditional upside pathway is noticeably above the aggregate upside pathway, especially in the later weeks. The main risk-profile difference is in the downside pathway. During the pre-COVID regime, there is a higher danger of volatility if the 6-4-D sequence doesn't yield the desired sentiment reversal.

So, how should investors interpret this data? I would argue that because of the broader integration of AI in the post-COVID regime, the risk profile has been somewhat tempered. Stated differently, in the current regime, the negative pathways have been nominally raised up, thus providing increased confidence for bullish speculators.

Putting Acquired Knowledge Into Practice

Based on the available information — including the out-of-sample tests — the trade that arguably makes the most sense is the 250/260 bull call spread expiring Oct. 17. This transaction involves buying the $250 call and simultaneously selling the $260 call, for a net debit paid of $480 (the most that can be lost in the trade). Should CRM stock rise through the short strike price ($260) at expiration, the maximum profit is $520, a payout of over 108%.

What makes this attractive is that under baseline conditions, the positive drift should take CRM stock above $260 by the Oct. 17 expiration date. Based on the conditional positive drift of the 6-4-D sequence, CRM could potentially go even higher, perhaps around $266.

For the most aggressive trader, betting on the 252.50/257.50 bull spread expiring Sept. 19 wouldn't be out of the question. Here, the net debit required is $245, with a max payout just over 104%. However, the response to tomorrow's earnings report needs to be enthusiastic. Otherwise, there may not be enough time for CRM stock to hit its profitability threshold.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

- Options Corner: Identity Security Specialist Okta’s Wild Swings Offer A Quick Flare Pass Opportunity

Image: Shutterstock