Fundamentally, cryptocurrency miner CleanSpark Inc (NASDAQ:CLSK) has likely been moving higher due to speculation of monetary policy. In the trailing five sessions, for example, CLSK stock has jumped over 13%. Heading into the Federal Reserve Open Market Committee's (FOMC) decision on a dovish adjustment of the benchmark interest rate — and more importantly commentary regarding the forward outlook — the security gained over 1%.

Still, it could ultimately be rising short interest that helps move CLSK stock even higher. Even more enticing, the stock is flashing a strong technical signal that is almost surely on the watchlist of meme traders and other market gamblers.

On the surface, the earlier moves of CLSK stock likely stem from buy-the-rumor, sell-the-news dynamics — and the headline rumor itself wasn’t all that groundbreaking. According to CME Group's FedWatch, the tool projected a 100% likelihood that the Federal Reserve would cut the benchmark interest rate. Instead of the actual decision, it's the central bank's commentary that had investors glued to their screens.

For the Fed, it has an incredibly difficult job because inflation remains sticky. However, weak jobs data and negative adjustments help bolster the case of a dovish shift in monetary policy. If so, that could be supportive of digital assets, which in turn would likely lead to positive spillover effects for blockchain miners like CleanSpark.

Nevertheless, the concern that traders just encountering CLSK stock may have is its already-strong performance. In the trailing half-year period, CLSK is up roughly 40%. Given the volatility of crypto-exposed assets, legitimate fears of holding the bag exist. At the same time, this rally could be an early chapter of a longer-term narrative.

CLSK Stock Flashes A Bullish Signal Amid Rising Short Interest

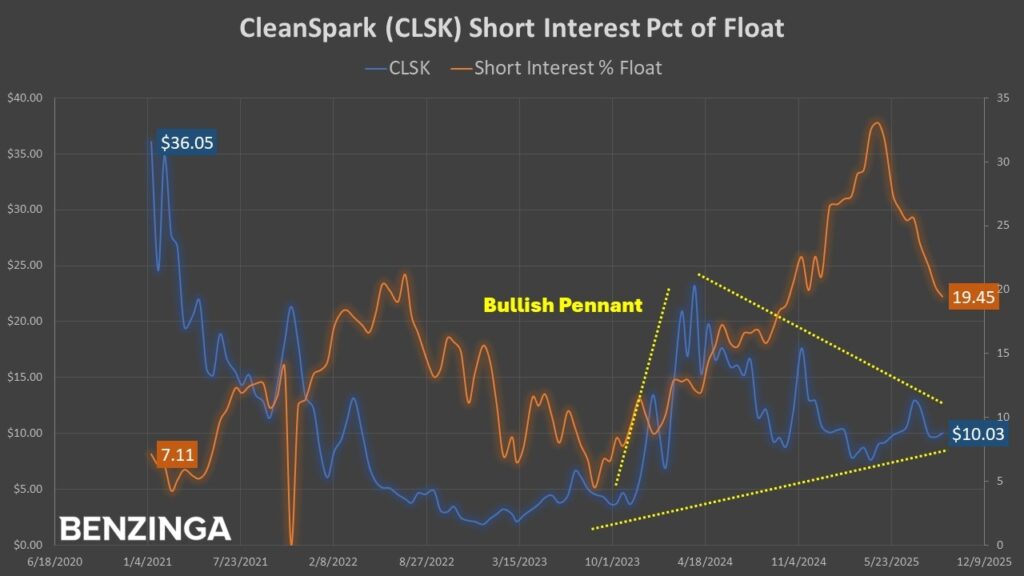

As with any healthy market, CLSK stock has both believers and skeptics. What makes CleanSpark a must-watch entity is that the skeptics are putting their money where their mouth is by opening short positions. Currently, CLSK's short interest stands at 19.4% of its float while its short interest ratio comes in at 3.41 days to cover. Essentially, bearish traders will need roughly one business week to fully unwind their short exposure.

To really understand the implications of high short interest, one must appreciate that true short positions are inherently credit-based transactions. Specifically, the securities that are sold which initiate a short trade (i.e. a sell-to-open transaction) are borrowed from a broker; that is, they're effectively sold on credit. Therefore, at some point — irrespective of whatever happens to the stock in question — the lending broker must be made whole.

From the bearish trader's perspective, the sold securities need to fall in value. If they do, the speculator can buy back the shares at a discounted price (relative to the original sale price) and return them to the broker. Obviously, the difference is pocketed as profit. But the danger for the bear is if the stock moves in the "wrong" direction (meaning up).

Again, either way, the broker has to be made whole because the sold shares were on credit.

Subsequently, the central idea of a short squeeze comes from panicked speculators attempting to mitigate their tail risk — the threat of an obligatory payout when the underwritten risk is realized toward the extreme ends of the underlying distribution. Prudent speculators cut their tail risk early and thus exit before extreme pain is realized.

Stubborn speculators? Theoretically, they risk unlimited liability. Realistically, they're going to get a margin call before the bleeding goes to infinity.

Enticingly, while the short interest is going wild, CLSK stock appears to be printing a technical buy signal known as the bullish pennant. Basically, the idea is that both bulls and bears have engaged in back-and-forth skirmishes, with the frontline eventually stagnating. In other words, the price action gradually narrows into a consolidation pattern.

However, at the apex of this consolidation, the principles of technical analysis suggest that the target security will resolve to the upside, often explosively. Supposedly, it's a high-probability event but it lacks falsifiability.

To be completely upfront, I've been moving further and further away from heuristics. But the juxtaposition of scorching short interest has likely attracted meme-stock traders. Therefore, this is a name to watch closely.

A Potentially Long Runway Ahead

Looking at the chart and considering the power of the short squeeze, I anticipate a long-term target of $20, which is a level last seen consistently in March 2024. Therefore, CleanSpark could easily be a staggered strategy where you might buy both an options spread as well as the security itself.

As for that options play, I'm looking at the 13/14 bull call spread expiring Nov. 21. This transaction involves buying the $13 call and simultaneously selling the $14 call, for a net debit paid of $25 (the most that can be lost in the trade). Should CLSK stock rise through the second-leg strike price ($14) at expiration, the maximum profit is $75, a 300% payout.

Of course, on paper, the above trade looks utterly wild. With a breakeven price of $13.25, CLSK would need to rise nearly 17% just to break even. That said, momentum appears to be steadily brewing, both technically and fundamentally.

Ultimately, it's going to come down to investor sentiment — and I'd bet that those who follow speculative ideas are eyeballing CLSK stock. Yes, there's a lot of heuristics and reading into things involved. But in terms of non-empirical ideas? This is probably the most exciting wager of the year.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock