/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla (TSLA) investors are once again caught between near-term realities and Elon Musk’s far-reaching vision for the future. The company’s third-quarter earnings report painted a mixed picture—record vehicle sales but sharply weaker profitability. Still, even as uncertainty grows around Tesla’s core EV business, Musk continues to look years ahead. His message to investors was clear: the future of Tesla isn’t just about electric vehicles (EVs)—it’s about robots.

During the company’s recent earnings call, Musk described the Optimus humanoid robot as an “infinite money glitch” once produced at scale and even went so far as to say it could become “the biggest product of all time.” It’s not the first time Musk has framed Tesla as an artificial intelligence and robotics company rather than a traditional automaker, but this time, the conviction seemed stronger than ever. Optimus was mentioned 36 times during the call, making it a major topic.

With Musk doubling down on his robotics vision while Tesla contends with short-term headwinds—falling earnings, intensifying EV competition, and his own attention stretched across multiple ventures—investors face a tough question: Does the long-term promise of Optimus make TSLA stock worth buying right now? Let’s break down what’s driving both the hype and the hesitation.

About Tesla Stock

With a market cap of $1.44 trillion, Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation.

Shares of the EV maker have gained 9.7% on a year-to-date (YTD) basis. TSLA stock initially dropped last Thursday following an earnings miss but ultimately closed higher, supported by strength in the broader market. Still, the stock dropped 3.4% on Friday as investors continued to digest the company’s weak results.

Musk Doubles Down on Optimus Humanoid Robot

Elon Musk often emphasizes that Tesla is more of an AI and robotics company than a traditional carmaker. And the most recent earnings call underscored that point even further. Musk reiterated his belief that Optimus, the company’s AI-trained humanoid robot under development, could become the biggest product of all time. He referred to Optimus as an “infinite money glitch” once produced at scale and has previously stated that sales could eventually make up 80% of Tesla’s value. Notably, Optimus was mentioned 36 times on the call, making it a major topic.

Musk’s pitch for Tesla’s robotics vision represents a much-needed new direction for the company. Tesla’s earnings declined in Q3 despite record vehicle sales, which were boosted by a surge in purchases ahead of the expiration of a federal tax credit (we will dive into its Q3 results a bit later). And a highly competitive EV market is raising the stakes for Tesla’s success in its robotaxi and AI initiatives. “We are at a critical inflection point for Tesla. It’s honestly going to be like a shock wave,” Musk said on the earnings call.

The most interesting part is that more analysts and top-level executives are beginning to speak seriously about robotics. Nvidia CEO Jensen Huang is eager to leverage his success in AI chips to expand into robotics. In early June, TSMC (TSM) Chairperson C.C. Wei noted that demand for chips powering humanoid robots is increasing rapidly. TSMC forecasts that by 2030, around 1.3 billion AI-powered robots will be deployed, creating a market worth $35 billion. And humanoid robotics is projected to become a key growth driver for TSMC between 2030 and 2040.

Meanwhile, Morgan Stanley Research estimates that the humanoid robotics market could reach $5 trillion by 2050. “Adoption should be relatively slow until the mid-2030s, accelerating in the late 2030s and 2040s,” according to Adam Jonas, Morgan Stanley’s Head of Global Autos and Shared Mobility Research.

Now, let’s turn back to some of the additional insights Musk shared about Optimus. He said that a prototype designed for volume production is expected to be ready for demonstration by March. Analysts are eager to get a closer look at Optimus, even though it isn’t expected to generate revenue in the near future. The chief executive also noted that “first generation production lines for Optimus are being installed in anticipation of volume production.” However, Musk did not specify when production might begin.

Meanwhile, during the earnings call, Musk also stated that with Optimus and self-driving technology, Tesla could help create a world without poverty, where everyone has access to top-quality medical care. He suggested that Optimus could, for instance, become an exceptionally skilled surgeon. Musk has stated that Tesla could produce up to 1 million robots per year by the end of the decade.

But let’s return to reality—there are numerous challenges to overcome before Optimus can reach mass production. The company has been working through design challenges involving the robots’ hands and forearms. Musk said that the Optimus hand and forearm are an extremely complex engineering challenge. He emphasized that creating a highly capable hand is essential for developing a truly useful general-purpose robot. Another challenge lies in the lack of an existing supply chain for humanoid robots, forcing Tesla to be highly vertically integrated and handle much of the manufacturing internally. You can also check out my previous article on TSLA to read what skeptics have said about Optimus.

Tesla’s Q3 Earnings Disappoint

Tesla released its third-quarter results last week, becoming the first of the Magnificent Seven companies to do so. Let’s take a quick look at the positives from the report. First, total revenue rose 11.6% year-over-year (YoY) to $28.09 billion, beating Wall Street estimates by $1.39 billion. The revenue increase came after two consecutive quarters of declines, driven by a surge in demand ahead of the expiration of EV tax credits. As a result, Tesla’s total automotive revenues grew 6% YoY to $21.2 billion. While this was a positive, it didn’t come as much of a surprise to investors, as record delivery figures released in early October had already signaled it. Another reason investors didn’t cheer the strong beat is that U.S. EV sales are widely expected to tumble in the current quarter, as many buyers who would have purchased later in the year rushed to take advantage of the expiring tax credit. Notably, nearly half of Tesla’s revenue comes from U.S. customers.

But let’s return to the positives. Another strong point from the report was Tesla’s energy business, which achieved record storage deployment levels. This resulted in segment revenue of $3.4 billion, up 44% YoY. During the quarter, Tesla introduced its “Megablock” energy storage product, a pre-engineered, medium-voltage battery that combines four Megapack 3s. Musk also mentioned that Tesla has ambitious plans for MegaPack 4, which will be capable of delivering approximately 35 kilovolts directly, removing the need for a 35 kV substation. Baird analysts noted that Tesla’s new energy products are a big deal, with the potential to expand the company’s margins and total addressable market. The services and other segment also performed well, with revenue rising 25% YoY to $3.5 billion.

When it comes to the negatives, the main disappointment in Tesla’s report came on the profitability front. Tesla’s margins fell across the board, with total GAAP gross margin declining 185 basis points YoY to 18%. The company’s operating profit dropped 40% YoY to $1.6 billion. Its adjusted EPS stood at $0.50, down 31% YoY and missing expectations by $0.06. With that, Tesla’s profitability continues to struggle in the current market environment, as cost pressures, partly driven by tariffs, have significantly weighed on the bottom line. CFO Vaibhav Taneja said that Tesla incurred roughly $400 million in tariff-related costs during the quarter, divided between its automotive and energy segments. It’s also worth noting that the company’s bottom line was hit by lower regulatory credit revenue after the Trump administration officially phased out the emissions credit market earlier this year.

Regarding the outlook, Tesla said that forecasting volumes is difficult amid shifting EV policies and ongoing geopolitical uncertainty.

What Do Analysts Expect for TSLA Stock?

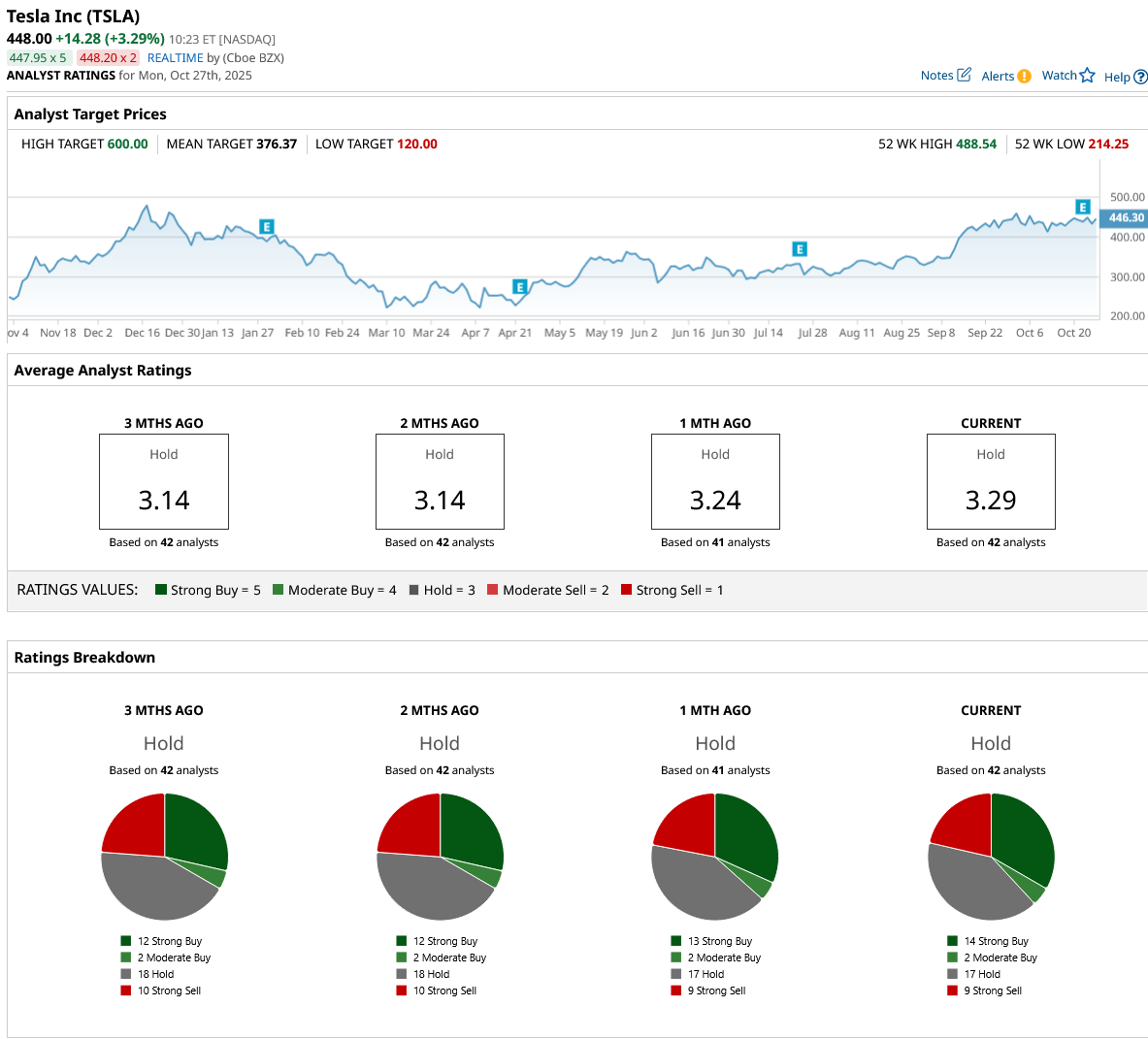

Wall Street analysts remain split on Tesla, as evidenced in the stock’s consensus “Hold” rating. Of the 42 analysts covering Tesla, 14 assign it a “Strong Buy” rating and two a “Moderate Buy,” while 17 recommend holding and nine give it a “Strong Sell” rating. Tesla bulls remain optimistic due to Musk’s bold promises in AI, robotics, and self-driving technology, while bears point to profitability struggles with more weakening ahead, an unjustified valuation (263.30x forward non-GAAP P/E), and a damaged brand image. Notably, the stock currently trades at a premium to its mean price target of $376.37.

Putting it all together, it’s difficult and very speculative to assess the Optimus project’s potential at the moment, as it remains years away from generating revenue, and the timeline could be extended even further due to the challenges mentioned earlier. So, I don’t think buying TSLA stock right now purely on optimism surrounding Optimus is a wise move. I believe a wait-and-see approach is the best course of action here, especially as Tesla’s core business faces “near-term uncertainty from shifting trade, tariff, and fiscal policy.”