Under ordinary circumstances, whenever a top-level enterprise like Advanced Micro Devices Inc (NASDAQ:AMD) rises sharply higher, hesitation naturally occurs for those who didn't yet punch their tickets. Unlike lesser-known entities where growth potential could be colloquially boundless, a very real threat exists that the good news is already baked into the share price. However, a recent quantitative signal that briefly flashed may force a rethink.

Last week, AMD stock soared after the underlying company signed a landmark agreement with OpenAI. Under the terms of the agreement, OpenAI will deploy up to 6 gigawatts of AMD Instinct GPU power for the tech specialist's next-generation AI infrastructure. However, with the extreme bump in valuation, management must now weave a compelling tale to justify the premium, especially with AMD trading at roughly 135-times last year's earnings.

Just recently, bearish activity in the options market gave prospective investors some reason for caution. Among the high-level activity was a massive acquisition (relative to open interest) of put options with a $225 strike. These options expire this Friday so that nuance must be considered. Still, the spike in debit put volume demonstrates that not everybody is enthusiastic about AMD stock.

Nevertheless, AMD stock popped sharply higher during the midweek session after multiple Wall Street analysts raised their price targets. Essentially, Advanced Micro is set to challenge the AI dominance of Nvidia Corp (NASDAQ:NVDA). Yesterday, AMD extended its relationship with Oracle Corp (NYSE:ORCL), reflecting a moxie that has investors excited.

However, buried beneath the headlines was a quant signal that may have tipped off where AMD stock may head next.

Behavioral Pivot In AMD Stock Forces A Rethink

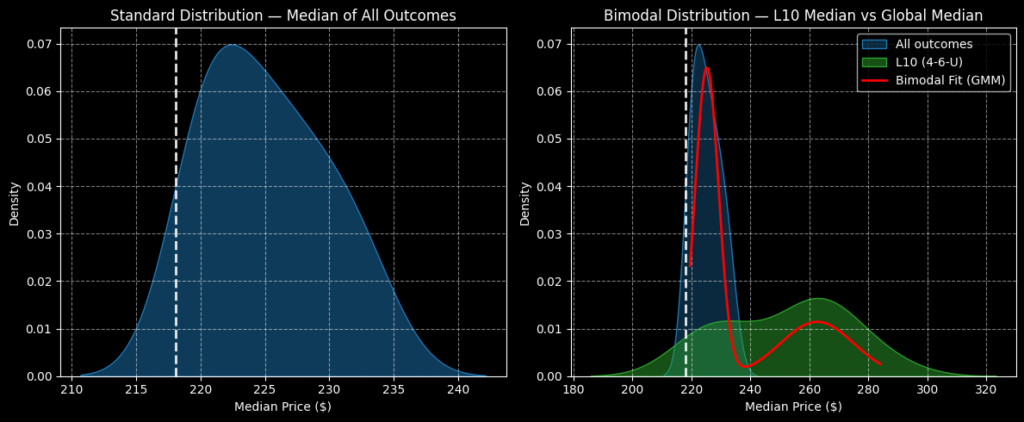

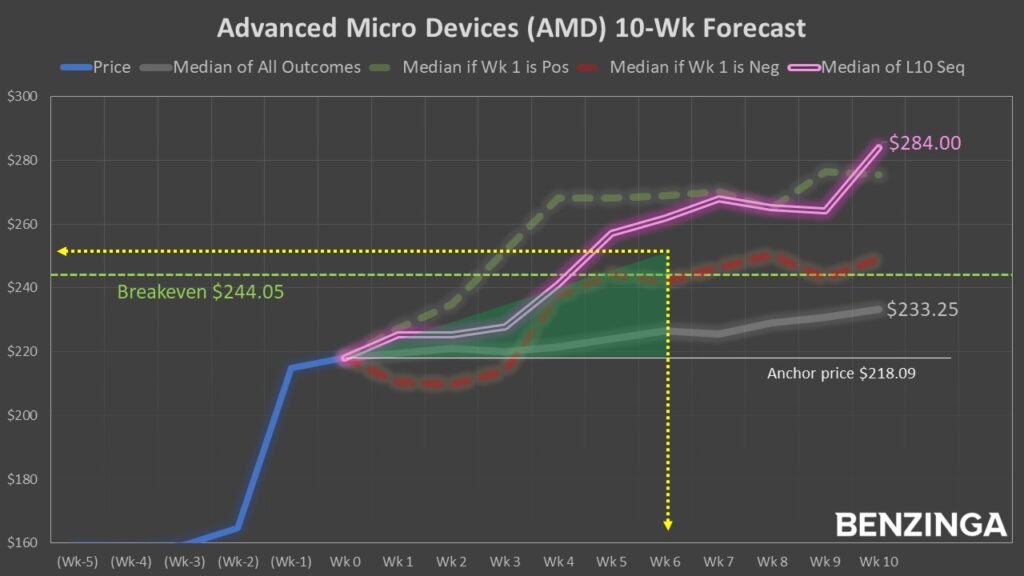

Based on data extending back to January 2019, AMD stock has a clear upward bias. Using past analogs, we can calculate that a position entered into AMD has about a 59.4% chance of rising higher over the next 10 weeks. Plotting the data as a distributional curve, most outcomes would land between $210 and $240, with the bulk of results ranging between $220 and $230 (assuming an anchor price of $218.09, yesterday's close).

However, the market is rarely homeostatic. Further, on a day-to-day basis, the fluctuations rarely resemble the aggregate average of all price activities. Instead, as with anything in life, publicly traded securities respond to stimuli. Further, the immediate stimuli are much more meaningful than catalysts that occurred, say, five years ago.

It logically follows, then, that if the immediate behavioral state or sentiment regime was distinct from the baseline state or condition, it may have an impact that causes a change in projected outcomes. Sure enough, by converting the scalar signal of AMD stock into a discrete signal, we can isolate how individual behavioral states respond relative to the baseline.

In the trailing 10 weeks up to Tuesday's close, AMD stock was printing a rare 4-6-U sequence: four up weeks, six down weeks, with an upward trajectory. With today's spike higher, this signal has disappeared, with the security printing a far less distinct 5-5-U. However, I hypothesize that the ephemeral signal represented a positive digestion of various fundamental drivers — and it's this digestion that forces a rethink against prior skepticism.

Mathematically, when we isolate the 4-6-U sequence, AMD stock would be expected to range between $190 and $310, with the bulk of outcomes ranging between $230 and $280 (again, assuming the $218.09 anchor). Yes, this means that AMD now has enhanced downside risk. At the same time, the projected magnitude and frequency of upside are much greater.

It's because of the elevated potential based on conditional statistics that possibly makes AMD stock call spreads favorably mispriced.

A Mathematically Attractive Spread

From the empirical intelligence above, I am extremely tempted by the 240/250 bull call spread expiring Nov. 21. This transaction involves buying the $240 call and simultaneously selling the $250 call, for a net debit paid of $405 (the most that can be lost in the trade). Should AMD stock rise through the second-leg strike price ($250) at expiration, the maximum profit is $595, a payout of nearly 147%.

To be fair, the breakeven price for the above trade is $244.05, which is nearly 12% above the aforementioned anchor price. Admittedly, that's an aggressive proposition. However, the statistical tendency of the price action responding to the 4-6-U sequence makes the 240/250 spread much more realistic than it looks like on paper.

That's not to say it's a risk-free proposition because it's not. Further, the buying of near-term puts does suggest that AMD stock could be choppy for the next two days. Still, if you're looking for a contrarian idea that's hiding in plain sight, Advanced Micro could be it.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read More:

Image: Shutterstock