Typically, when a publicly traded enterprise loses 14% of equity value, it's a strong sign to avoid that name. However, an exception could be arguably made for cybersecurity giant Check Point Software Technologies Ltd (NASDAQ:CHKP). Despite delivering an earnings beat for the second quarter, Check Point suffered an exodus of investors as they read between the lines. Still, it's very possible that the selloff in CHKP stock could be overdone.

In terms of headline numbers, Check Point posted earnings per share of $2.37. This figure landed at the midpoint of management's guidance but was 6.28% above analysts' estimated EPS of $2.36. In the year-ago quarter, the company posted earnings of $2.17 per share. On the top line, the cybersecurity giant rang up $665.2 million, above the midpoint guidance of $662 million. Analysts anticipated sales of $661.75 million.

However, investors had a dim view of the finer details. According to Check Point's second-quarter presentation, billings landed at $642 million, representing only 4% growth from the year-ago period's tally of $620 million. In contrast, total revenues grew 6%. Since billings represent a leading indicator of future revenue, the market likely viewed this metric as a major red flag.

Another problem likely centered on the business forecast. Management decided to make no change regarding its fiscal year 2025 expectations despite the second-quarter earnings beat. Investors may have interpreted this silence as a lack of confidence regarding future expectations.

Still, not all hope may be lost. With the post-earnings implosion, you could make the argument that CHKP stock is more attractively priced. Such assertions are tricky because you would be assuming that the prior price represented the security's "true value" and that today's drop is somehow a deviation. From a lived experience perspective, though, we know that some stocks tend to overcorrect prior to reaching a relative equilibrium.

Now, what makes CHKP stock a more credible discount — rather than a wild presuppositional fallacy — is the underlying industry. For practically all intents and purposes, cybersecurity is permanently relevant. As other analysts have pointed out, it's the one line item that companies really can't afford to skimp out on due to the criticality of digital protection.

A Risky But Compelling Empirical Argument For CHKP Stock

Earlier, I mentioned that the concept of CHKP stock being discounted risks becoming a presuppositional fallacy. The reason isn't so much that the assessment itself is fallacious. Rather, it's more of a structural problem. Simply put, there's no objective way to define "true value" as opposed to "fake value" or some other financial pejorative.

It comes down to the harsh reality that stock prices and financial metrics such as earnings are continuous scalar signals. They merely represent the point at which a transaction took place. Even worse from an analyst's perspective, the signal is unbounded. Theoretically, CHKP stock could rise infinitely, which necessarily means that there's no objective mechanism to define when it has reached a "good price."

As far as I know, the only objective truth that has real analytical meaning is that, at the end of the day, the market is either a net buyer or net seller.

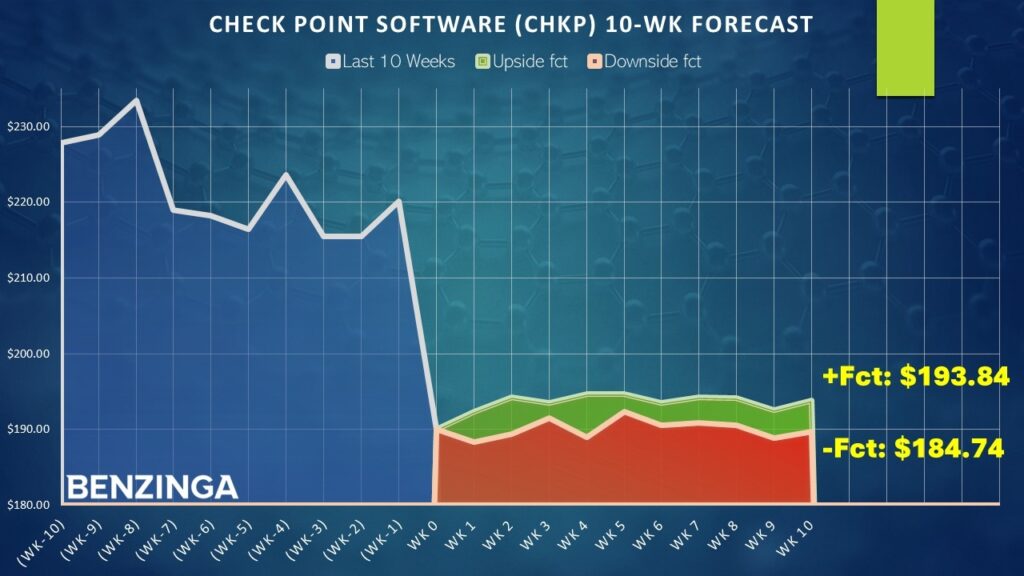

Let's take a look at the last 10 weeks of CHKP stock. Most people see an undulation of pricing activity. I see a sentiment voting record. During this period, the market voted to buy CHKP four times and sell six times. Overall, the security saw a downward trajectory. For brevity, we can label this sequence as 4-6-D.

Why the simple binary code? Because now, I can look back in the history of my dataset (which goes back to January 2019) to determine how many times on a rolling basis this sequence has flashed. This gives me an empirical basis to understand how the market responds to the 4-6-D sequence. As well, I can categorize the entire demand profile of CHKP stock, which would allow us to have a decision tree:

| Ticker | L10 Category | Sample Size | Up Probability | Baseline Probability | Median Return if Up |

| CHKP | 3-7-D | 7 | 71.43% | 58.60% | 0.77% |

| CHKP | 4-6-D | 31 | 70.97% | 58.60% | 1.22% |

| CHKP | 4-6-U | 11 | 72.73% | 58.60% | 1.02% |

| CHKP | 5-5-D | 56 | 58.93% | 58.60% | 1.75% |

| CHKP | 5-5-U | 35 | 45.71% | 58.60% | 2.16% |

| CHKP | 6-4-D | 30 | 60.00% | 58.60% | 2.44% |

| CHKP | 6-4-U | 43 | 46.51% | 58.60% | 2.45% |

| CHKP | 7-3-D | 11 | 81.82% | 58.60% | 1.99% |

| CHKP | 7-3-U | 55 | 63.64% | 58.60% | 1.27% |

| CHKP | 8-2-U | 41 | 51.22% | 58.60% | 1.52% |

From the table above, the chance that a long position in CHKP stock will rise on any given week is 58.6%, a strong upward bias. This is effectively our null hypothesis, the expected performance assuming no mispricing. Our alternative hypothesis is that, because of the 4-6-D sequence flashing, the upside probability is now 70.97%.

Assuming that CHKP stock finds itself around $190 by the end of this week, it could work its way above $192. If the bulls manage to maintain control over the next two weeks, CHKP could rise above $194.

The thing to remember, though, is that the current drop represents an extraordinary event. It's possible that, under the right conditions, a dead-cat bounce could be more pronounced than it would be following a "regular" bout of volatility.

An Intrepid Wager On Check Point Software

Those wanting to take a shot on the deep discount may consider the 190/195 bull call spread expiring Aug. 15. This transaction involves buying the $190 call and simultaneously selling the $195 call, for a net debit paid of $200 (the most that can be lost in the trade). Should CHKP stock rise through the short strike price ($195) at expiration, the maximum profit is $300, a payout of 150%.

The breakeven price for the above trade is at $192 at time of writing. Therefore, even though the median expected performance would put CHKP stock a bit shy of $195, it would still be forecasted to rise above the breakeven point. Of course, there's no guarantee that CHKP will move higher. However, the last time CHKP suffered such a massive drop — in October 2024 — it managed to move up about 3.2% week-to-week.

If CHKP stock could close at $190 or thereabouts, the $195 target by Aug. 15 does seem reasonable based on past analogs.

Of course, much hinges on the validity of the 4-6-D sequence. Running a one-tailed binomial test reveals a p-value of 0.0844, which means that there's an 8.44% chance that the implications of the sequence could materialize randomly as opposed to intentionally. This doesn't quite meet the 5% threshold of statistical significance. However, because of the stock market's open and entropic system, this is arguably an empirically intriguing signal.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock