While posting record revenues can generally excite investors, context matters, as Iron Mountain Inc (NYSE:IRM) is finding out the hard way. Sure, some of the headline figures did stand out, with the enterprise information management specialist aggressively expanding its data center business, which of course is one of the hottest sectors right now. However, certain metrics appeared to spook investors away from IRM stock — which then potentially opens an opportunity for aggressive traders.

For the second quarter, Iron Mountain generated revenue of $1.71 billion, beating Wall Street analysts' consensus target of $1.68 billion. Last year, the company posted sales of $1.53 billion. On the bottom line, though, the information management firm — which is structured as a real estate investment trust (REIT) — only managed to deliver adjusted earnings per share of 48 cents. This figure missed the consensus view of 84 cents.

Unfortunately, the questions didn't end there. According to the company's press release, while total revenues saw a sequential quarter-to-quarter rise of 7.5%, total operating expenses increased by 8.5%. Further, certain line segments saw rather large lifts, such as selling, general and administrative expenses jumping 18.4%. With expenses outpacing growth, it's possible that investors flagged that as an emerging risk factor.

Another issue may stem from funds from operations (FFO). While the normalized metric saw an 11.5% year-over-year growth rate, the Nareit variety — as defined by the National Association of Real Estate Investment Trusts — suffered a 55.3% drop. Essentially, FFO (Nareit) tells investors how much actual cash profit the company made from its core real estate business, stripping out accounting noise.

Still, you might argue that the selloff in IRM stock — which is down about 5% in afternoon trading — may be overdone. In addition to the record top line, it's worth pointing out that Iron Mountain's data center, digital and asset lifecycle management (ALM) businesses collectively grew more than 30%.

Plus, the company deals with mission-critical data for top-tier institutions in the legal, healthcare, financial and government sectors. These entities don't casually switch major service providers, thereby providing cash flow traction.

Playing the Odds with IRM Stock

Although it's tempting to say that the market is overreacting to Iron Mountain's mixed earnings results, that would be a presuppositional fallacy. Essentially, I would be smuggling the conclusion (that IRM stock will rise) into the premise (that the market is incorrect about IRM's valuation). That would be an extraordinary claim for which I lack evidence, extraordinary or otherwise.

When it comes to analyzing publicly traded enterprises — especially for short-term options wagers — it's better (in my opinion) to treat the market as a political campaign. It's difficult to gauge the full spectrum of an individual's ideological stance, especially if they insist on giving a preamble of being neither right nor left. But you can cut through the clutter and noise by focusing on who they ultimately vote for.

It's the same thing with the equities sector. At the end of the day, the market is either a net buyer or a net seller.

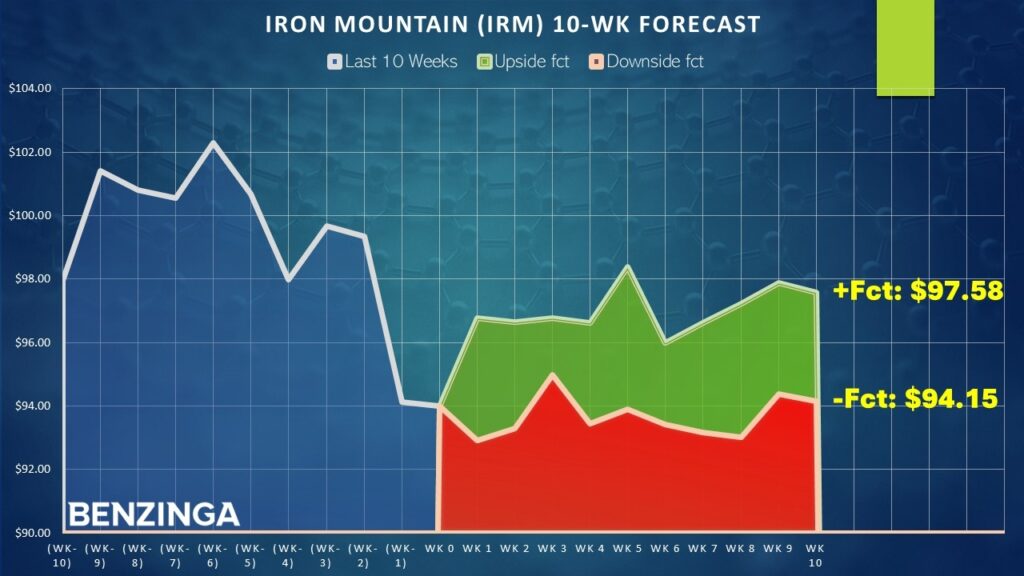

With that framework in mind, in the past 10 weeks, the market voted to buy IRM stock four times and sell six times. During this period, the security incurred a downward trajectory. For brevity, we can label this sequence as 4-6-D.

In a dataset that extends back to January 2019, the 4-6-D sequence has materialized 35 times on a rolling basis. Using past analogs, we can project how the market responds to this signal, facilitating the creation of an empirical gameplan. Even better, we can map out the major signals, creating a decision-tree logic:

| L10 Category | Sample Size | Up Probability | Baseline Probability | Median Return if Up |

| 3-7-D | 15 | 53.33% | 56.69% | 4.34% |

| 4-6-D | 35 | 65.71% | 56.69% | 2.94% |

| 4-6-U | 12 | 66.67% | 56.69% | 3.55% |

| 5-5-D | 31 | 67.74% | 56.69% | 2.10% |

| 5-5-U | 42 | 57.14% | 56.69% | 3.00% |

| 6-4-D | 13 | 46.15% | 56.69% | 3.74% |

| 6-4-U | 62 | 51.61% | 56.69% | 2.16% |

| 7-3-U | 40 | 55.00% | 56.69% | 2.21% |

| 8-2-U | 27 | 62.96% | 56.69% | 2.38% |

| 9-1-U | 11 | 54.55% | 56.69% | 1.82% |

From the table above, the chance that a long position in IRM stock will rise on any given week (the baseline probability) is 56.69%, a strong upward bias. This is effectively our null hypothesis, the odds of long-side success assuming no mispricing. However, our alternative hypothesis is that, because of the 4-6-D sequence flashing, a mispricing exists. Specifically, the long odds in the following week jump to 65.71%.

In simple terms, the process above — which is applied game theory — is similar to card counting in blackjack, where we strike when the deck is hot in our favor. However, the difference between blackjack and the stock market is that we don't have to bet on securities that don't have favorable odds. Over time and at scale, the idea is that our winners will outpace our losers.

Assuming that IRM stock can get to $94 by the end of this week, it could be on course to reach close to $97 relatively quickly (since the median return following the 4-6-D sequence is 2.94%). Optimistically, IRM may be able to hit roughly $98.50 over the next five weeks.

Two Aggressive Trades to Consider

For the gutsiest speculator, the 91/95 bull call spread expiring Aug. 15 could be enticing. This transaction involves buying the $91 call and simultaneously selling the $95 call, for a net debit paid of $200 (the most that can be lost in the trade). Should IRM stock rise through the short strike price ($95) at expiration, the maximum profit is also $200, a 100% payout.

Here's the deal. The breakeven price for the above call spread is $93. At the current price, a 2.94% lift would only put IRM stock at $93.26. For this trade to make sense, it's going to need some help beyond the expected median performance rate. With expiration just around the corner, this is going to be a little too rich for my blood.

If it were me, I would rather go for the 95/100 bull spread expiring Sep. 19. This is probabilistically risky because of the $100 short strike price. However, the breakeven price for this spread is $96.55, which is a realistic target. Plus, if the market gods smile, reaching $100 at expiration would see a payout of roughly 223%.

Mathematically, the biggest concern I have about the 4-6-D sequence is that a one-tailed binomial test reveals a high p-value of 0.247. This means that there's a 24.7% chance that the implications of the signal could materialize randomly as opposed to intentionally.

What I believe is setting off the p-value is the high baseline probability of nearly 57%. Essentially, the positive delta in odds between the baseline and the 4-6-D sequence isn't that big. However, with the baseline already favoring the bulls, IRM stock is arguably an attractive idea to consider because the aforementioned sequence tends to improve those odds.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read Next:

Photo: Michael Vi/Shutterstock