/ON%20Semiconductor%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $20.6 billion, ON Semiconductor Corporation (ON), also known as onsemi, is a global semiconductor supplier headquartered in Scottsdale, Arizona. Established in 1999 as a spin-off from Motorola's Semiconductor Products Sector, it specializes in intelligent power and sensing technologies. The company serves diverse industries, including automotive, industrial, communications, computing, consumer electronics, medical, and military/aerospace sectors.

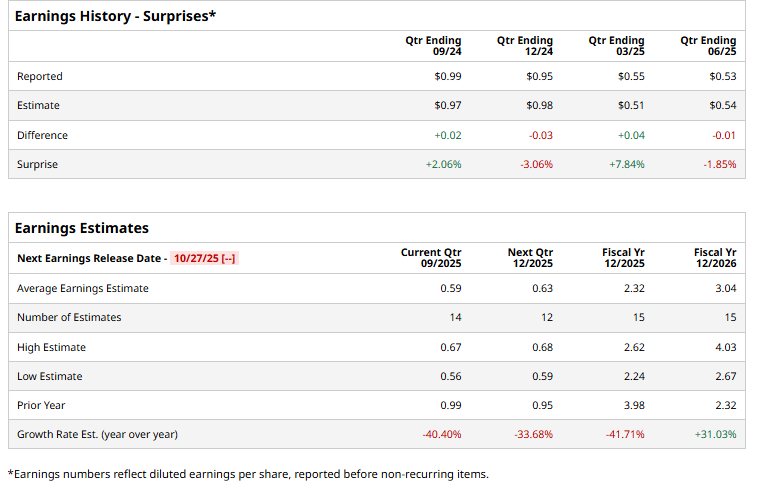

The chip titan is poised to announce its Q3 2025 earnings results soon. Ahead of this event, analysts expect the company to report an adjusted EPS of $0.59, down 40.4% from $0.99 in the same quarter last year. The company has surpassed Wall Street's bottom-line estimates in two of the past four quarters, while missing on two other occasions.

For fiscal 2025, analysts expect ON to report an adjusted EPS of $2.32, down 41.7% year-over-year from $3.98 in fiscal 2024. However, in fiscal 2026, the company’s adjusted EPS is expected to increase 31% year-over-year to $3.04.

ON stock has declined 29.6% over the past 52 weeks, underperforming the Technology Select Sector SPDR Fund’s (XLK) 27.7% surge and the S&P 500 Index’s ($SPX) 17.2% rise during the same time frame.

On September 23, ON announced its acquisition of Vcore Power Technologies and related IP from Aura Semiconductor. The deal strengthens onsemi’s power management portfolio, aiming to provide comprehensive solutions for AI data centers, from grid to core. The acquisition enhances the company’s ability to deliver high-efficiency, high-density power solutions, supporting greater compute capacity per rack and positioning onsemi as a leading provider for modern AI infrastructure.Top of FormBottom of Form ON shares rose 1% in the next trading session.

Wall Street analysts are moderately optimistic about ON’s stock, with an overall "Moderate Buy" rating. Among 33 analysts covering the stock, 12 recommend "Strong Buy," two suggest a “Moderate Buy,” 18 indicate a “Hold,” and one suggests a “Strong Sell.” Its mean price target of $57.71 implies a premium of 14.6% from the prevailing price levels.