While buy-and-hold strategies can be very effective for trusted, quality enterprises, options strategies can be more appropriate for publicly traded assets that exhibit choppy behavior. Among the most kinetic companies on Wall Street right now is identity and access management specialist Okta Inc (NASDAQ:OKTA). With rapid integration of cloud architectures, Okta's gatekeeping role in digital systems for various organizations will likely rise in relevance. It's just that the bullish window of opportunity could be narrow.

For optimists, there doesn't seem to be much lack of good news. A few days ago, Okta disclosed strong second-quarter results, with earnings per share landing at 91 cents. This figure beat Wall Street analysts' consensus view of 64 cents and was also an improvement over the year-ago quarter's print of 72 cents. On the top line, Okta generated $728 million, also beating the consensus target set at $711.52 million. Further, it exceeded last year's tally of $646 million.

Adding to the positive vibes, the company's leadership team anticipates revenue landing between $728 million and $730 million. This was noticeably above the Street's target of $723.55 million. As well, Okta boosted its fiscal 2026 forecast, now guiding full-year revenue to hit between $2.875 billion and $2.885 billion, with adjusted earnings per share of $3.33 to $3.38.

Not surprisingly, OKTA stock has responded well to the print, with Cantor Fitzgerald offering a helping hand by reiterating its Overweight rating and its $130 price target. Moreover, analysts praised the company's "strong execution" in the second quarter, noting outperformance on several key metrics.

However, the distraction is that OKTA stock is all over the map. For all its gyrations — which features a 52-week range between $70.56 and $127.57 — OKTA is up roughly 18% so far in 2025. That's not bad but it's not particularly earth-shattering either.

Why Options Make A Whole Lot Of Sense For OKTA Stock

On paper and divorced from key context, OKTA stock would be an unquestioned buying opportunity for investors. In an era of remote work, cloud adoption and cyberattacks, identity management represents the first line of defense. In other words, the underlying business can best be summed up with this adage: an ounce of prevention is worth a pound of cure.

However, investors don't live in a world where narratives align neatly and linearly with market psychology. Sure, OKTA stock could be celebrated for its many underlying positives but there's a counterargument: simply look at the performance since the close of May 27 (when it finished the session at $125.50).

That's a 25% loss, which would be massive if you're heavily exposed. This is where certain options strategies could make a world of sense because of their defined (or contained) risk-reward structure. Plus, with the expiration of these derivative contracts, one is effectively forced to abide by a splash-and-dash mentality.

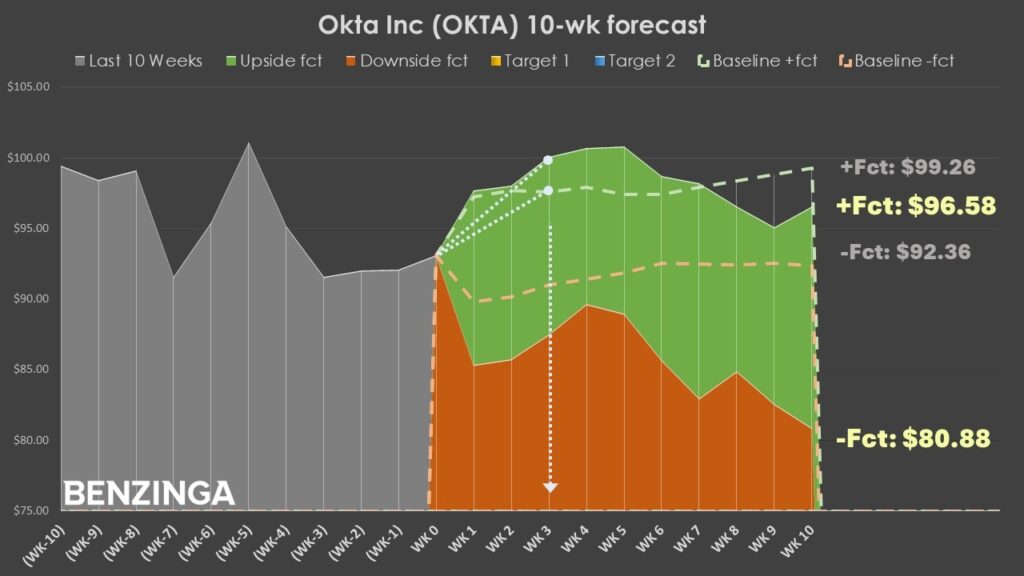

Having said that, the temptation to buy OKTA stock at a relative discount is understandable. Based on the natural drift of the security — which takes into account aggregate historical pricing data — OKTA is roughly projected to range between $92 and $99 over the next 10 weeks.

But OKTA stock has printed a distinct quantitative signal. In the trailing 10 weeks, it posted four up weeks, six down weeks, with an overall downward trajectory (labeled 4-6-D for convenience). This sequence typically projects a forward 10-week drift between approximately $81 and roughly $97. Stated differently, there could be significantly widened volatility, with an overall skew pointing southward.

However, in the near term, the 4-6-D sequence typically tends to skew upward before eventually rolling over.

To use (American) football terms, the market may be positioning OKTA stock in a Cover 2 defensive scheme, where two safeties split the deep half of the field. At the same time, the cornerbacks are showing blitz, leaving the flat open. Therefore, one can audible for the running back to enter the uncovered area for a quick flare pass to move the chains.

Going For The First Down, Not The Touchdown

Unlike other opportunities where the longer-term narrative and the speculative thesis generally align, OKTA carries a more dichotomous personality. It's easier to see a short-term bullish opportunity but a cloudy (and potentially bearish) outlook over the next several weeks.

Subsequently, an options strategy called the bull call spread could be appropriate. This transactional geometry involves buying a (long) call option and simultaneously selling a (short) higher-strike-price call. The proceeds received from the short call partially offset the debit paid for the long call, resulting in a discounted bullish position. However, both the potential loss and potential profit are capped.

Arguably, the most probabilistically sensible idea is the 93/96 bull spread expiring Sept. 26. This transaction involves buying the $93 call and simultaneously selling the $96 call, for a net debit paid of $150. Should OKTA stock rise through the short strike price at expiration, the maximum profit is also $150, a 100% payout.

The most tempting trade may be the 94/100 bull spread also expiring Sept. 26. This trade requires OKTA stock to rise through the short strike price at expiration. However, if this happens, the payout stands at nearly 173%.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Photo: Shutterstock