Eric Jackson, founder of EMJ Capital, has announced a new long position in Hut 8 Corp. (NASDAQ:HUT), arguing the market misunderstands the company as a simple Bitcoin (CRPTO: BTC) miner when it is rapidly pivoting to become a significant player in AI infrastructure.

Check out HUT’s stock price here.

Jackson Says HUT’s Assets Are Undervalued

In a detailed thread on X, Jackson positioned Hut 8 alongside his other high-conviction energy and infrastructure plays, IREN Ltd. (NASDAQ:IREN) and Cipher Mining Inc. (NASDAQ:CIFR).

He asserted that the company’s vast power and data center assets are deeply undervalued. According to Jackson, Hut 8's balance sheet, which includes over $1 billion in Bitcoin and a 60% stake in the entity American Bitcoin Corp. (NASDAQ:ABTC), already accounts for most of its current $5.1 billion market cap.

"You're essentially paying $1–1.5 B for the entire power, data-center & AI infrastructure platform," Jackson stated. He believes a significant re-rating is imminent as the company secures high-performance computing (HPC) and AI tenants for its extensive energy capacity.

HUT: From Miner To A Digital Infrastructure REIT With AI Leverage

Jackson outlined a path for massive growth, noting the company has over 1 GW of active capacity with plans to develop up to 7 GW. “When those deals get announced,” Jackson wrote, “HUT stops trading like a miner and starts trading like a digital infrastructure REIT with AI leverage.”

The investor projects that if Hut 8 executes on just a quarter of its 7 GW plan, it could achieve a valuation of $37–$50 billion. Full execution, combined with a rising Bitcoin price, could lead to a potential 100-fold return by 2029. He also praised Hut 8’s CEO, Asher Genoot, as a “modern-day tech operator” capable of delivering on this vision.

Short Seller Raises Capital Concerns

The bull thesis, however, was met with some skepticism. Prominent short-seller Jim Chanos questioned the capital required for such an ambitious build-out, commenting, "Good thing they will only need to raise $280B for that 7 GW to be developed. Should be easy."

Price Action

Shares of HUT closed 1.70% higher at $49.94 per share on Tuesday and rose 0.51% in after-hours. It has a 52-week range of $10.04 to $52.40 per share. Higher by 128.16% year-to-date, the stock has gained 324.34% over the year.

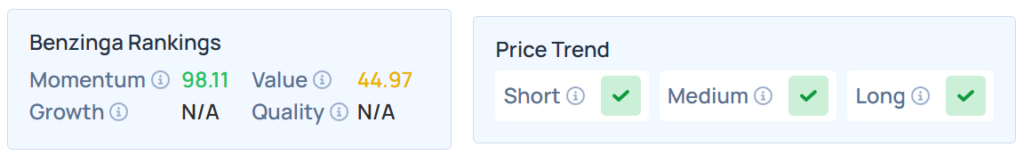

HUT maintained a stronger price trend over the short, medium, and long terms, with a moderate value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

The S&P 500 index ended 0.16% lower at 6,644.31 on Tuesday, whereas the Nasdaq 100 index declined 0.69% to 24,579.32. On the other hand, Dow Jones gained 0.44% to 46,270.46.

On Wednesday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading higher.

Read Next:

- Eric Jackson Rejects ‘Roaring Kitty’ Label: OPEN ‘Isn’t A Meme Stock. It’s A Cult Stock,’ Unlike GME

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock