On the surface, e-commerce giant Amazon.com Inc (NASDAQ:AMZN) appears to have fired a shot across the bow, which seemingly has grave implications for Pinterest Inc (NYSE:PINS). For one thing, disruption and subsequent domination is Amazon's modus operandi. Specific to the threat to PINS stock, the tech juggernaut is very much a legitimate competitor in the visual search ecosystem. Still, PINS' volatility may offer intrepid options traders an enticing discount.

To be quite blunt, the contrarian narrative for Pinterest does seem a tad irrational. Last week, Amazon announced the debut of Lens Live, a visual shopping feature integrated with its mobile app that lets users point at real-world objects, instantly revealing product matches from the e-commerce site's catalog. Armed with advanced artificial intelligence, Lens enables real-time product scanning and discovery for U.S. shoppers.

Fundamentally, the new program clashes with Pinterest due to the combination of product discovery and commerce. It also capitalizes on existing consumer behavior of comparison shopping at brick-and-mortar retailers relative to Amazon's marketplace listings. As such, the concern is that Pinterest could be left out in the cold. Not surprisingly, PINS stock is down about 7% in the trailing five sessions.

Nevertheless, it might be premature to call time on Pinterest. Mainly, that's because the focus is still different. Lens effectively aims at improving transactional shopping efficiency. On the flipside, Pinterest has always been about creative discovery and inspiration, which is an experiential concept. And while this business model may sound whimsical, the company's delivering the goods.

It's not just about Pinterest delivering a strong second-quarter earnings and revenue beat. Rather, management emphasized that the business is resonating with consumers, particularly with Generation Z. Mathematically, this key point underscores a massive potential runway. Nominally, global monthly active users (MAUs) have increased 11% year-over-year to 578 million.

In other words, people are still going to shop on Amazon — and they're still going to be on Pinterest.

The Market Isn't Wrong on PINS Stock…But It May Not Be Right Either

It would be awfully audacious to declare that the market is wrong on PINS stock. Whatever price investors are willing to pay for the security would be considered the correct price. Colloquially, though, there is arguably a case to be made that investors could be misreading the forward implications of PINS.

Indeed, bullish speculators may want to thank Amazon for creating a mini-panic.

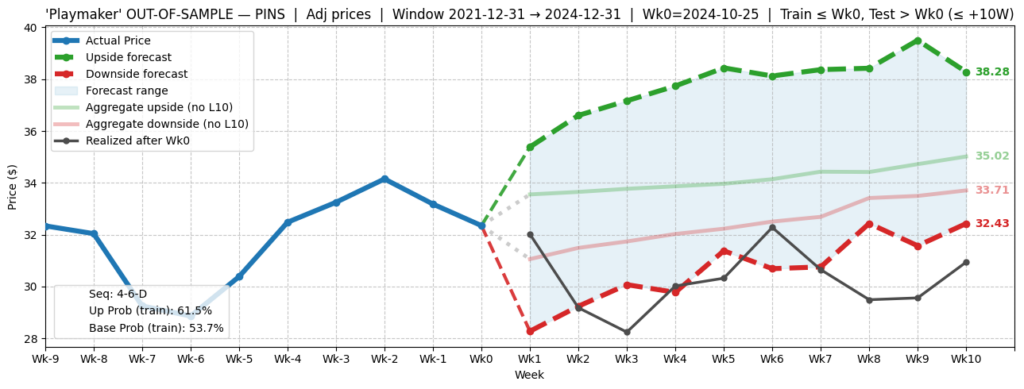

Looking at the matter quantitatively, in the trailing 10 weeks, PINS stock has printed four up weeks and six down weeks, with an overall downward trajectory. For classification purposes, this sequence can be labeled 4-6-D. Having a falsifiable signal allows for the analyzing of past analogs to determine how the market responded to it.

In my dataset, which runs from January 2019 to July 2025, the 4-6-D sequence tends to create an unusual drift, spiking higher over the next four weeks before fading out and under the aggregate or baseline drift over the next six weeks. Stated differently, the investment narrative may be choppy. However, for options traders, there does seem to be an opportunity to the upside.

With that said, we want to make sure that we're accounting for the impact of different sentiment regimes. To that effect, I ran an out-of-sample test to isolate the expected impact of the 4-6-D sequence for the years 2022 through 2024. In this test, the risk-reward profile is elevated relative to the baseline drift of PINS stock. Still, the reward potential is much more elevated than the expected risk.

That's not to say that PINS stock is a slam dunk. Plus, with Pinterest launching its initial public offering in April 2019, not much data exists. But from the evidence that is available — and isolating a slice of the post-pandemic era outside of the extreme boom-bust cycle — the aforementioned market sequence has yielded contrarian opportunities for bullish speculators.

An Unconventional Wager

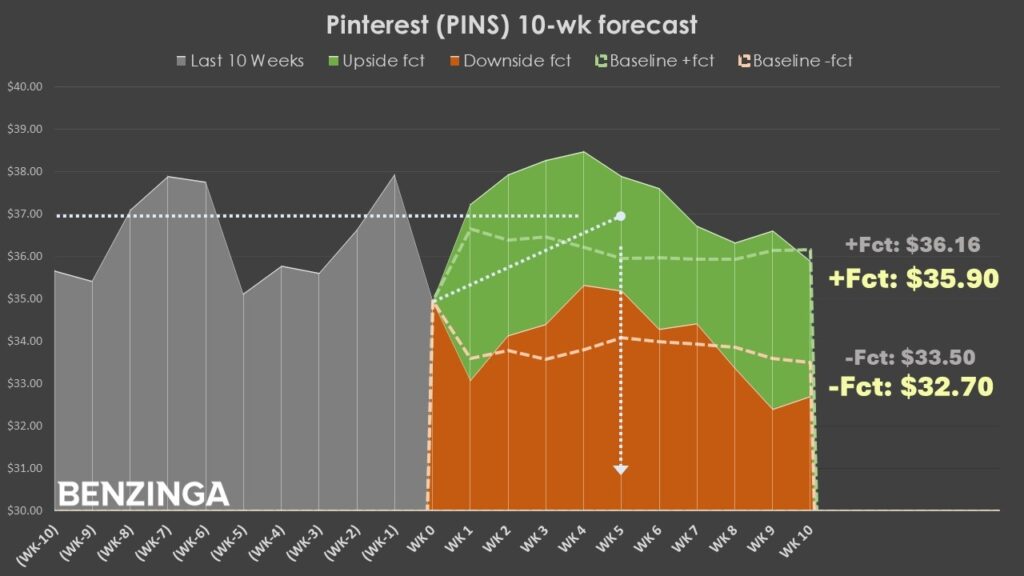

Using the market intelligence above, the one trade that's arguably the most attractive is the 36/37 bull call spread expiring Oct. 17. This transaction involves buying the $36 call and simultaneously selling the $37 call, for a net debit paid of $39 (the most that can be lost in the trade).

Should PINS stock rise through the second-leg strike price ($37) at expiration, the maximum profit is $61. At time of writing, this translates to a payout of over 156%.

What makes the aforementioned bull spread so tempting is that market makers don't believe that PINS stock moving up roughly 6% over the next five weeks is particularly credible; hence, the high payout. Indeed, the baseline drift of PINS would be expected to land the security (assuming the positive scenario) at around $36 by the Oct. 17 expiration date.

However, investors have historically bought into distribution-heavy phases. Therefore, the bullish argument would appear to be the most intriguing.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock