With the precious metals market ranking among the hottest sectors on Wall Street, Canadian mining company B2Gold Corp (NYSEAMERICAN: BTG) is understandably having its moment. At the same time, the tremendous performance raises serious questions. Since the start of the year, BTG stock has more than doubled in value. Most of that upswing came in the trailing six months, with BTG gaining nearly 74%. Of course, bag-holding concerns dominate discussions.

Fundamentally, though, circumstances do appear net favorable for gold. Earlier today, the precious metal surged to $3,800 per troy ounce, sending the market value of U.S. gold reserves past the $1 trillion mark. Interestingly, the federal government still values its reserves at $42.22 per ounce — a price set by Congress in 1973. That would amount to a total of only $11.04 billion on paper.

It should be noted that the spike in gold may be related to somewhat cynical catalysts. With fears that the government may shut down soon, anxieties have pushed investors into safe-haven assets. Further, the Federal Reserve recently cut its benchmark interest rate, with policymakers signaling that more easing may follow.

In fairness, the magnitude of the Fed's dovish policy shift is up for debate. However, it's also relatively clear that the central bank is taking a more active approach to help guide the economy. With certain inflation indicators being elevated but in line with expectations, there could be room for policy modulation.

Potentially, that would be positive for gold due to the implied currency devaluation — and BTG stock may enjoy downwind benefits.

Where Will BTG Stock Head Next? Watch The Smart Money

As compelling as the fundamentals may be, B2Gold's prospective investors are almost certainly concerned about holding the bag. Even in the near term, the performance has been robust. For example, in the trailing month, BTG stock has gained roughly 21%. Still, if the smart money offers any influence, the forward trajectory could be quite positive.

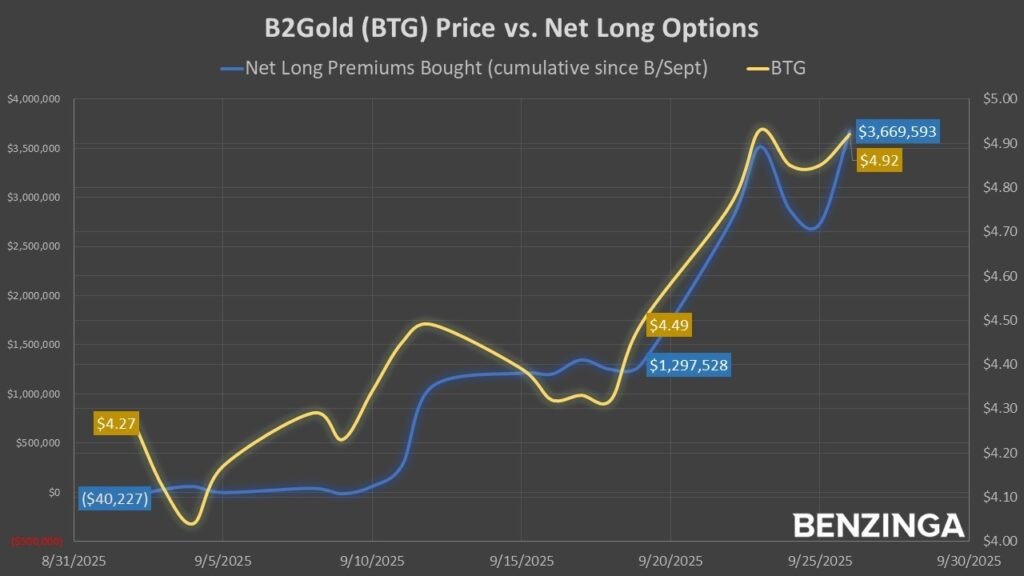

According to Fintel, BTG's net long option premiums bought stood at $940,400 following last Friday's close. This metric represents the difference between debit-based call options (which have bullish implications) and credit-based calls (which generally have bearish implications), while backing out net long puts (bearish) and baking in net short puts (bullish).

With so many moving parts, this overlooked metric is a little confusing. Colloquially, though, it can be thought of as the net bullish exposure in the options market. And since the derivatives space largely represents the domain of professional and institutional traders, trends witnessed in this arena may have significant implications for the underlying security.

Critically for BTG stock, the smart money is aggressively loading the boat. At the beginning of the month, net long premiums sat at $40,227 below parity. On Friday's close, net longs reached a cumulative value of nearly $3.67 million. Coincidentally, during this period, the share price of B2Gold jumped from $4.27 to $4.92.

Looking at the matter empirically, the correlation coefficient between BTG stock and its cumulative net long premiums clocked in at 93.21%. That's an extremely strong direct relationship, meaning that as BTG moves higher, so too does its net long options exposure.

To be clear, we're talking about correlation, not necessarily causation. I simply don't have enough evidence to declare absolutely that one is driving the other. However, based on eyeballing the chart, it seems that the enthusiasm for BTG stock and the broader gold market is creating a fear-of-missing-out (FOMO) effect among smart money traders.

As such, it might not be a bad idea to remain bullish on B2Gold, despite its enormous rally.

Going For The Long Bomb

While the smart money may be aggressively bullish on BTG stock, it's difficult to say where the security may end up and over what time period. Given the uncertainties, going for a simple naked debit options strategy might be enticing.

At time of writing, the $4 call expiring Jan. 16, 2026 seems relatively attractive. This trade carries an ask price of $1.20 (or $120 when applying the options multiplier), which means that BTG stock must reach $5.20 at expiration to break even (strike price plus premium paid).

Currently, the above debit call commands a bid-ask spread of 4.27% at the midpoint. That's quite low when considering that most investors would view BTG as a penny stock. It also means that you're dealing with less slippage — the hidden cost you pay due to the gap between the buy and sell prices.

Of course, so much hinges on the smart money. However, from the data that I'm seeing, the big dogs are bidding up BTG stock. Without much evidence to suggest that a severe correction is imminent, the above call option appears very tempting.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Photo: Shutterstock