Just a few days after a new CEO took charge of operations, shares of real estate technology company Opendoor (OPEN) received another shot in the arm after the company revealed that it will grow its portfolio of products in the coming weeks. In a recent SEC filing, Opendoor stated, "Opendoor intends to expand its product offerings to allow the company to provide services through the entire continental United States in the coming weeks, through one or more of its direct cash offer, cash plus or working with its partner agents to provide listing services."

This sent the OPEN stock soaring, which is now up a staggering 521.3% on a year-to-date (YTD) basis, with a market cap of $7.5 billion.

Overall, while this is a positive development, investors should be wary of hurriedly opening their wallets for the OPEN stock. Why? Let's find out.

Financials: A Mixed Set

Before delving into Opendoor's results for the most recent quarter, investors would be well served to steal a glance at the company's performance over a longer time period. Worryingly, Opendoor has yet to report annual profits, and its sales have grown at a CAGR of just 3.03% over the past five years.

Meanwhile, the most recent quarter saw the company's bottom line reporting a miss when compared to the consensus estimates. Although losses narrowed to $0.04 per share from $0.13 per share in the previous year, it came in wider than the consensus estimate of $0.03 per share. On the other hand, revenues inched up by a mere 4% in the same period to $1.6 billion. However, the sales exceeded the consensus estimate by about $64.5 million.

While homes sold by Opendoor stood at 4,299 in the June 2025 quarter, the same metric stood at 4,078 in the June 2024 quarter. However, the company purchased significantly fewer homes in the June 2025 quarter when compared to the June 2024 quarter, which came in at 1,757 versus 4,771 in the prior year. Consequently, the inventory of homes declined to 4,538 at the end of the June 2025 quarter from 6,399 in the year-ago period. Also, the contribution margin dropped to 4.4% from 6.3% in the corresponding period a year ago.

All these developments are signs of concern, as even in an environment where it is expected that there will be multiple rate cuts, which should make owning real estate cheaper, Opendoor’s dwindling inventory and decline in purchases hint towards a demand slowdown. This, coupled with a falling contribution margin, is not a healthy sign for an unprofitable company.

However, Opendoor can draw some succor from its performance in generating cash flow from operations. In the first six months of 2025, the company reported net cash flow from operating activities of $544 million, which was an outflow of $577 million in the previous year. Overall, the company closed the quarter with a cash balance of $789 million, higher but not much higher than its short-term debt levels of $557 million.

Finally, in continuation of its mixed trend, Opendoor has guided for Q3 revenues to be in the range of $800 million to $875 million, the midpoint of which would denote an annual decline of 40.2%.

Can the New CEO Take Opendoor on a Sustainable Growth Path?

Appointed as CEO on Sept. 10, 2025, Kaz Nejatian has had extensive experience in product development over the years at notable platform companies such as Shopify (SHOP) and Meta (META), while also being a founder of Kash, which helped small businesses adopt mobile payments for brick-and-mortar stores. The company was acquired by an undisclosed large fintech player for an undisclosed amount in 2017.

At Meta, Nejatian worked as Product Lead for Payments and Billing, where he helped build payment products for WhatsApp, Instagram, Marketplace, etc. Specifically, he is noted for reducing the barriers for businesses in cash-dependent markets to purchase digital ads without needing a credit card. This means enabling more flexible billing/payment options in places where credit card penetration is low. That helps increase ad revenue in emerging markets.

At Shopify, he took over leadership for the financial and payments side of Shopify’s merchant services. This includes the payment processing business, which has been a major revenue driver. Under his leadership, Shopify expanded and improved Shop Pay, the accelerated checkout/payment tool, which has become one of the more streamlined payment options for merchants and buyers. In the more recent period at Shopify, under Nejatian’s oversight, there has been work to improve tools via AI, e.g., product listing suggestions, photo editing, and store assistant tools (“Sidekick,” etc.). These are intended to reduce friction for merchants, improve onboarding, and improve marketing/sales tools.

These product achievements show he understands how to build service layers (payments, fintech, merchant tools), not just software storefronts. For Opendoor, which has heavy financial/transactional components (buying homes, holding them, financing, pricing, etc.), this is relevant.

Another management reshuffle that Opendoor carried out was that it brought back co-founders Keith Rabois (as chairman) and Eric Wu to its board.

The housing market could also get a lift as mortgage rates are expected to ease and President Donald Trump pushes for fast, targeted policies aimed at boosting the sector. These measures may include tax credits or even direct stimulus, creating a strong tailwind for Opendoor, which has already established itself as the leading player in the iBuyer market.

In addition, Opendoor is well-positioned to widen its operating margins over time by embedding AI more deeply into its operations, allowing it to fully harness the vast troves of data it has amassed over the years.

However, Nejatian has some problems to tackle. While lower inventory buildup is hinting at signs of a demand slowdown, it falls upon the new CEO to limit the consequences of the near admission of the failure of the company's iBuying model. The model has resulted in the company making less money per transaction, even though it is buying fewer homes. Moreover, the company's technological pivot will not be easy as well due to possible teething issues regarding adoption by users, sustainability of the new model, along with operational challenges that it may have to address, which is a tall ask for any company, let alone an unprofitable one like Opendoor.

Analyst Opinion of OPEN Stock

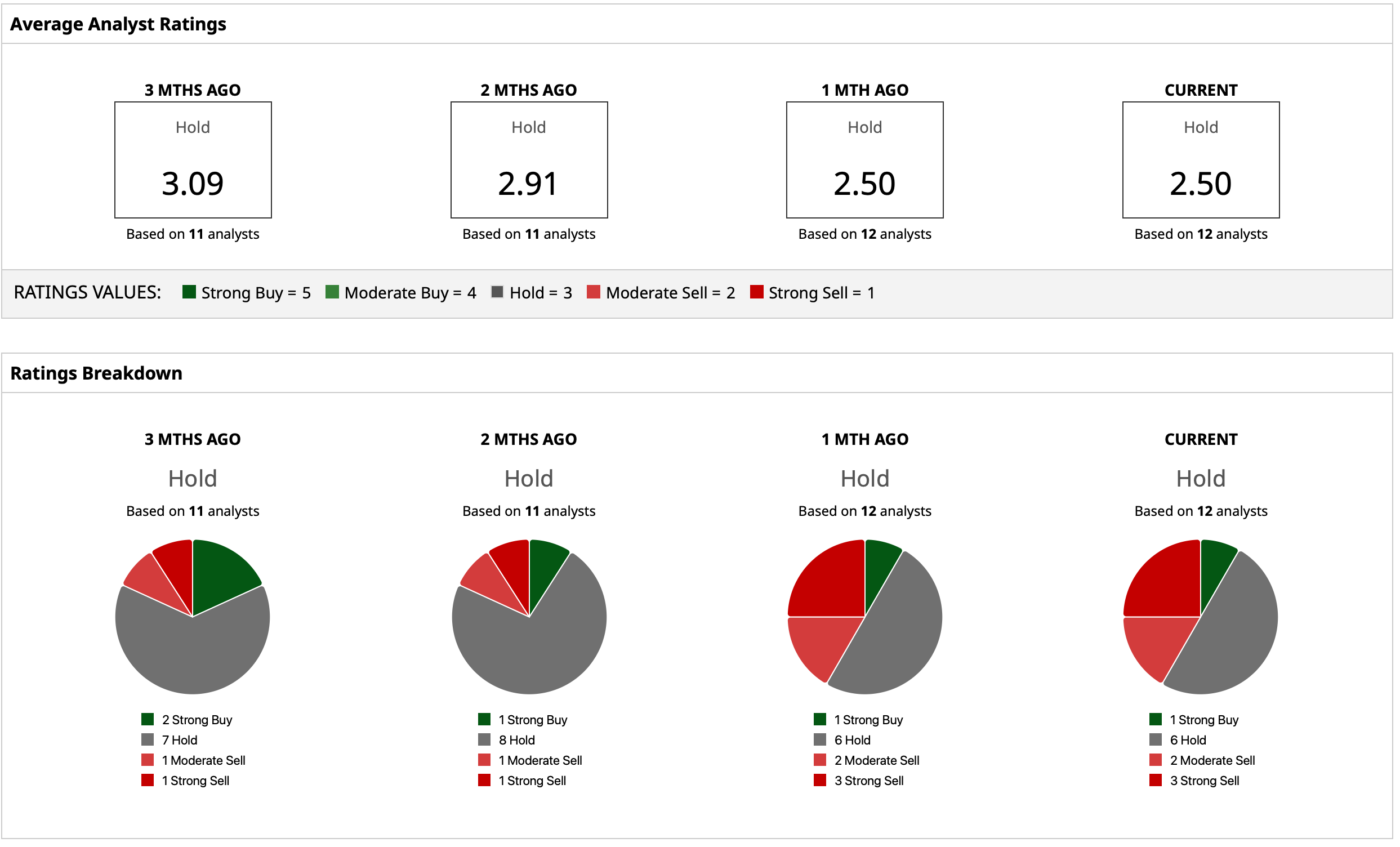

Thus, analysts have assigned a “Hold” rating for the OPEN stock, amid mixed signals, with a mean target price and high target price of $1.11 and $2, both of which have already been surpassed. Out of 12 analysts covering the stock, one has a “Strong Buy” rating, six have a “Hold” rating, two have a “Moderate Sell” rating, and three have a “Strong Sell” rating.