Shares of Opendoor Technologies Inc (NASDAQ:OPEN) are trading higher Monday morning, likely fueled by favorable macroeconomic signals. The stock has now seen a 27% increase over the last five trading sessions and a 102% surge in the past month.

What To Know: The primary catalyst for Monday’s momentum came from Federal Reserve Chair Jerome Powell's address last week at Jackson Hole. Powell suggested a softening stance on monetary policy, hinting that the central bank could consider cutting interest rates if the economy shows further signs of slowing.

Lower interest rates typically translate to more affordable mortgages, a critical driver for the housing market and Opendoor’s iBuying business model. Prominent supporters on social media amplified the sentiment, suggesting rate cuts could “unfreeze the housing market.”

Adding to the bullish sentiment, Opendoor's interim CEO, Shrishia Radhakrishna, recently expressed strong confidence in the company’s future, centered on an AI-driven, multi-product model.

In a message to investors, Radhakrishna hailed AI as a “core primitive” for the company’s next phase of growth, detailing its role in optimizing cost structures and enhancing platform efficiency.

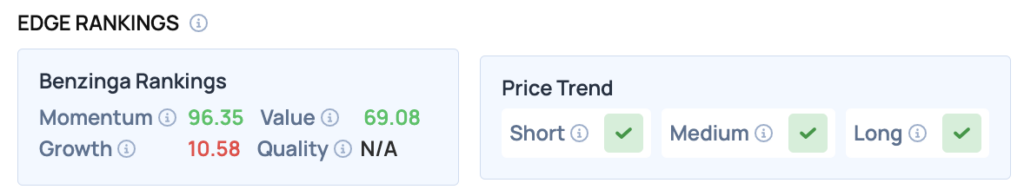

Price Action: According to data from Benzinga Pro, OPEN shares are trading higher by 8.58% to $5.44 Monday morning. The stock has a 52-week high of $5.30 and a 52-week low of $0.51.

Read Also: Retail Investors’ Top Stocks With Q2 Earnings This Week: NVIDIA, Webull, IREN And More

How To Buy OPEN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Opendoor Technologies’ case, it is in the Real Estate sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock