A short iron condor is an income strategy that aims to profit when a stock stays within a specified range over the course of the trade. The trade is composed of four options with the same expiration:

- A long put far out of the money

- A short put closer to the money

- A long call far out of the money

- A short call closer to the money

The maximum profit is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Traders should have a neutral outlook on the stock and ideally look to enter when the stock has a high implied volatility rank.

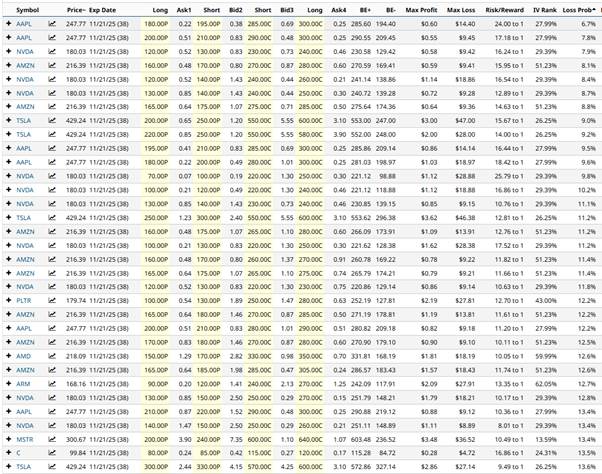

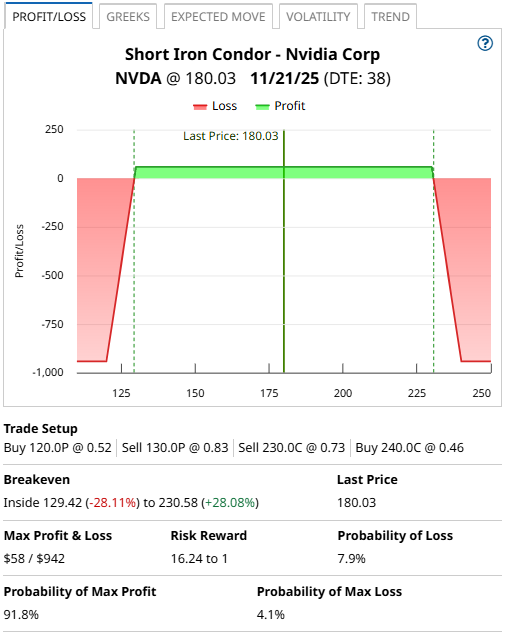

Let’s take a look at Barchart’s Short Iron Condor Screener for October 15th:

As you can see, the scanner shows some interesting Iron Condor trades on stocks such as AAPL, NVDA, TSLA, AMZN and PLTR.

Let’s look at the first line item – an iron condor on Apple.

Using the November 21st expiry, the trade would involve selling the $195 put and buying the $180 put. Then on the calls, selling the $285 call and buying the $300 call.

The price for the condor is $0.60 which means the trader would receive $60 into their account. The maximum risk is $1,440 for a total profit potential of 4.17% with a loss probability of just 6.7%.

The profit zone ranges between $194.40 and $285.60. This can be calculated by taking the short strikes and adding or subtracting the premium received.

The Barchart Technical Opinion rating is a 64% Buy with a Strengthening short term outlook on maintaining the current direction.

Apple is showing an IV Percentile of 80% and an IV Rank of 27.99%. The current level of implied volatility is 29.75% compared to a 52-week high of 65.20% and a low of 15.97%.

Apple is due to report Q3 earnings on October 30th, so this trade would have earnings risk if held to expiration.

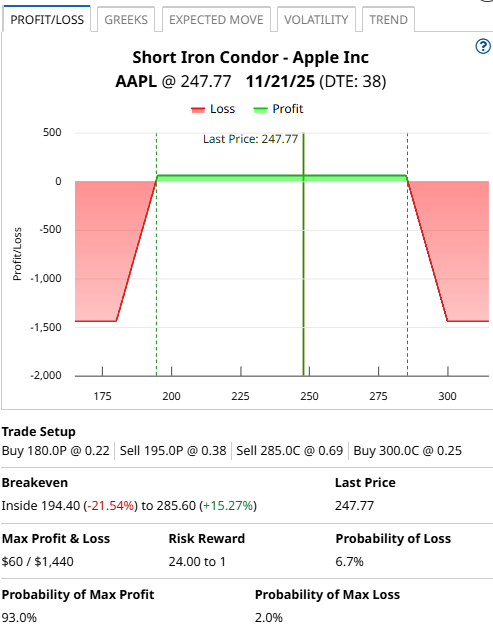

The next Iron Condor we will look at is on the third line using Nvidia (NVDA) for the November 21st expiration.

This example involves selling the $130 put and buying the $120 put, then selling the $230 call and buying the $240 call.

The maximum profit potential is $58 with maximum risk of $942 and a loss probability of 7.9%. The total profit zone ranges between $129.42 and $230.58.

The Barchart Technical Opinion rating is an 88% Buy with a Weakening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength just crossed below 50%. The market is indicating support for a bearish trend.

NVDA is showing an IV Percentile of 50% and an IV Rank of 29.39%. The current level of implied volatility is 44.63% compared to a 52-week high of 75.61% and a low of 31.73%.

Mitigating Risk

Thankfully, iron condors are risk defined trades, so they have some build in risk management. The most the AAPL example can lose is $1,440 while the NVDA condor has risk of $942.

For each trade consider setting a stop loss of 25-30% of the max loss.

Iron condors can also contain early assignment risk, so be mindful of that if the stock breaks through the short strike and it’s getting close to expiry.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.