ONEOK, Inc. (OKE) is a midstream energy company headquartered in Tulsa, Oklahoma. The company operates in gathering, processing, fractionation, transportation, storage and marine exports of natural gas, natural gas liquids (NGLs), refined products and crude oil. ONEOK’s market cap stands at around $42.9 billion. The midstream giant is set to release its third-quarter results after the market closes on Tuesday, Oct. 28.

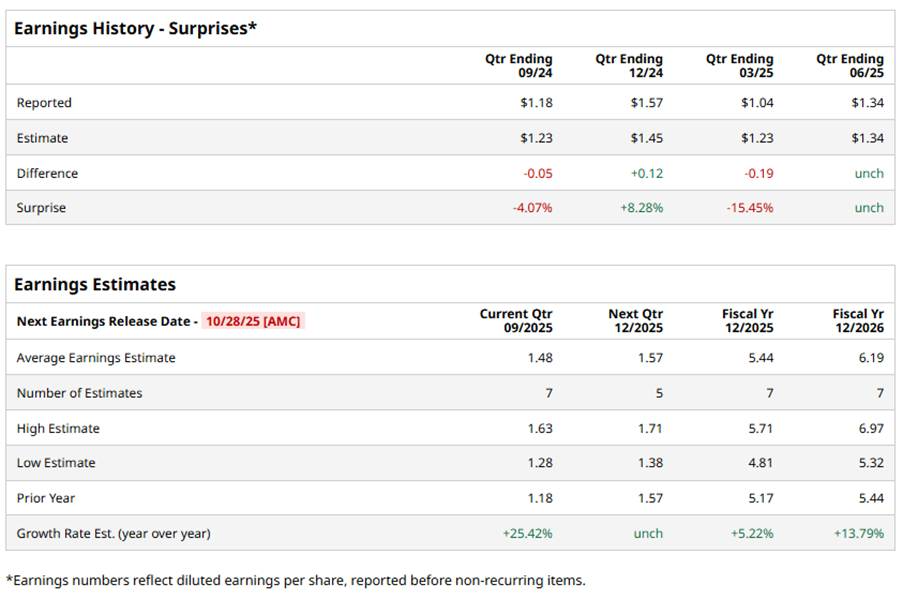

Ahead of the event, analysts expect ONEOK to report an EPS of $1.48, marking a 25.4% increase from $1.18 reported in the year-ago quarter. The company has missed Street’s bottom-line estimates twice over the past four quarters, but has surpassed or met the projections on two other occasions.

For the full fiscal 2025, ONEOK is anticipated to deliver an EPS of $5.44, up 5.2% from $5.17 reported in fiscal 2024. In fiscal 2026, its earnings are expected to further surge 13.8% year over year to $6.19 per share.

OKE stock has dropped 29.5% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 14.8% gains and the Energy Select Sector SPDR Fund’s (XLE) 3.8% dip during the same time frame.

ONEOK’s recent share price weakness stems from modest earnings growth, rising interest expenses, and a valuation reset following its acquisitions amid broader macroeconomic pressures. While the company’s stable cash flows provide portfolio diversification, they remain sensitive to shifts in interest rates and energy prices. Its potential rebound will likely depend on the smooth integration of recent deals and a more favorable market sentiment.

The stock maintains a consensus “Moderate Buy” rating overall. Of the 19 analysts covering the OKE stock, 11 have a “Strong Buy,” one gives a “Moderate Buy,” and seven analysts are playing it safe with a “Hold.” Its mean price target of $93.44 represents a 36.3% premium to current price levels.