In a market ecosystem accelerating toward artificial intelligence and other exciting innovations, there's not much room left for blue-chip giants like Coca-Cola Co (NYSE:KO). It's completely understandable given its legacy business and the fact that consumer tastes have shifted. Nevertheless, the underlying consistency of the KO stock price presents an intriguing argument for the iconic beverage brand.

Essentially, the broader argument is that Coca-Cola is a laggard — but one that could make a comeback. Admittedly, though, the situation initially doesn't look that appetizing.

Since the start of the year, KO stock has gained 7%, which is rather poor. Sure, the soft-drink juggernaut does pay a dividend of 3.06%. But even adding that into the total return, you're still getting a little over 10%. On the other hand, just buying a share of the S&P 500 would get you a return of 13% during the same frame.

However, one interesting wrinkle comes from the options market. Earlier this month, Benzinga's options scanner identified multiple large-scale transactions — likely caused by market whales — which mostly featured bearish intent. However, among these negative-sentiment trades, most were credit-based transactions (i.e. sold calls), which have ambiguous undertones. Such trades could be pessimistic or they could represent other activities, such as hedging.

The one debit-based transaction, bought puts with a $66 strike price, expired on Sept. 19. As such, there may be less bearish pressure working against KO stock.

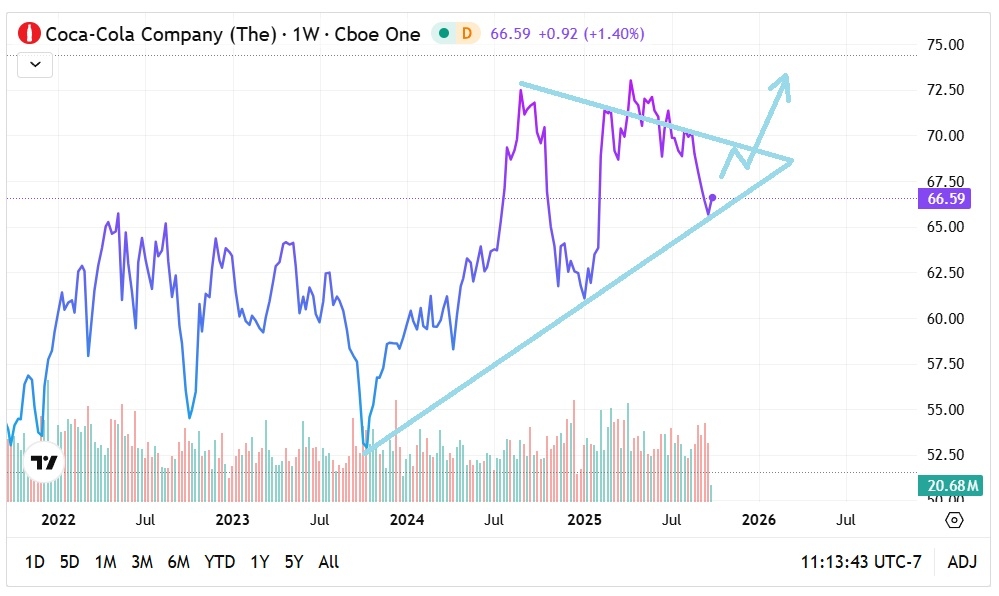

Further, the discipline of technical analysis offers another potential wrinkle. It's possible that KO stock is in the middle of charting a long-term bullish pennant formation. If so, we could see a rebound before an eventually decisive move higher.

Using Statistics To Extract A Trading Idea For KO Stock

While both the unusual options activity and technical datapoints appear compelling, the difficult matter is interpretation. KO stock certainly appears to be headed in the positive direction after succumbing to earlier volatility. Unfortunately, the aforementioned elements don't provide much specificity. For that, we can turn to the statistical evidence.

In the last several months, I have applied a methodology known as a first-order Markov chain defined on higher order states. Essentially, this is a probabilistic model which assumes that the next (behavioral) state depends only on the current state.

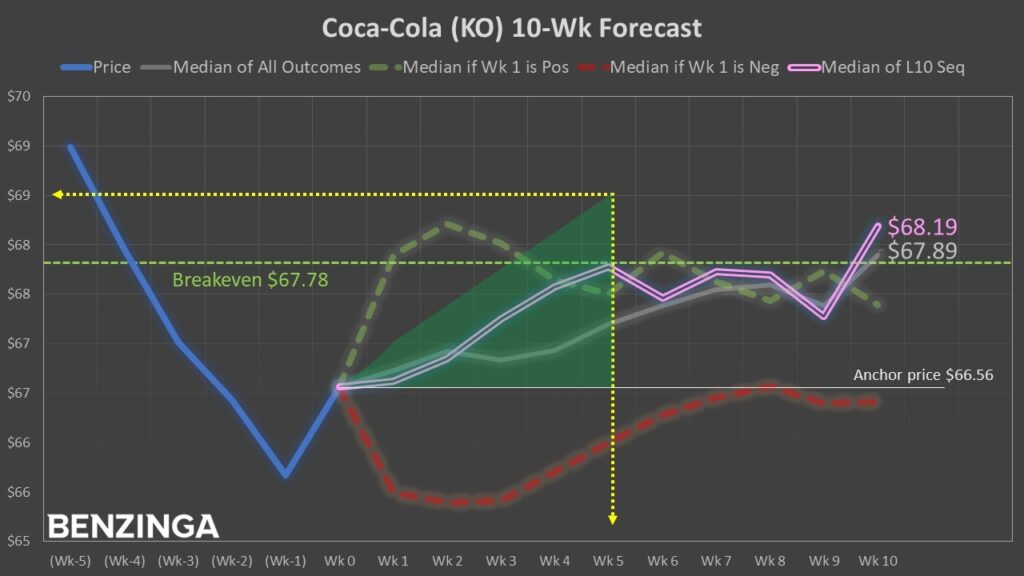

In my unique interpretation of Markovian theory, I operate under the assumption that the distinctive characteristics of the last 10 weeks of price action can best extrapolate what might happen in the following 10 weeks. Further, I compare this conditional probability to the baseline probability, which integrates all outcomes (rather than certain distinctive behavioral states).

For instance, if the last 10 weeks were incredibly bearish, that would (I believe) almost certainly have a greater impact on how the next 10 weeks will materialize, as opposed to if the last 10 weeks were evenly balanced between bulls and bears.

As for the situation at hand, in the trailing 10 weeks, KO stock has printed a 4-6-D sequence: four up weeks (defined as the return between Monday's open and Friday's close), six down weeks, with an overall downward trajectory. Since January 2019, this quantitative signal has occurred 43 times on a rolling basis.

Now, what's fascinating is that in the fifth week following the flashing of the signal, the probabilistic chance of upside is 67.4%. This means that KO stock has moved up 29 out of 43 times relative to the starting point (which in our case is the time-of-writing price of $66.56). Also, the median price of outcomes associated with the 4-6-D clocks in at $67.78.

In other words, at the fifth week, half of the outcomes tied to the quant signal have landed above this point and half below. That's a sensible marker to consider when formulating an options strategy.

Putting The Data To Work

Based on the market intelligence above, the most aggressive wager to consider that's still within the realm of rationality is the 67/69 bull call spread expiring Oct. 31. This transaction involves buying the $67 call and simultaneously selling the $69 call, for a net debit paid of $82 (the most that can be lost in the trade).

Should KO stock rise through the second-leg strike price ($69) at expiration, the maximum profit is $118, a payout of nearly 144%. Further, the breakeven price is $67.82, which is very close to the previously mentioned "sequential" median price of $67.78.

Granted, it's an ambitious trade because we're banking on a sizable response to the extended volatility of KO stock. For a more probabilistically reasonable trade, you may consider the 67/68 bull spread. To be sure, the payout would drop to 104%. Still, all things considered, it's a robust reward.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock