Shares of nuclear startup Oklo Inc (NYSE:OKLO) are trading lower Monday afternoon, dropping amid the absence of any direct company-specific news. The decline follows a volatile week for the energy stock.

- OKLO stock is struggling to find support. Check the analyst take here.

What To Know: Last Wednesday, Oklo shares plunged after a Financial Times report questioned the company’s lofty $17 billion valuation, its pre-revenue status and reliance on historically challenging reactor technology.

The stock then staged a remarkable two-day rebound, closing the week higher. Oklo had a market cap of over $20 billion as of Friday’s close, according to Benzinga Pro. The rally was fueled by investor enthusiasm for its potential role in powering the AI industry, its partnership with developer newcleo and a Pentagon project to deploy the company’s microreactors.

Monday’s downturn suggests investors may be taking profits after the sharp recovery, or re-evaluating the fundamental risks highlighted last week. Despite being up over 500% this year, Oklo remains a classic battleground stock, pitting its disruptive potential against significant operational and financial hurdles.

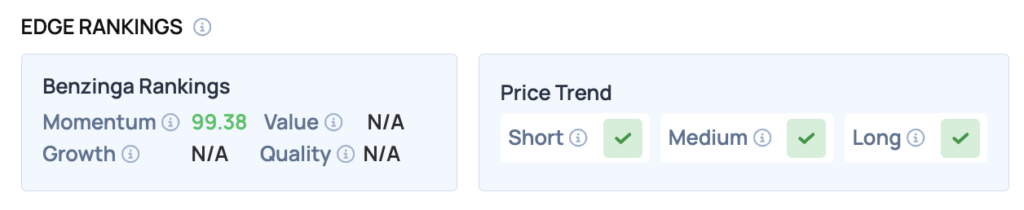

Benzinga Edge Rankings: Highlighting the stock’s recent price action, Benzinga Edge rankings give Oklo an exceptionally strong Momentum score of 99.38.

OKLO Price Action: Oklo shares were down 1.79% at $133.61 at the time of publication on Monday, according to Benzinga Pro data.

Read Also: 5 Energy Stocks With Strong Upward Momentum To Consider

How To Buy OKLO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oklo’s case, it is in the Utilities sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock