Shares of nuclear startup Oklo Inc (NYSE:OKLO) are trading higher Friday afternoon, extending a rebound from a midweek sell-off. The stock, up over 500% this year, continues to attract investors despite its high-risk profile and recent volatility.

What To Know: Enthusiasm is fueled by the booming AI industry’s energy needs and Oklo's promising small modular reactor technology. High-profile backing from OpenAI's Sam Altman, a partnership with European developer newcleo and a Pentagon project to deploy microreactors for the U.S. Army have bolstered investor confidence and driven its remarkable rally.

However, the gains follow a sharp plunge Wednesday after a Financial Times report questioned the company’s lofty $17 billion valuation. Skeptics point to Oklo's pre-revenue status, its lack of a federal operating license, and reliance on historically challenging reactor technology.

With political ties also drawing scrutiny, Oklo remains a classic battleground stock, pitting its disruptive potential against significant operational and financial hurdles.

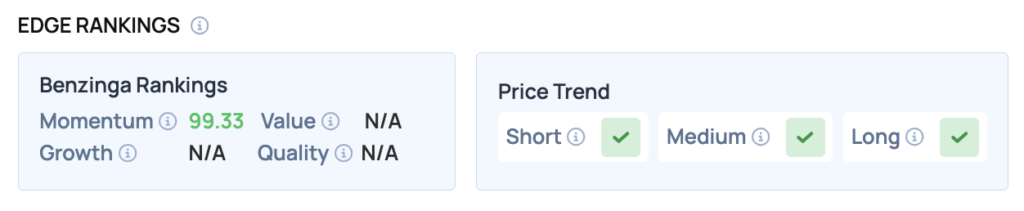

Benzinga Edge Rankings: Underscoring this powerful price action, Benzinga Edge stock rankings give Oklo an exceptional Momentum score of 99.33 out of 100.

OKLO Price Action: Oklo shares were up 8.4% at $135.19 at the time of publication on Friday, according to data from Benzinga Pro.

From a technical perspective, the stock is currently trading approximately 25.9% above its 50-day moving average of $107.38, indicating a robust upward momentum. Additionally, it is trading approximately 129.1% above its 200-day moving average of $59.00, further underscoring the strength of the current trend.

Read Also: Fed Has Green Light To Cut Rates After Soft Inflation, Economists Say

How To Buy OKLO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oklo's case, it is in the Utilities sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Read Next:

Image: Shutterstock