For cryptocurrency investors, the blistering rise of major digital assets has been nothing short of remarkable. Last month, the total market capitalization of all virtual currencies reached nearly $4.2 trillion. However, blockchain enterprises like MARA Holdings Inc (NASDAQ:MARA) have not fared as well. Since the start of this year, MARA stock is up less than 3%. For context, the venerable Dow Jones is up roughly 8% during the same frame.

Still, speculators may not want to give up on MARA just yet. According to the latest information, the blockchain miner's short interest stands at 35.6% of its float, which is massive. To be sure, no one number exists that officially separates the threshold between high short interest from a normal reading. That said, Charles Schwab notes that a figure of 10% or higher could indicate a warning sign.

Intuitively, securities that attract bearish activity tend to have a cloud hanging over them. However, extremely elevated short interest is also risky for the bears. That's because a true short position is a credit-based transaction. Essentially, the sold securities that initiate such a trade are loaned on credit. Therefore, either way, the lending broker must be made whole — and that's where both the trouble and opportunity lie.

Obviously, short sellers expect the targeted security to fall in value. If so, the red ink allows these speculators to buy back the shorted securities at a discounted price and return them to the broker, with the difference pocketed as profit. However, an unexpected rally may force speculators to exit early, forcing a massive wave of buy-to-close transactions.

The end result? That would be a short squeeze — and it could easily happen to MARA stock.

Why Speculators Are Looking For A Bounce Back In MARA Stock

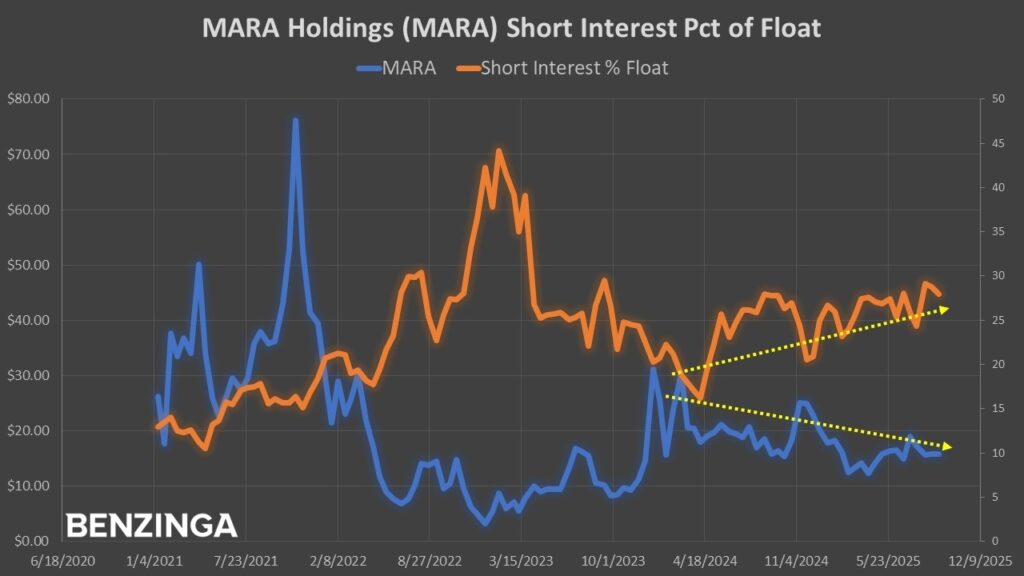

While MARA's short interest by itself warrants attention, it's also the relationship between this metric and the security's price action that raises eyebrows. Since January 2021, the baseline short interest has generally been moving higher. In contrast, MARA stock has been choppily heading lower. However, with the crypto ecosystem becoming a powerful economic force, this arguably unnatural relationship may resolve favorably for MARA bulls.

It really comes down to the hard data. Between January 2021 and early September 2025, MARA stock has fallen from around $26 to about $16, roughly a 38% loss. However, short interest (as a percentage of the float) has jumped from 13% to 28%, a 115% increase. With the current short interest coming in at almost 36%, the bears are increasingly exposed.

All it might take is an unforeseen trigger to send MARA stock screaming higher.

During the aforementioned period, the correlation coefficient between MARA stock and its short interest landed at -0.7149. That's a strong inverse relationship, meaning that as MARA has faded, the bears have been increasingly ramping up their exposure. Again, such a trend isn't necessarily or inherently bullish; in fact, quite the opposite. However, the increased exposure raises the prospect of something going wrong.

While direct comparisons should be avoided, it's difficult not to mention the meme that's apparently not a meme: Opendoor Technologies, Inc. (NASDAQ:OPEN). During the worst of the COVID-19 pandemic, Opendoor's quick and effectively contactless platform garnered tremendous demand. However, dramatic changes socially and economically saw OPEN stock plunge from its prior highs.

Still, what has kept Opendoor relevant from a speculative standpoint is its security's short interest of 26.6%. With MARA stock commanding a higher short interest — and I would argue a much more relevant business considering the huge barriers to homeownership — it has the potential to be the next big short squeeze.

Taking A Bold Bet

Quantitatively, MARA stock in the trailing 10 weeks has printed four up weeks and six down weeks, with an overall downward trajectory. This 4-6-D sequence — under the positive pathway — would be expected to rise about 11% over the next six weeks. That would translate to a $19 price target for the Oct. 31 options chain.

As such, one idea to consider would be the 18/19 bull call spread expiring on Halloween. This transaction would involve buying the $18 call and simultaneously selling the $19 call, for a net debit paid of $35 (the most that can be lost). Should MARA stock rise through the second-leg strike price ($19) at expiration, the maximum profit would be $65, a payout of nearly 186%.

However, because of the possibility of a short squeeze, I believe the 18.50/20 bull spread also expiring on Halloween is in play. This trade would involve paying a net debit of $40. But if MARA stock hits the $20 target at the end of October, the payout stands at 275%.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Photo: Shutterstock