On Holding (ONON) has had an up-and-down year.

At its recent high, the stock had more than doubled this year. But a four-day 20% slump followed the company's earnings report this week.

While shares of the popular shoe producer are still up about 60% so far in 2023, the recent price action has left the bulls with a bad taste in their mouths — particularly as the S&P 500 has finally started to break out over resistance.

On May 16 On Holding delivered record revenue as sales grew more than 78% year over year. Direct-to-consumer sales were up more than 60%, while gross and net income soared year over year and profit margins widened.

So what’s the problem?

Don't Miss: Can AI Power Nvidia Stock to All-Time Highs?

Some might say it’s the guidance, although even that was pretty good. Management boosted its full-year revenue outlook, now expecting 1.74 billion Swiss francs ($1.93 billion), edging past consensus expectations of 1.73 billion Swiss francs.

The retail sector is not one where a rising tide is lifting all boats. There are those doing well and being rewarded and those that are struggling and being punished for it.

On Holding seems to simply be a case of "buy the rumor, sell the news.” Given that the shares had a year-to-date gain of about 95% going into the report, investors wanted more.

Trading ONON Stock

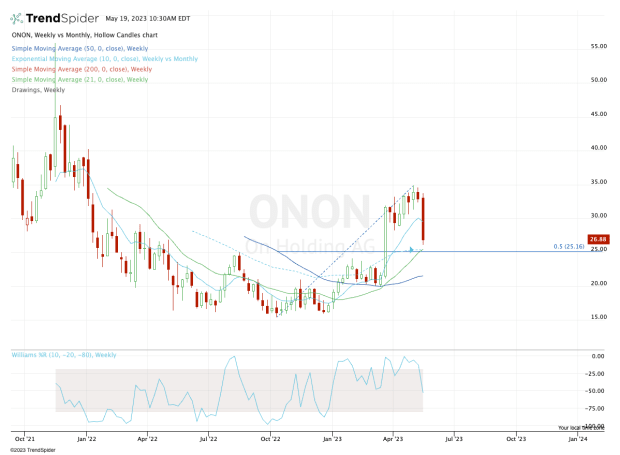

Chart courtesy of TrendSpider.com

On Holding has not been public all that long, and the stock has been volatile. At one point the shares were trading north of $50, but the bear market of 2022 started roaring and sent the stock down into the $16 to $17 range, where it found strong support.

Will we get a full pullback to the $25 area? Now the shares are almost $2 away from that area.

The bulls should keep a close eye on this zone, as it marks the 50% retracement from the 52-week high to the 52-week low. It’s also where the 10-month and 21-week moving averages come into play.

Don't Miss: Walmart Beat on Earnings; Now, It Needs a Breakout

This would be a reasonably attractive buying opportunity. If the $24 to $25 zone fails, bulls can bail and wait for a test into the lower $20s. If it holds, perhaps the shares could rebound to $30.

Back above that level and the $34 to $35 zone could eventually be in play.

The stock is now working on its fourth straight daily decline after what seemed to be a pretty good quarter. Aggressive buyers will likely consider accumulating down near current levels. Conservative bulls will wait for the $24 to $25 area.

Either way, ONON stock may be worth a shot on this dip given its relative strength in 2023.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.