Shares of Oklo Inc (NASDAQ:OKLO) are trading lower Tuesday after Bank of America Securities downgraded the nuclear energy company from Buy to Neutral, citing valuation concerns. Here’s what investors need to know.

What To Know: While BofA raised its price target to $117 from $92, it suggested the stock's valuation may have "run ahead of reality" following a 430% year-to-date surge. The firm also pointed to fuel supply concerns and questions over cost targets. The company also earlier reported that the U.S. Nuclear Regulatory Commission accepted a key design report under an "accelerated timeline."

A late Tuesday announcement from the Department of Energy sparked a recovery for the stock, after the department announced it had selected Oklo for a pilot program to build and operate three advanced nuclear fuel fabrication facilities to support its Aurora and Pluto reactors.

The program is part of an effort to strengthen domestic supply chains for nuclear fuel. However, the positive development was not enough to completely reverse the stock's downward trend, which was fueled by the morning's analyst downgrade.

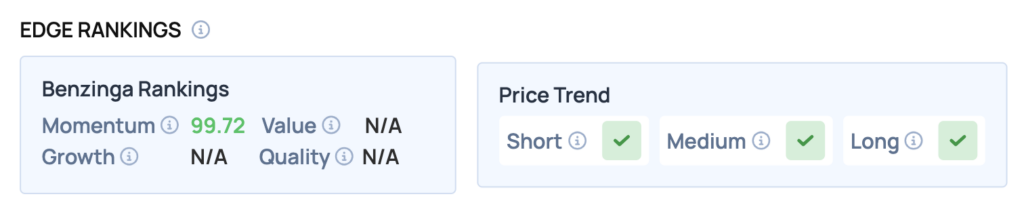

Benzinga Edge Rankings: Highlighting the stock’s rapid ascent this year, Benzinga Edge stock rankings give Oklo a momentum score of 99.72.

OKLO Price Action: Oklo shares were down 3.53% at $112.39 at the time of publication Tuesday, according to Benzinga Pro. Over the past month, OKLO has gained about 60.2% versus a 4.1% rise in the S&P 500 and is up roughly 429% year-to-date compared to the index’s 12.6% gain. The stock is trading within its 52-week range of $7.90 to $144.49.

The stock is significantly above its 50-day ($82.88), 100-day ($67.10), and 200-day ($48.29) moving averages, suggesting a strong upward trend over the longer term. Immediate support appears to be around the recent low of $109.62, while resistance may be encountered near the high of $116.87.

Read Also: Oklo Stock Falls As Analyst Warns Valuation May Be ‘Ahead Of Reality’

How To Buy OKLO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oklo’s case, it is in the Utilities sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock